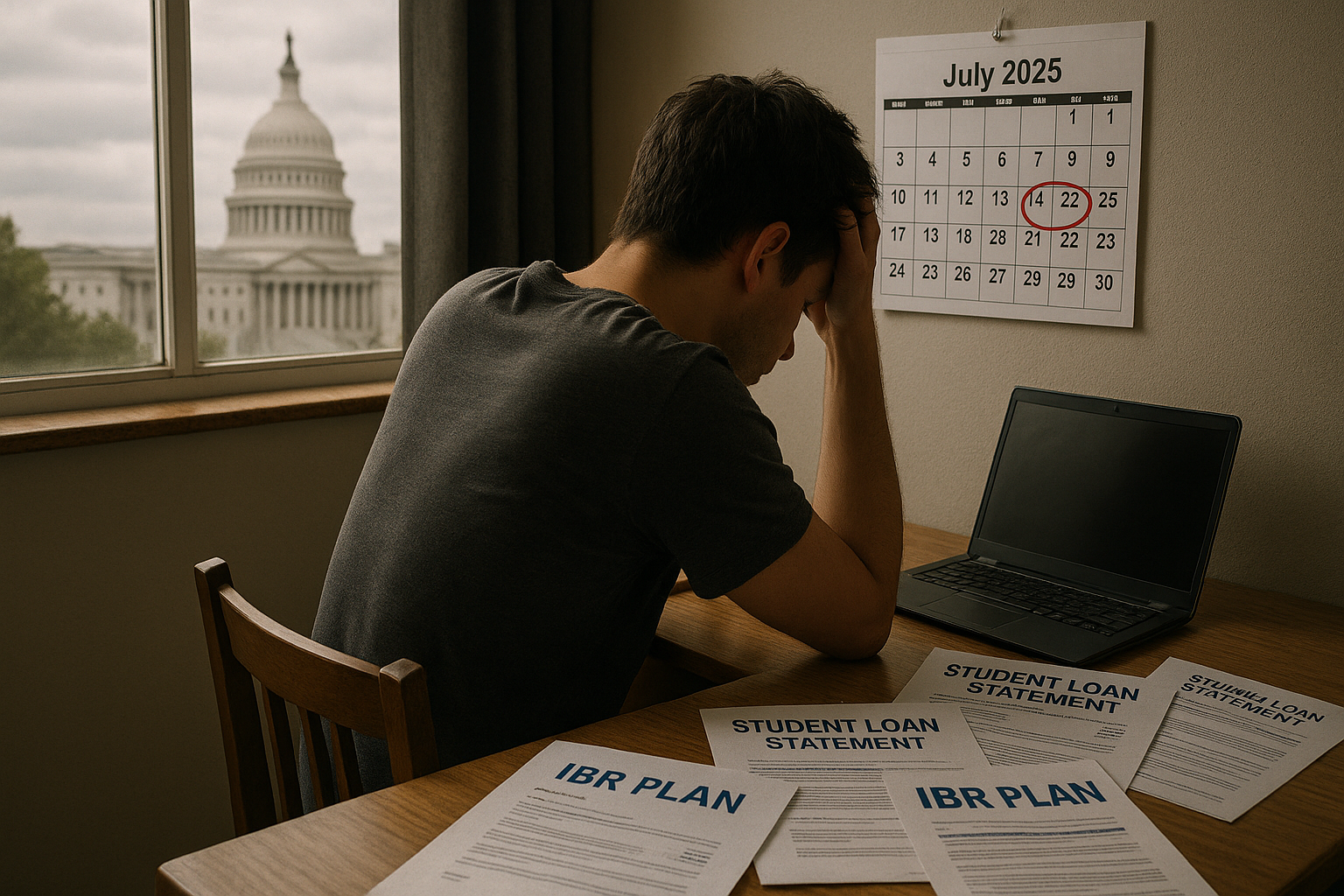

Student loan forgiveness has become something of a political football in recent months, leaving millions of borrowers wondering where they stand. As of July 22, 2025, the situation remains frustratingly unclear for those hoping for relief from their education debt.

Policy Gridlock Continues

The Biden administration's ambitious student loan forgiveness plans have hit one roadblock after another. What started as a promising initiative has become bogged down in congressional debates, court challenges, and budget considerations. It's the classic Washington story - big promises followed by bureaucratic inertia.

I've been following this issue closely, and frankly, the lack of progress is disappointing. Borrowers deserve clarity, regardless of where you stand on the merits of loan forgiveness itself.

Real Impact on Real People

For the average borrower (and there are roughly 43 million Americans with federal student loan debt), this uncertainty isn't just an abstract policy debate - it's affecting major life decisions. I've spoken with recent graduates who are delaying homeownership, postponing starting families, or staying in jobs they dislike simply because they can't plan their financial futures.

Income-Based Repayment (IBR) plans offer some relief, but even these programs face potential modifications that leave borrowers guessing about their long-term obligations. The current system requires monthly payments of 10-15% of discretionary income - manageable for some, but still burdensome for many.

Expert Perspectives

Dr. Emily Smith (who's written extensively on education finance) shared an interesting perspective with me last week: "The prolonged uncertainty surrounding student loan forgiveness creates an environment of financial stress for many Americans. A clear policy direction is imperative to alleviate this burden and foster economic growth."

She's right - the economic implications extend far beyond individual borrowers. When millions of Americans are constrained by debt, their reduced spending power affects the broader economy.

Looking Abroad for Solutions

It's hard not to glance enviously at countries like Germany and Sweden, where higher education is largely funded through public investment rather than individual debt. While their tax structures and educational systems differ significantly from ours, they demonstrate that alternative models exist.

That said, completely restructuring American higher education financing would be a massive undertaking - probably too massive for our current political climate to handle.

Possible Paths Forward

From where I sit, the most likely outcome seems to be a scaled-back, targeted approach to forgiveness. Public service workers, low-income borrowers, and those who attended predatory institutions might see relief, while broader forgiveness remains elusive.

Meanwhile, IBR plans will likely continue to evolve - perhaps with more generous terms to make monthly payments more manageable, even if total forgiveness isn't in the cards.

For borrowers navigating this uncertainty, staying informed and financially flexible remains the best strategy in a situation that, unfortunately, shows few signs of resolution in the immediate future.