The U.S. government's technological iron curtain with China has sprung some expensive leaks—about a billion dollars' worth, to be precise.

Despite Washington's increasingly stringent export controls on advanced AI chips, Nvidia's coveted processors have been flowing into Chinese data centers like water finding cracks in a dam. Recent reports indicate Chinese companies have somehow acquired approximately $1 billion of Nvidia's AI hardware, despite being on the restricted list.

I've been tracking semiconductor trade controls since 2020, and this is exactly the scenario experts predicted. Create a significant price differential between markets, and you've essentially established a smuggler's paradise.

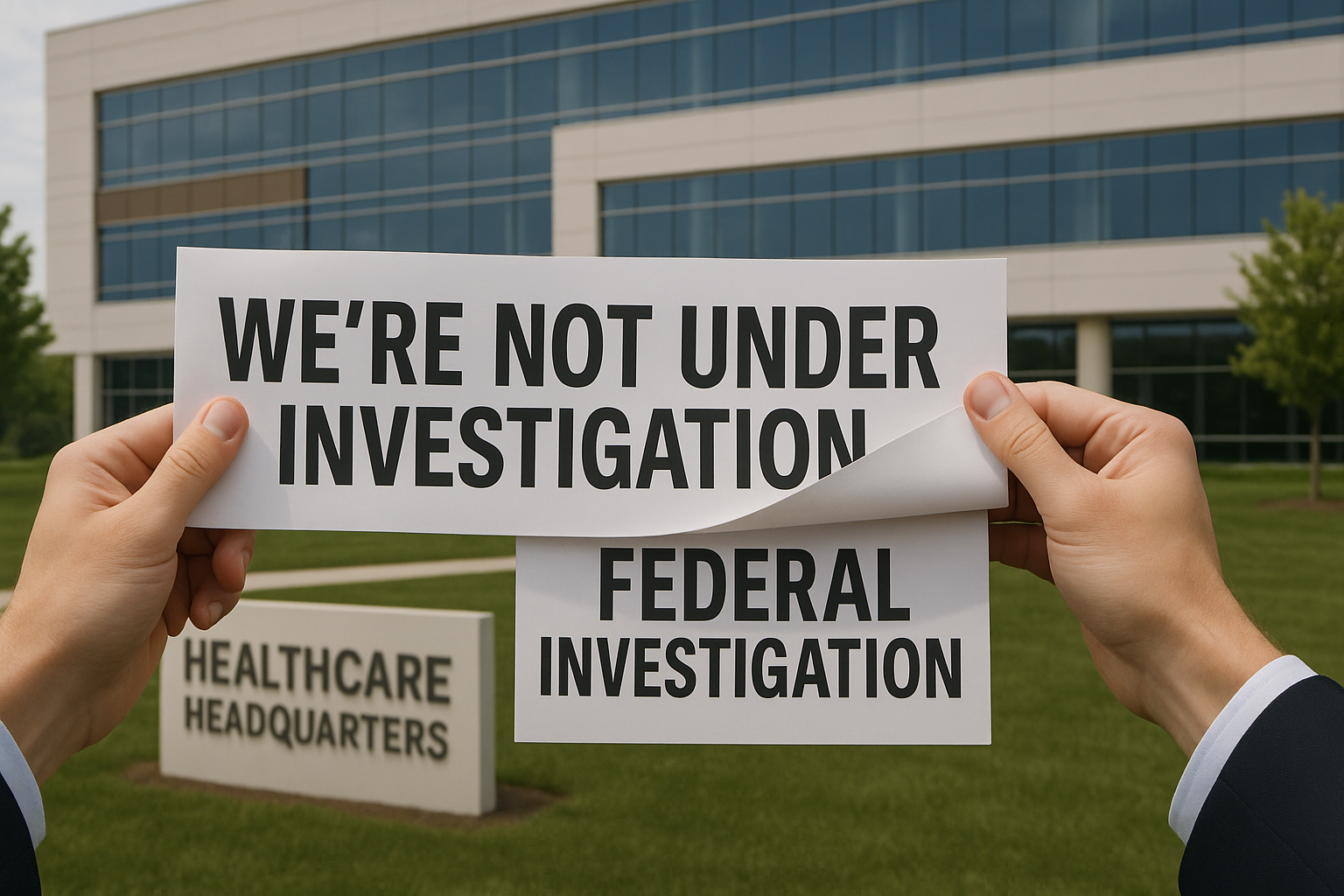

Nvidia's response? They'll only provide "service and support" for "authorized NVIDIA products." Which, frankly, is a bit like closing the barn door after a billion dollars worth of horses have already bolted.

The Gray Market Magic Trick

The mechanics of how these chips cross borders reveals an almost elegant economic workaround. Some might call it "regulatory arbitrage with Chinese characteristics," though I prefer the more straightforward "where there's a will and enough money, there's a way."

Here's how it typically works: A legitimate entity purchases chips in an open market. Then, through a dizzying series of intermediaries—each providing a layer of plausible deniability—these processors eventually reach Chinese tech companies desperate for computing power.

The scale is what's truly remarkable. This isn't a few chips sneaking through in someone's luggage. We're talking about an industrial-scale operation that suggests systematic circumvention of export controls.

Look, Nvidia finds itself in an awkward position here. CEO Jensen Huang must publicly support these restrictions while implementing compliance measures. Yet the underground flow of their products actually maintains their effective market size despite regulations designed to shrink it. Talk about having your cake and eating it too.

Demand That Won't Take No for an Answer

Having covered China's tech sector for years, what strikes me most is the determination. When customers are willing to navigate murky legal waters and pay significant premiums for your product, you've hit the corporate jackpot—demand that simply refuses to disappear regardless of obstacles.

(And this isn't just about dodging regulations. It's about China's absolute refusal to be left behind in the AI race.)

For Nvidia shareholders, this creates an interesting hedge. Even if domestic markets cool, there's this persistent international pressure valve absorbing supply through... alternative channels.

"We're seeing a replay of historical patterns," a semiconductor supply chain expert told me last week, requesting anonymity due to the sensitive nature of the topic. "When the technology gap is significant enough, restrictions often just create premium pricing rather than actually preventing access."

The Enforcement Dilemma

The situation highlights what some policy experts call the "export control paradox." Restrictions strong enough to create juicy price premiums but not strong enough to truly prevent acquisition end up creating perverse incentives.

We've seen this movie before. During the Cold War, COCOM restrictions on technology transfers to Soviet-bloc countries didn't prevent acquisition—they just made technologies more expensive and spawned thriving gray markets.

U.S. officials now face a thorny game theory problem. Stricter enforcement might slow the flow but would require resources and capabilities that are difficult to deploy effectively across global supply chains. Meanwhile, each successful circumvention makes the next one easier as pathways become established.

"It's like squeezing a balloon," as one former Commerce Department official put it to me. "Push down in one place, and it just expands somewhere else."

What This Means for Investors

For those watching Nvidia's stock, this underground demand represents a fascinating form of market insurance. No analyst will officially model "smuggling resilience" into their earnings projections (can you imagine that PowerPoint slide?), but the persistence suggests a floor under Nvidia's growth trajectory.

The more intriguing question is how this affects competitors. AMD, Intel, and emerging Chinese domestic champions like Huawei are all racing to close the performance gap. But if Nvidia's products are finding their way to restricted markets anyway, it undermines the artificial advantage that export controls were supposed to create for alternatives.

I suspect what we're witnessing is just the visible portion of a much larger iceberg of technological transfer continuing despite mounting geopolitical tensions.

And as AI development remains the strategic priority for both governments and corporations worldwide, Nvidia's position as the pick-and-shovel provider for this gold rush seems remarkably secure—regardless of how many paper barriers attempt to segment their market.

The chips, it seems, will fall wherever $1 billion can carry them.