Tesla took a bruising tumble yesterday, shedding 8.2% of its value and dropping out of the trillion-dollar club faster than a drunk guy falling off a mechanical bull. The stock crash wasn't just predictable—it was practically screaming its arrival.

I've watched Tesla's quarterly earnings calls for years now, and this one hit different. When Musk—a man not exactly known for understating potential—warns investors about "rough quarters" ahead, you better believe Wall Street's collective ears perk up. The numbers tell a story that even the most rabid Tesla stan would find hard to spin: revenue down a stomach-churning 12% year-over-year, operating income landing with a thud at $923 million (analysts wanted $1.23 billion), and those magical regulatory credits? Nearly cut in half.

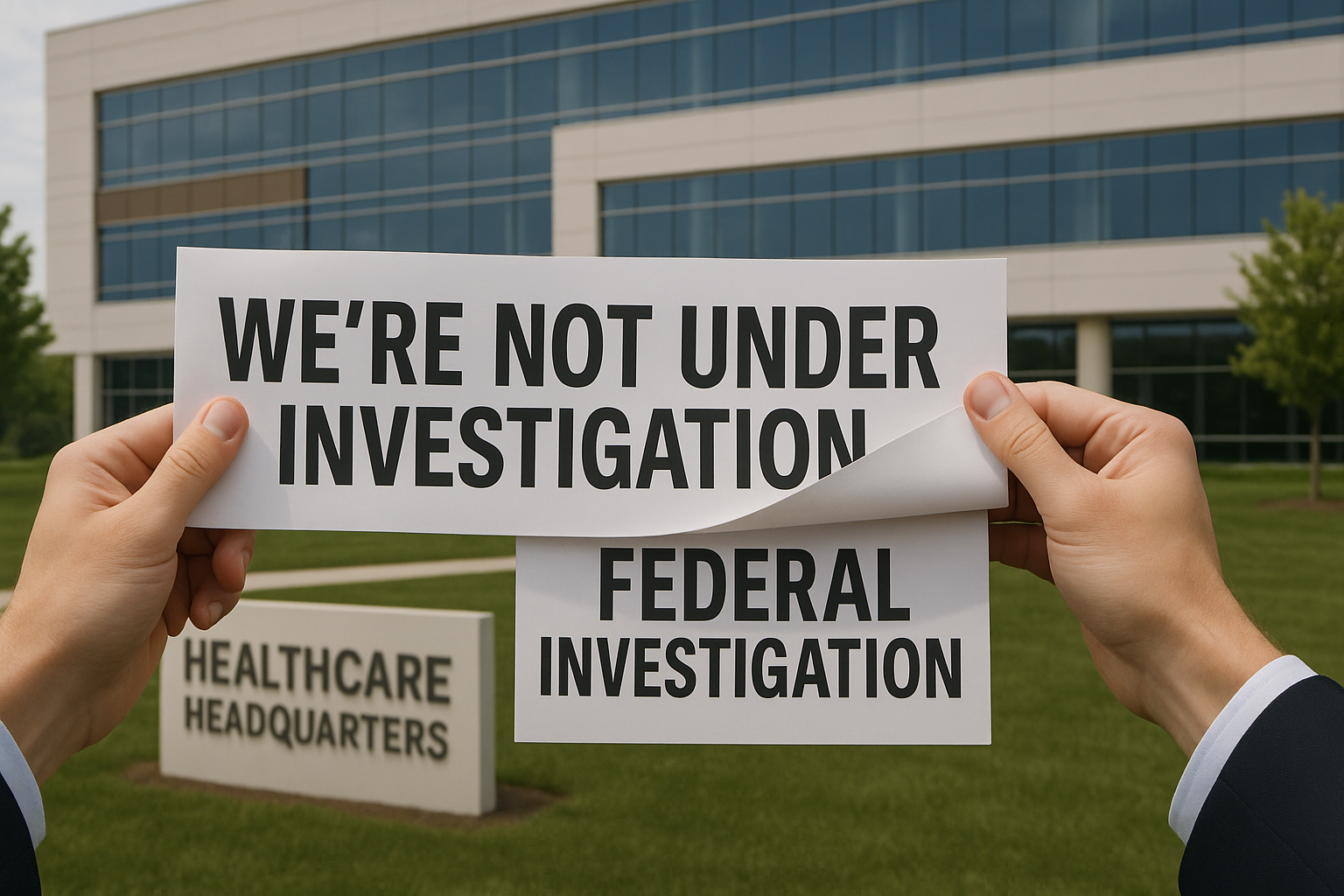

Let's talk about those credits for a second. There's something almost... karmic about Tesla's regulatory credit revenue cliff-diving right after the passage of the One Big Beautiful Bill Act. You know, the very legislation Musk spent months trashing before Trump eventually signed it? The market, which occasionally displays a wicked sense of humor, seemed to particularly relish this particular plot twist.

Tesla has always been two companies in one: a car manufacturer struggling with real-world problems like supply chains and manufacturing hiccups, and a tech stock fantasy where promises of future dominance outweigh trivial concerns like "current profitability." Yesterday felt like the car company reality crashed the tech stock party. Hard.

Is this just a temporary pothole or the beginning of a more serious breakdown? That's the trillion-dollar question.

(And yes, I'm aware that's no longer literally true since they're now worth less than a trillion. Details, details.)

The timing couldn't be worse. Tech stocks broadly are taking a beating, consumers are clutching their wallets tighter than a toddler with a candy bar, and EV competition is ramping up globally. Tesla's always defied conventional valuation metrics—something I've scratched my head about since covering their first profitable quarter back in 2019—but even gravity-defying acts eventually come back to earth.

Those regulatory credits deserve special attention. They've been Tesla's secret weapon for profitability—pure margin boosters requiring zero additional investment. With the OBBB Act kneecapping this revenue stream, Tesla faces the decidedly unfun task of making actual profits from, you know, selling cars. It's like watching a restaurant suddenly lose its liquor license. The place might survive, but nobody's having as much fun.

Market darlings have an annoying habit of not staying darlings forever. Remember BlackBerry? General Electric? Both once seemed unstoppable. Markets eventually circle back to fundamentals, typically right when everyone's convinced "this time it's different."

Now, betting against Elon Musk has historically been about as profitable as opening an ice cream shop in Antarctica. The man's pulled off more seemingly impossible feats than a Vegas magician on a hot streak. Tesla still maintains extraordinary brand loyalty, leads in battery tech, and that Supercharger network remains a genuine competitive moat.

But... (and it's a big but)

Yesterday's market reaction suggests investors are discounting not just a couple tough quarters but potentially a whole new chapter for the EV pioneer. That trillion-dollar valuation always required some creative squinting—and investors seem to be getting new prescriptions.

The road ahead involves navigating fiercer competition, dwindling regulatory advantages, and the omnipresent risk of Musk getting distracted by his seventeen other companies. For a stock that's been priced for absolute perfection, that's one hell of an obstacle course.

Which seems, you know, not ideal.