Beauty brands are caught in a trade war mess. It's a doozy. And nobody's feeling the squeeze quite like e.l.f. Beauty right now.

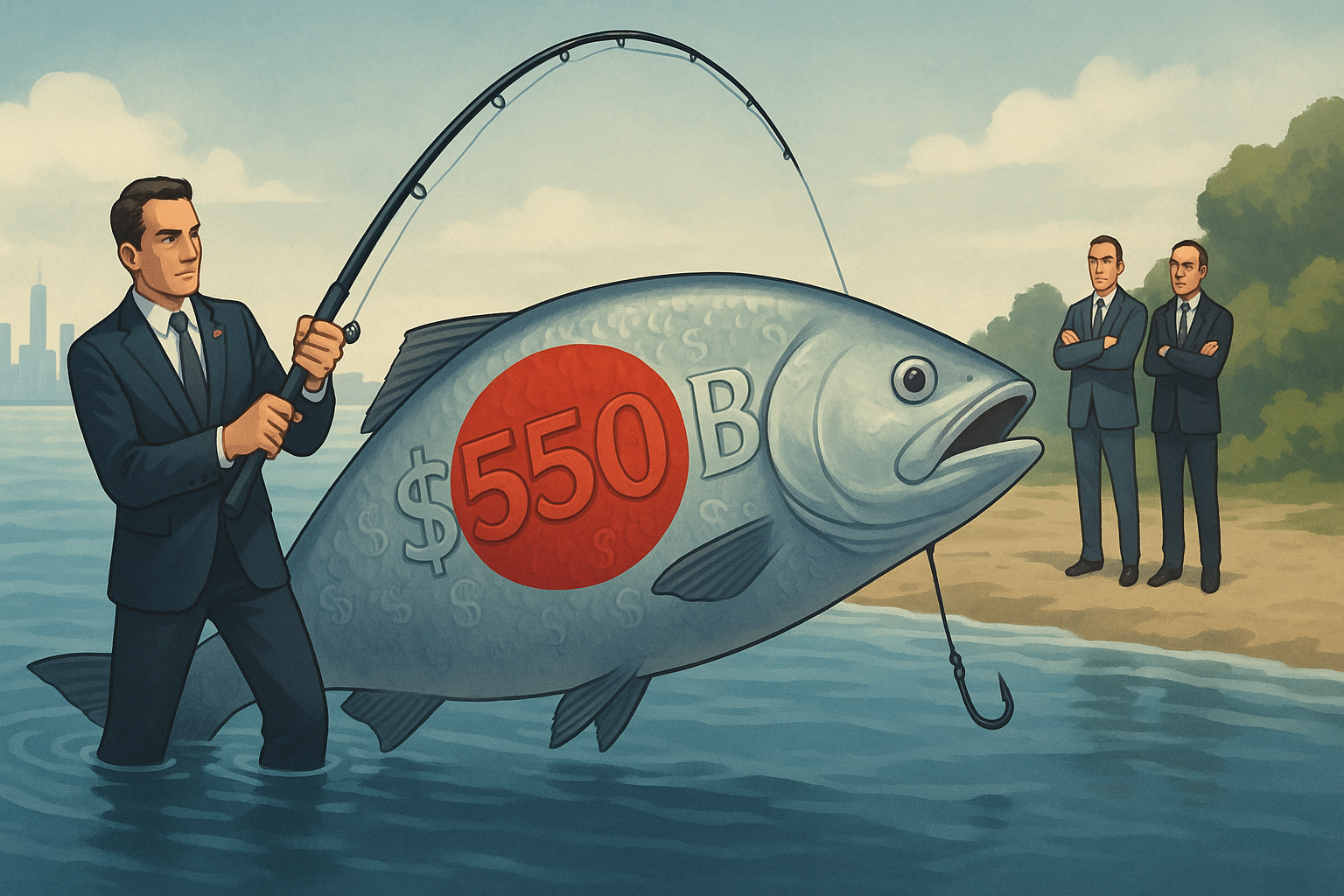

The company finds itself staring down the barrel of a combined 55% tariff on its China-sourced products—which, by the way, make up about three-quarters of everything they sell. That's what happens when you add Trump's original 25% tax on Chinese imports to the fresh 30% slapped on top.

Most CEOs would be scrambling for the exit doors, desperately trying to relocate production while issuing press releases about their newfound commitment to American manufacturing. But not Tarang Amin.

E.l.f.'s chief has taken a different tack entirely. He's doubling down on China.

"It's a competitive advantage we've been honing for 21 years," Amin declared, in what might be the corporate equivalent of planting a flag on contested territory.

I've covered beauty industry strategy since the pre-pandemic days, and I've got to say—there's something refreshing about this approach. It's honest. Maybe even brave.

Look, the reality is simple: e.l.f.'s entire business model revolves around creating affordable "dupes" of high-end cosmetics. Their ability to sell $5 eyeliners that perform like $25 ones depends entirely on that China-based supply chain they've spent two decades perfecting.

So what's the plan? For starters, customers will see prices climb by about a buck across the board beginning in August. It's not much in absolute terms (what's a dollar these days?), but percentage-wise? That's significant when many of your products live in single-digit price territory.

It's beauty's version of that annoying shrinkflation trend we've all noticed in the grocery aisles. Same product, higher price. Sigh.

The Rhode acquisition provides another fascinating window into e.l.f.'s thinking. Beyond snagging Hailey Bieber's star power (which ain't nothing in the beauty world), the billion-dollar deal gives e.l.f. a supply chain diversification play without abandoning ship in China.

Smart move? Time will tell.

What makes this whole situation particularly interesting—at least to industry nerds like me—is how unevenly these tariffs hit different companies. L'Oréal's CEO couldn't help but gloat that their NYX brand only sources about 20% from China, a not-so-subtle dig at competitors "closer to 80%" (three guesses who he meant).

The market, weirdly enough, seems to love e.l.f.'s chutzpah. Their stock jumped a whopping 23% after these announcements. Investors apparently believe that "diversify where possible but stick to your guns where necessary" makes sense in our current geopolitical circus.

But what about the little guys? The indie beauty brands without e.l.f.'s scale or L'Oréal's global manufacturing network? They're absolutely screwed, caught between impossible choices: eat the costs (goodbye, profits), raise prices (goodbye, customers), or reformulate (goodbye, product quality).

I spoke with several small brand founders last week who described the situation as "existential." One told me, "It's like being asked which limb you'd like to amputate."

The beauty world now exists in a bizarre reality where geopolitics shapes business decisions as much as consumer preferences do. Having watched industry cycles for years, I can tell you this is unprecedented territory.

(And yes, I still find it strange to write about mascara and international trade policy in the same article, but here we are.)

Perhaps the ultimate lesson from e.l.f.'s approach is this: sometimes the best response to external shocks isn't dramatic reinvention but strategic adaptation. They're essentially saying, "This is who we are, this is what made us successful, and we're not abandoning our core identity—even if it costs us."

After all, even in a world where lipstick comes with a side of tariff drama, consumers still want the same thing they've always wanted: affordable beauty products that actually work.

And that, friends, is a truth that transcends trade wars.