I've spent twenty years covering international trade deals, and let me tell you – political campaign promises about massive foreign investments follow a predictable pattern: the bigger the number, the fuzzier the details.

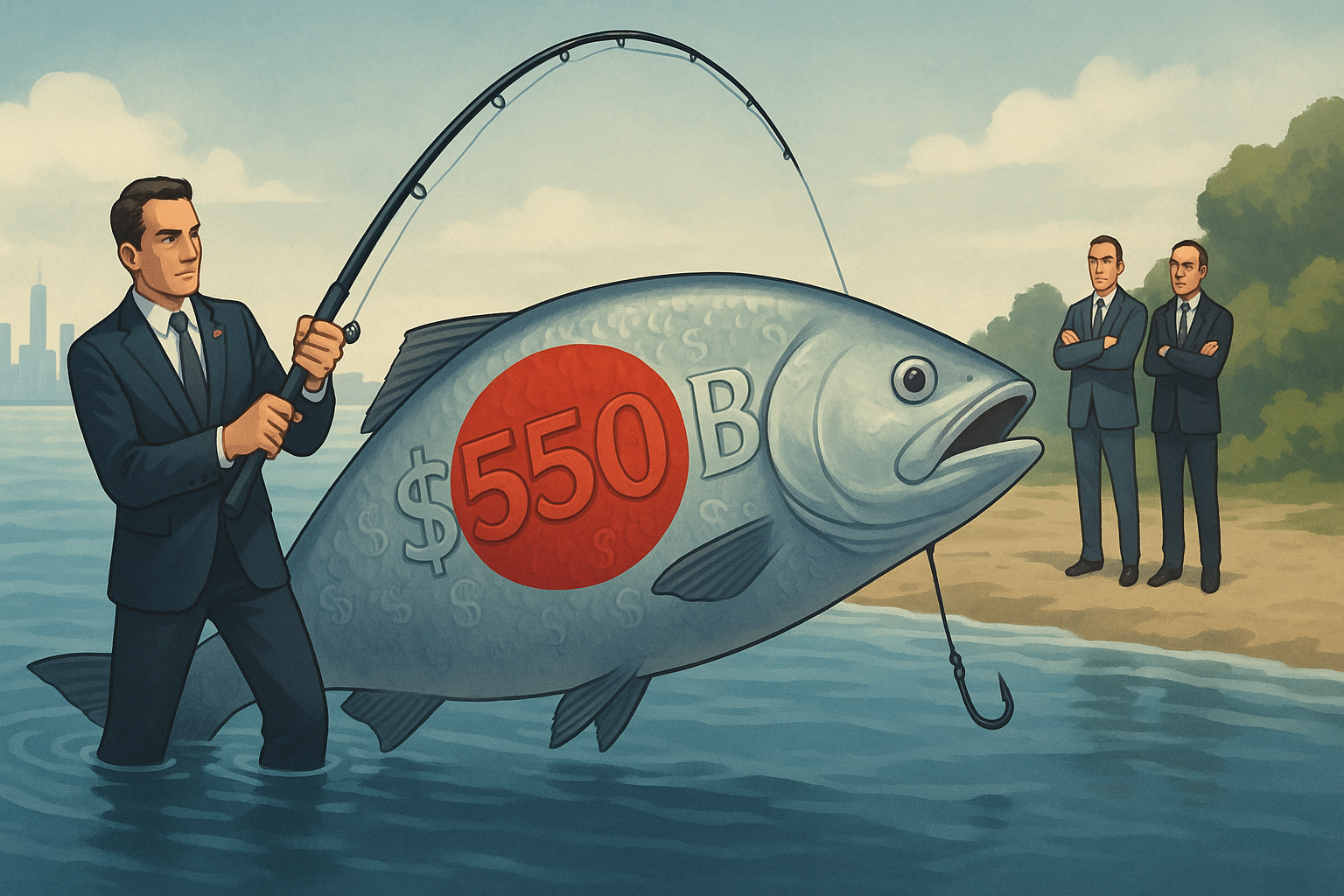

Former President Trump's latest economic proclamation might just take the cake. He's touting what he calls the "largest deal ever made" with Japan – a jaw-dropping $550 billion investment that would supposedly create hundreds of thousands of American jobs while funneling 90% of profits back to U.S. shores.

There's just one tiny problem. Well, actually, several giant ones.

For starters, Japan's entire annual GDP sits around $4.2 trillion. This deal would represent roughly 13% of their entire economic output being shipped off to America. That's... ambitious, to put it mildly. It'd be like the United States casually deciding to invest $3 trillion in Paraguay over dinner.

The financial mechanics don't make any sense either. When foreign companies invest in America, they typically, you know, keep their profits (minus taxes). There's simply no mechanism through which the "United States" as a country collects 90% of returns from foreign direct investment. That's not how capitalism works, folks.

Look, I've been watching these campaign-trail economic announcements since NAFTA was fresh news, and they all share certain qualities – namely, impressively large numbers followed by increasingly diminishing real-world results.

Remember 2019? Trump announced a Japan trade deal that would revolutionize American agriculture. What actually materialized was a modest adjustment to existing arrangements that benefited a narrow slice of agricultural products. The impact? Measured in millions, not billions – and certainly not hundreds of billions.

For a bit of perspective, Toyota's total investment in America over decades sits around $35 billion. So we're supposed to believe Japan is about to invest more than fifteen times that amount all at once?

(The financial markets, those cold-eyed judges of economic reality, barely registered this announcement. Bond yields didn't budge. The dollar/yen exchange rate yawned. Professional money managers know what's what.)

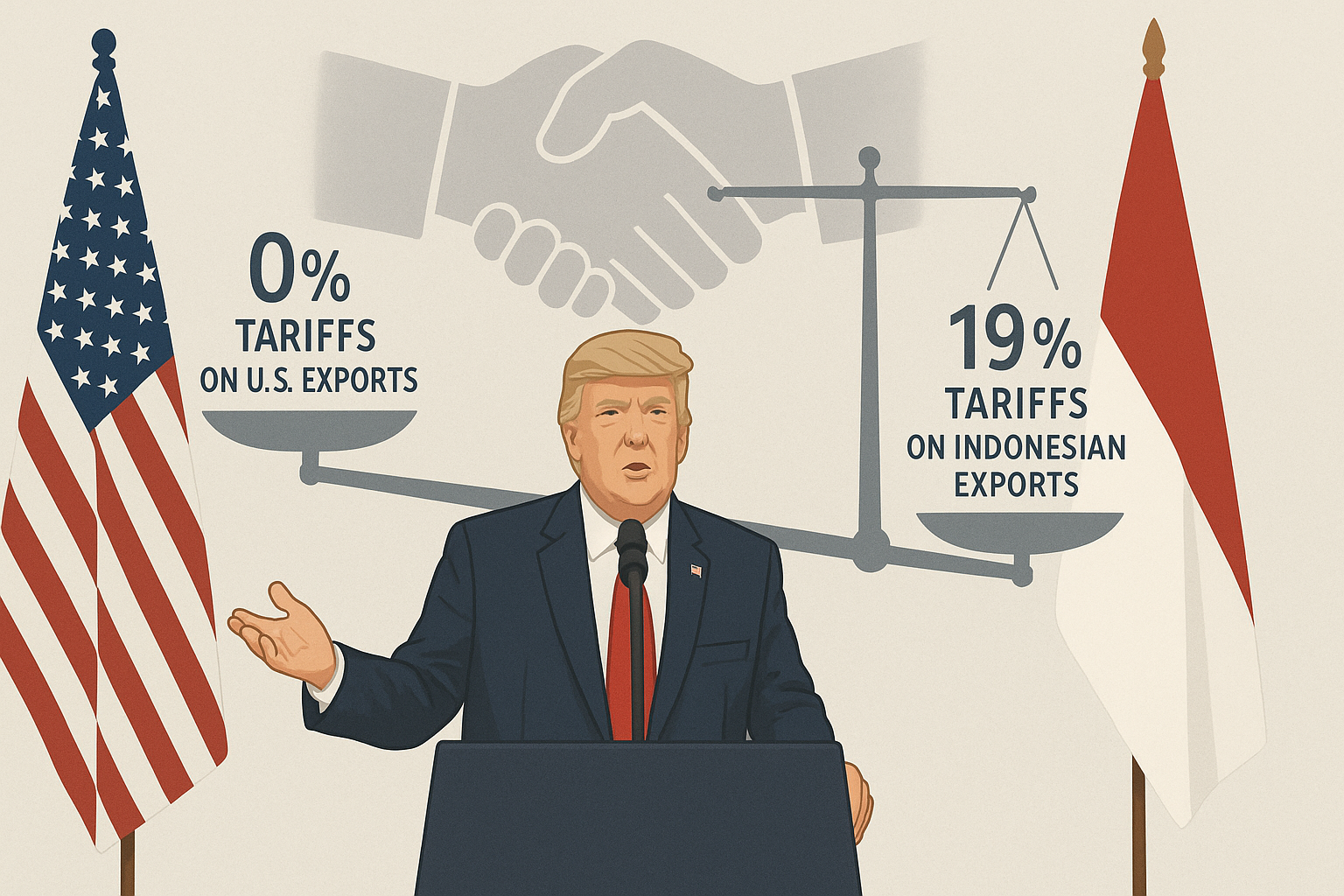

The deal reportedly includes reciprocal 15% tariffs and expanded trade access for vehicles and agricultural products. Which might sound impressive if you haven't been following the actual mechanics of U.S.-Japan trade relations over the past decade.

What we're witnessing is something I call "deal hyperbole inflation" – a political phenomenon where promised economic benefits grow at rates that would make cryptocurrency promoters blush. It follows a simple formula: Take a real but modest possibility, multiply by voter anxieties, then round up to the nearest campaign-friendly number.

This isn't even the first time... well, you know the history. The border wall Mexico was supposed to finance? The 2017 tax cuts that would pay for themselves? The outcomes landed somewhat short of the projections.

So what's really happening here?

In the theater of campaign economics, boldness trumps feasibility every time. That $550 billion figure wasn't chosen for accuracy – it was selected for its attention-grabbing power and ability to project dealmaking prowess.

And hey, mission accomplished. We're all talking about it, aren't we?