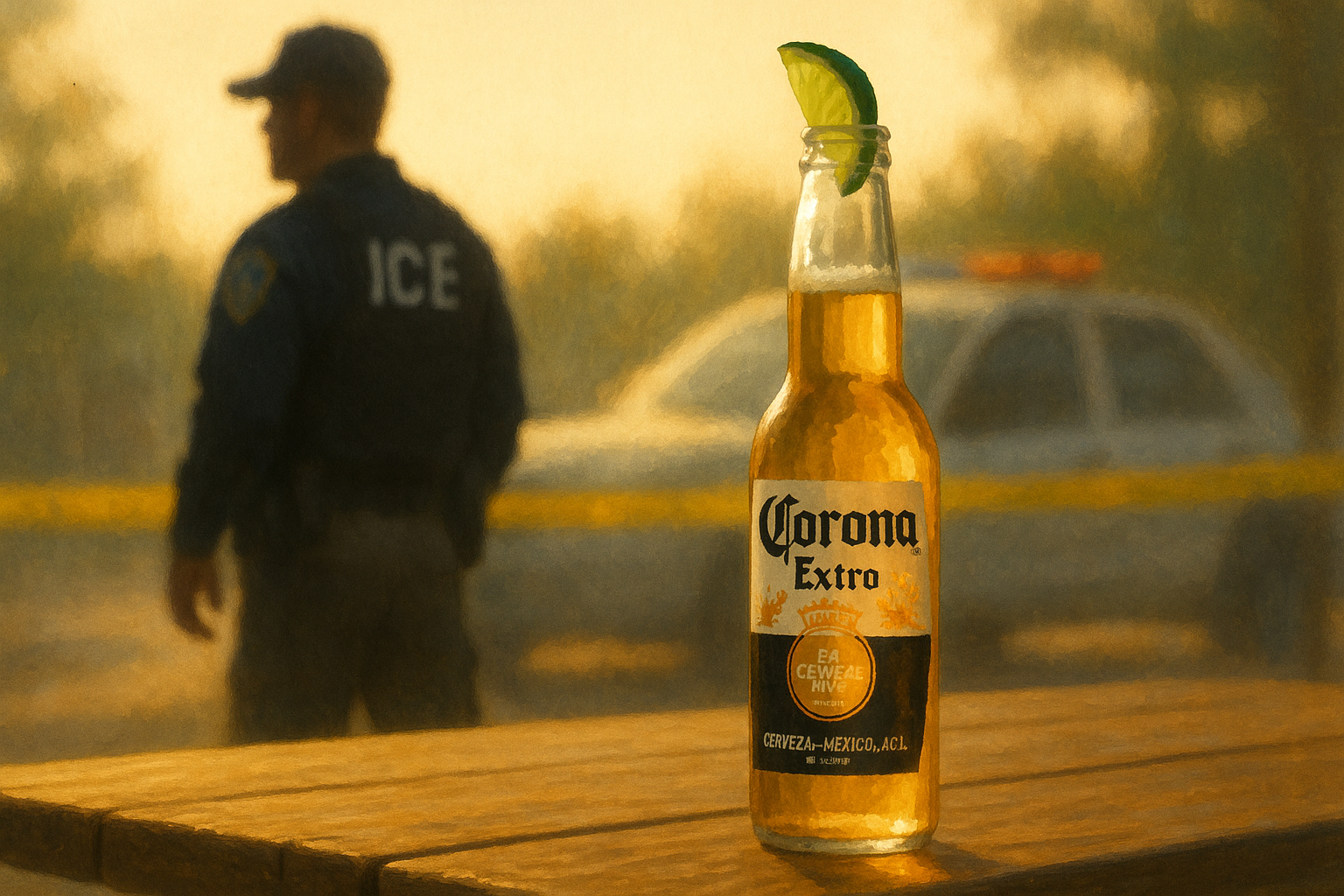

Constellation Brands is having a rough quarter, and it's not because Americans suddenly stopped enjoying beer on hot summer days.

The U.S. distributor of Corona and Modelo reported a surprising 3.3% drop in beer sales last quarter. Their explanation? "Recent consumer uncertainty in the Hispanic community."

Let's read between the lines here, folks. What they're really saying is that immigration enforcement is taking a bite out of their customer base.

I've covered consumer markets for years, and this might be one of the most fascinating examples I've seen of political policy directly hitting a company's bottom line. We're living in strange times when ICE raids and deportation fears show up as line items in corporate earnings calls.

The mechanics aren't particularly mysterious. Constellation's flagship brands—Corona, Modelo, Pacifico—have built their American success largely through strong connections with Hispanic consumers. When that demographic feels threatened or uncertain... well, beer purchases aren't exactly the first priority.

"We've seen this movie before," Constellation's CEO insisted during the earnings call, suggesting this is just a temporary blip. But have we really? Because this feels different.

Look, market segmentation is Marketing 101. Target a specific demographic, understand their needs, craft your messaging accordingly—business school basics. But what happens when your carefully targeted consumer segment becomes the focus of the country's most divisive political battle? Suddenly you're not just selling beer; you're unwittingly entangled in America's immigration wars.

Some of the sales decline is likely direct—fewer consumers in the market due to increased deportations. But I suspect much more is behavioral. People gathering less frequently. Spending more cautiously. Maintaining lower profiles in public spaces. (And yes, purchasing beer is a public activity for most people.)

There's a certain irony that a company named "Constellation"—literally a collection of stars that transcend earthly borders—finds itself tripped up by those very borders. The universe has a strange sense of humor sometimes.

This isn't without precedent. Remember when Russian vodka brands took a beating after the Ukraine invasion began? Or how French wine sales collapsed during the "freedom fries" era of the early 2000s? Consumer products with strong national or cultural identities often become collateral damage in larger political conflicts.

The difference here? The impact isn't coming from politically motivated boycotts, but from government policies directly affecting consumer behavior.

For investors trying to make sense of this, the question is whether this 5% stock drop represents buying opportunity or warning sign. Constellation isn't just beer—their wine and spirits segment actually grew 10% during the same period. And immigration enforcement intensity tends to follow political cycles.

But there's a bigger lesson here about the impossibility of corporate political neutrality in 2023. Constellation didn't choose to enter the immigration debate. They just wanted to sell beer. Yet here they are, their quarterly earnings now a data point in America's culture wars.

Perhaps we need a new metric for evaluating companies: political earnings sensitivity. How vulnerable is your business model to shifts in the political winds? A company selling generic products to broad demographics probably has lower risk than one selling culturally-specific products to particular communities.

In the meantime, I can't help feeling a bit of sympathy for Constellation's management team. They signed up to sell refreshing beverages, not navigate the treacherous waters of immigration politics.

Sometimes the market hands you a Corona without the lime. And you just have to make do.