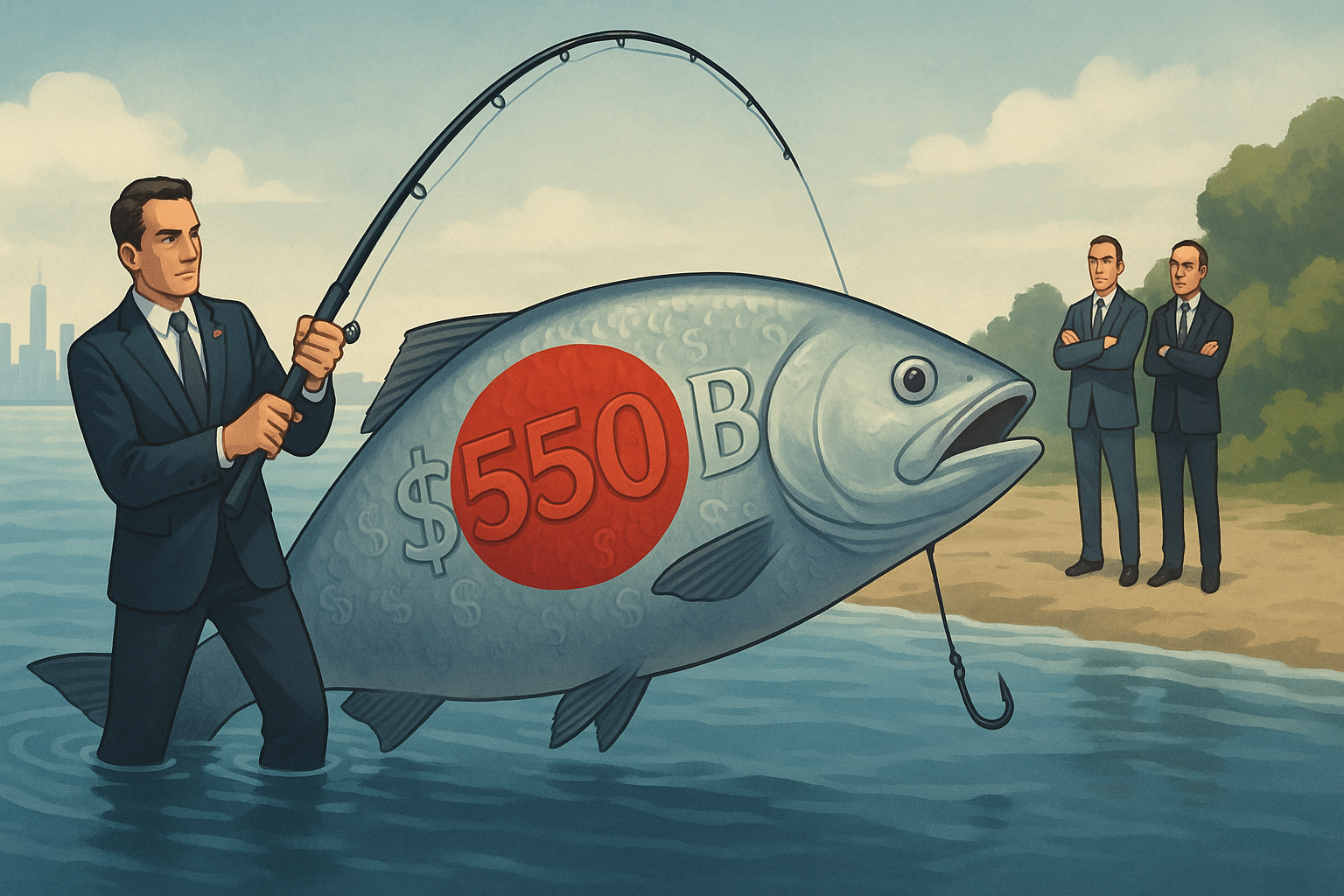

Morgan Stanley just cranked up Amazon's price target to $300—a jaw-dropping 35% upside from where the stock sits now. Analyst Brian Nowak points to a "more favorable tariff environment" and AWS growth that's apparently hitting the gas pedal as reasons why everyone should get even more excited about... a stock that nearly everyone was already excited about.

Here's the thing that made me pause: 70 out of 73 analysts covering Amazon rate it a buy. That's not just consensus—it's practically a cult. We're talking about 96% agreement, which in the financial world is about as common as a humble hedge fund manager.

I've covered tech stocks for years, and when analysts agree this overwhelmingly, I start wondering if they're all drinking the same Kool-Aid.

The valuation? Astronomical. But that doesn't seem to bother anyone. AWS growth is supposedly accelerating because of "reduced supply constraints," which, translated from analyst-speak, means "they can finally build data centers fast enough to keep up with all this AI madness."

What we're witnessing is less about innovation and more about real estate and electricity. Amazon doesn't need to reinvent the wheel right now—they just need warehouse space and power lines. Twenty years ago, if I'd told you investors were salivating over a company because it was really good at building digital storage facilities, you'd have thought I was nuts.

Now it's worth a 35% target bump. Go figure.

The improved tariff situation Nowak mentions is particularly interesting (or troubling, depending on your perspective). Have these analysts looked at the political calendar lately? We're heading into an election that could flip trade policy upside down in either direction. But sure, let's assume everything stays peachy.

Look, Amazon is clearly a phenomenal business. It's conquered everything from books to cloud computing to whatever Bezos decided looked interesting on a particular Tuesday. The empire is impressive—no argument there.

What's bizarre is this analyst herd mentality. When was the last time you saw 96% of highly paid professionals agree on anything? Even "the sky is blue" would generate more debate among a random group of 73 experts.

The consensus price target actually suggests even more upside than Morgan Stanley's bullish view. Because... of course it does. Nothing says "rigorous independent analysis" quite like dozens of financial professionals reaching nearly identical conclusions about one of the world's most visible companies.

(I once asked an analyst at a conference about this phenomenon. His response? "Nobody ever got fired for being bullish on Amazon." Not exactly the scientific method at work.)

As the cloud infrastructure gold rush continues and AI hype maintains its fever pitch, Amazon is certainly sitting pretty. The question isn't whether Amazon is good—it's whether all this goodness is already baked into the price. And then some.

When everyone's nodding in unison about a stock's prospects, that's precisely when you might want to look around for what they're missing. Or maybe—just maybe—Amazon really is the exception that proves the rule.

The cloud does have silver linings, after all. But so did plenty of other "can't-miss" investments throughout history.