The stock market's favorite grandfather figure is getting nervous again, and maybe—just maybe—we should be paying attention.

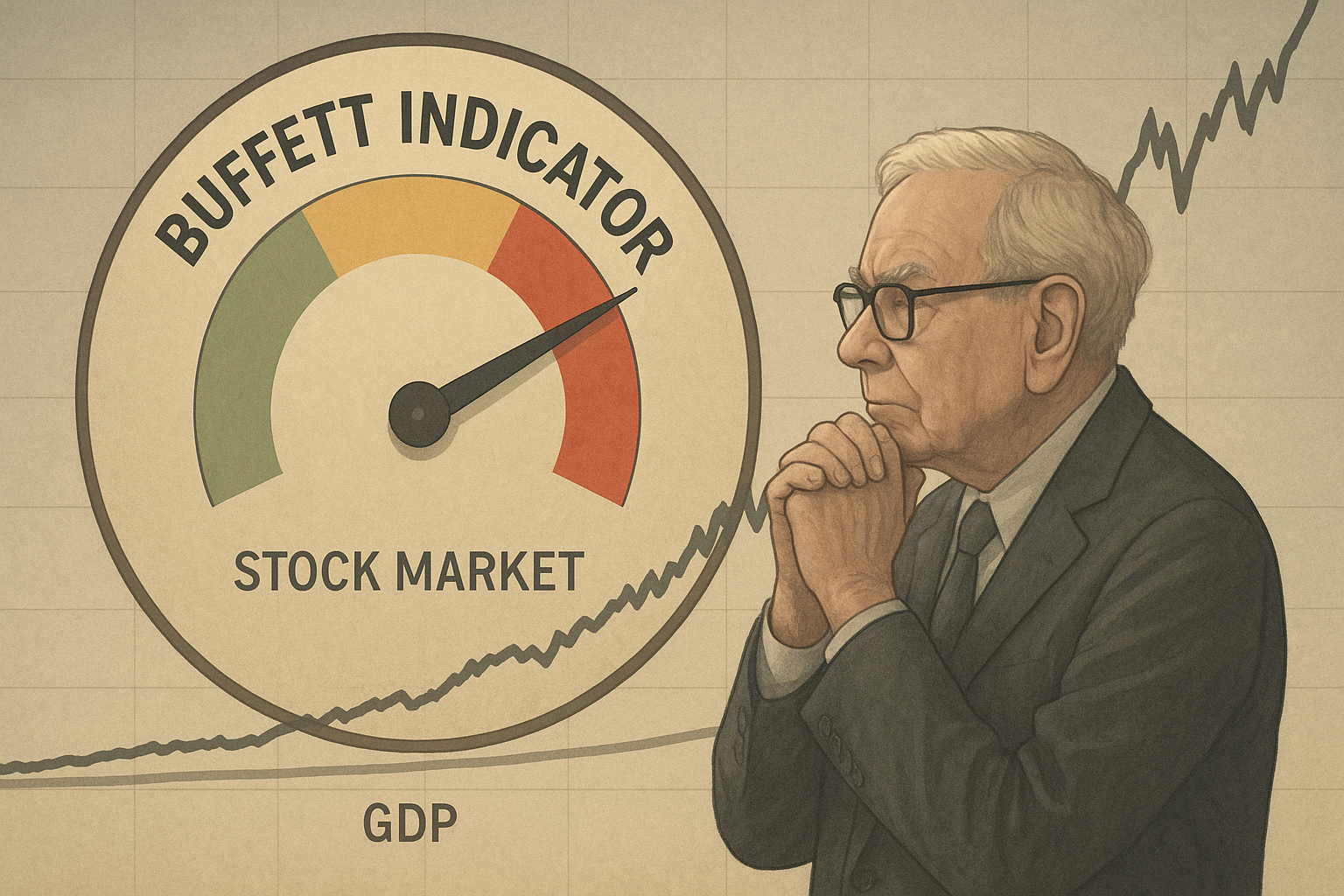

Warren Buffett's preferred market valuation metric (nicknamed the "Buffett Indicator") sits at a whopping 207% above historical norms. For the uninitiated, this measures total stock market capitalization against GDP, and right now it's flashing a warning signal that would make a traffic light jealous.

So what's an average investor to do? Especially one eyeing a nice, sensible VOO purchase?

I've been covering market psychology for years, and there's something uniquely paralyzing about hearing Buffett express concern. It's like having your doctor mutter "interesting" during a routine checkup—suddenly your heart's racing for reasons entirely unrelated to your actual health.

The Oracle of Omaha presents us with what I call the Buffett Paradox. Here's a man who simultaneously preaches eternal optimism about American capitalism while stockpiling cash like he's preparing for financial armageddon. Berkshire Hathaway is sitting on roughly $180 billion in cash reserves right now. That's enough to buy several Fortune 500 companies outright—with pocket change left for a few professional sports teams.

"The contradiction is part of his charm," explained a portfolio manager I spoke with last week (who requested anonymity to speak freely about the investment legend). "Buffett tells everyday folks to buy index funds while he hoards cash and waits for blood in the streets."

But here's the thing that keeps me up at night: Buffett has been "concerned" about valuations for much of the past decade. Had you retreated to cash when this indicator first started flashing warnings in 2018, you'd have missed one hell of a market run.

Markets, it turns out, can remain "overvalued" much longer than most people's patience can remain intact.

The Waiting Game Nobody Wins

Look, market timing is a fool's errand dressed up as wisdom. There's always—and I mean always—a compelling reason to stay on the sidelines.

Remember 2020? Global pandemic. 2022? Inflation and rate hikes. Today? Sky-high valuations and tech concentration. Tomorrow? Something else entirely.

I call this the "Perpetual Anxiety Framework," and it's the most reliable market pattern I've ever observed. The market climbs a wall of worry, stopping occasionally to throw off passengers who can't stomach the vertigo.

Even professionals get this wrong constantly. Buffett himself doesn't claim to predict market movements—his genius lies in identifying undervalued businesses, not market turning points.

The current environment is particularly maddening. We've got full employment alongside stubborn inflation. Consumer spending remains robust while manufacturing data looks shaky. The housing market refuses to crash despite mortgage rates that would've seemed apocalyptic in 2019.

(Sometimes I wonder if economic indicators are just elaborate practical jokes played by statisticians with too much time on their hands.)

Your VOO Dilemma

That VOO purchase you're contemplating? It's not really a market timing question—it's a question about your faith in American capitalism over the next few decades.

The Vanguard S&P 500 ETF is essentially betting that American businesses will continue to innovate, grow, and generate profits. When you're buying VOO, you're not making a call on next quarter; you're making a call on the next quarter-century.

The harsh reality—and I've seen this play out countless times—is that waiting for the perfect entry point often costs more than slightly overpaying. Even the worst day to buy the market in 2019 turned out better than waiting for the "obvious" correction that CNBC talking heads were predicting with absolute certainty.

That said, there are smarter approaches to navigating uncertainty than the all-or-nothing decision that's probably tormenting you:

Dollar-cost averaging breaks your investment into chunks, spreading your entry points over time.

You might allocate slightly more toward value stocks or international markets, which look less stretched by traditional metrics.

Maintain perspective. Even Buffett, for all his caution, isn't selling his Apple or Coca-Cola shares.

The market may indeed be overvalued. A correction wouldn't surprise anyone who's studied market history for more than fifteen minutes. But corrections are normal, healthy, and—this is crucial—ultimately forgettable blips in long-term returns.

Buffett's caution is worth noting, sure. The man didn't amass a fortune by accident. But his investment horizon is measured in decades, not days or months. He's playing a different game than most of us.

Can I tell you whether to buy VOO today? Nope. And neither can Warren. What history suggests is that indecision and paralysis typically cost more than imperfect timing.

The real question isn't whether you'll ever regret your purchase timing—you almost certainly will, no matter when you buy—but whether that regret will still matter to you in 2035.

If Warren's worried, maybe buy a little less VOO today and a little more next month. Just don't mistake his caution for a crystal ball. Even oracles have their limitations.