The Biden administration just threw down the economic gauntlet against China's battery material dominance. And boy, it's a doozy.

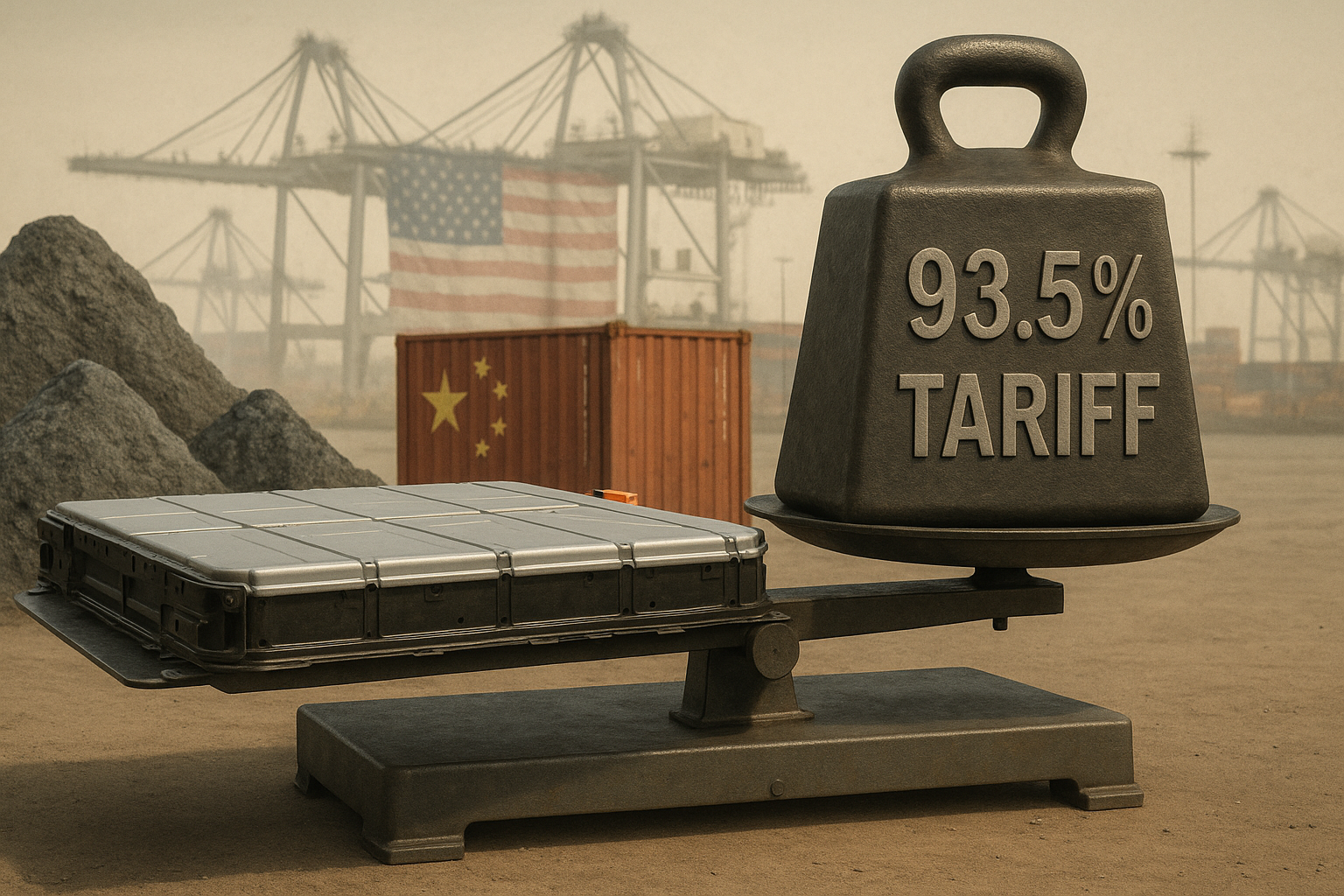

Yesterday's Commerce Department announcement revealed plans for a whopping 93.5% tariff on Chinese graphite—you know, that critical stuff that goes into basically every EV battery on the planet. This comes on top of earlier duties announced in May, potentially pushing the total tariff north of 200%.

Let me put this in perspective. China controls roughly 65% of global graphite production. Not just mining it, mind you, but processing nearly all the world's natural graphite into the specialized material needed for EV battery anodes. We're talking complete supply chain dominance.

Having covered clean energy markets since 2019, I've watched this dependency grow increasingly problematic. American policymakers have been wringing their hands about it for years.

But here's the thing—EV makers are already struggling with affordability issues. (Ask anyone who's shopped for an electric car lately.) Tesla, Ford, GM... they've all been slashing prices to move inventory because consumers remain skittish about higher upfront costs.

Will adding a nearly 100% tax on a key component help this situation? I'll wait while you do the math.

The timing is... interesting. This tariff joins a broader push including the Inflation Reduction Act's domestic content requirements and various other trade restrictions. It's industrial policy with the subtlety of a sledgehammer.

"We need to secure our supply chains," a Commerce Department official told me, speaking on background. "The dependence on China presents unacceptable risks." Fair enough, but at what cost?

Look, there's a classic policy trilemma at work here. Energy independence, affordable clean tech, reduced reliance on China—pick two. The administration has clearly sacrificed affordability on the altar of the other priorities.

Syrah Resources—which runs the only active graphite processing facility in the US—saw its shares jump on the news. No surprise there.

I spoke with three industry analysts yesterday who all echoed the same sentiment: this protection might stimulate domestic production, but consumers will foot the bill in the meantime.

The market reaction beyond Syrah was surprisingly muted. Most EV manufacturers had already begun diversifying supply chains after earlier tariff announcements. They saw this train coming down the tracks.

What we're witnessing is nothing less than the real-time rewiring of global supply chains. Geopolitics is trumping economics, plain and simple.

The greatest irony? If these tariffs keep EV prices high enough to slow adoption, they could delay the very climate benefits that motivated the clean energy push in the first place. Sometimes you have to wonder if policymakers think these things all the way through.

Will this gambit build a domestic battery supply chain through taxation? History isn't exactly bursting with successful examples. But maybe—just maybe—this time is different.

I wouldn't bet my 401(k) on it, though.