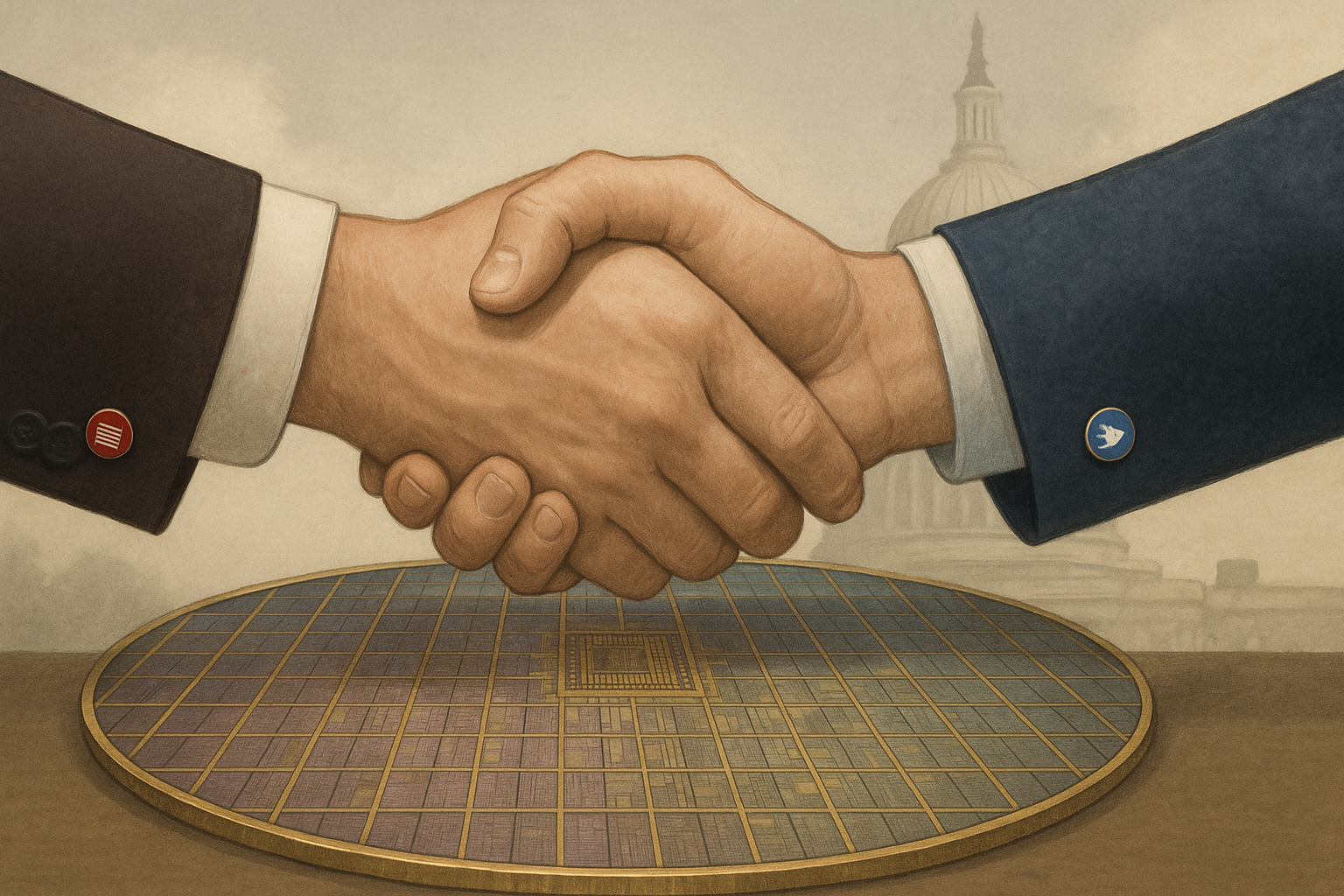

In a political twist that nobody saw coming, Bernie Sanders has thrown his support behind Donald Trump's plan to transform billions in semiconductor subsidies into government equity stakes. Yes, that Bernie Sanders—the democratic socialist who's spent his career fighting corporate handouts—is now nodding along with Trump's surprisingly interventionist approach to the CHIPS Act funding.

Let me say that again: Bernie Sanders and Donald Trump agree on something. In 2024.

The proposal would convert $10.9 billion earmarked for Intel into partial government ownership rather than straight grants. It's a fundamental shift in how America approaches industrial policy, and it's created what might be the strangest political bedfellows in recent memory.

"If microchip companies make a profit from the generous grants they receive from the federal government, the taxpayers of America have a right to a reasonable return on that investment," Sanders declared, in what could easily have been a Trump campaign speech.

He's got a point. The original CHIPS Act structure was essentially corporate welfare dressed up as national security—here's billions with minimal strings attached, please build some factories. The kind of arrangement Sanders has railed against for decades.

Trump's equity stake idea changes everything. It's not charity; it's investment. Uncle Sam becomes a shareholder, not just a benefactor.

America's Accidental Sovereign Wealth Fund

What we're witnessing might be the backdoor creation of an American sovereign wealth fund. Norway has oil money; we could have chip money.

This isn't completely unprecedented. During the 2008 financial meltdown (which I covered as a young reporter, God help me), the government took ownership stakes in banks through TARP. Those investments eventually returned profits to taxpayers—about $110 billion in total, if memory serves.

The shift creates entirely new incentives. When you're getting free money, you do the minimum. When someone owns part of your business? That's a whole different ballgame.

But hold on—this raises a ton of questions nobody seems ready to answer. What kind of shareholder would the federal government be? Would it demand board seats? Push for worker-friendly policies? Or just sit back and cash dividend checks?

And how would Intel's executives feel about quarterly earnings calls where disappointing the government isn't just bad PR but potentially catastrophic?

Look, there's something oddly logical about this approach. If taxpayers are shouldering the risk of these massive investments, shouldn't they get a shot at the rewards too? The traditional American way—socializing losses while privatizing profits—has always seemed like a raw deal for the public.

Political Realignment in Real Time

I've been covering Washington for years, and I've never seen anything quite like this convergence. The Sanders-Trump overlap represents exactly the kind of populist horseshoe that political scientists keep theorizing about—where the far left and the new right find common ground in their distrust of corporate power and establishment economics.

Intel now faces a genuine dilemma. CEO Pat Gelsinger has bet the company's future on a manufacturing renaissance that requires mountains of capital. The CHIPS Act money was supposed to be the easy part. Now it comes with a potential government co-owner.

(I reached out to Intel for comment but haven't heard back. Can't imagine why they're taking their time with this one.)

The semiconductor industry is caught between competing visions of American capitalism. On one side: the hands-off approach where government creates conditions for growth but stays out of boardrooms. On the other: government as active investor with expectations of returns and influence.

American capitalism has never actually been as free-market as we pretend. From land grants to defense contracts to targeted tax breaks, the government's fingerprints have always been all over our "free" market.

What's different now is the explicit acknowledgment that the public deserves direct benefits from public investments. Radical concept, I know.

The strangest part? Both Sanders and Trump are essentially advocating for partial nationalization of strategic industries—a concept that would have been political suicide a decade ago. Times change, I guess.

Will it work? Who knows. Government equity stakes could provide accountability and returns—or create bureaucratic nightmares and political interference. The implementation will determine everything.

But when Bernie Sanders and Donald Trump find themselves nodding in agreement, we've entered uncharted territory. The old political maps are useless. We're watching America's relationship with its largest corporations being redrawn in real time, and nobody—not me, not you, not even the politicians themselves—can predict exactly where this road leads.