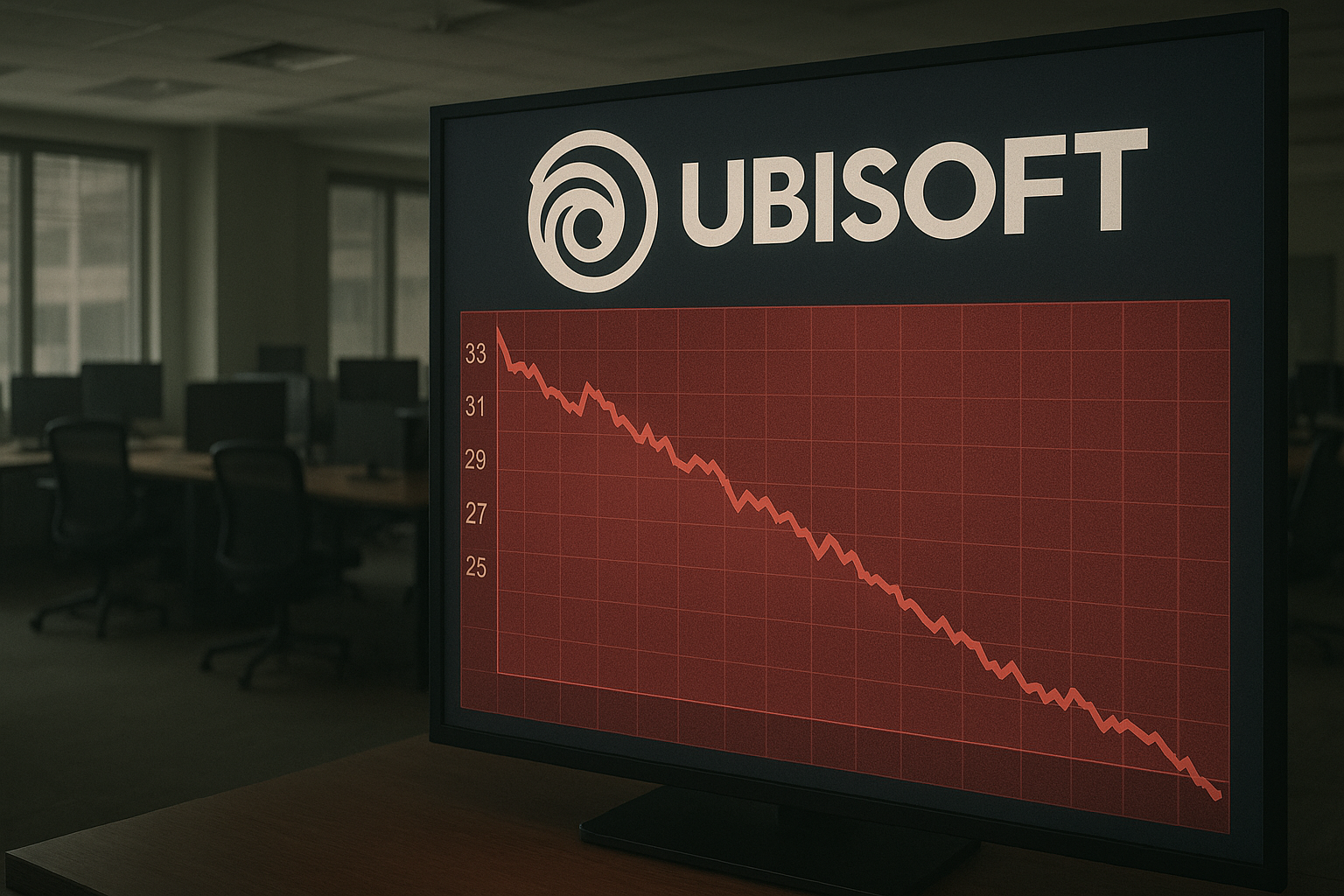

Ubisoft's shares have slumped below €9, landing at a concerning €8.92 yesterday. And honestly? This isn't just another blip on the radar for a notoriously volatile industry. What we're witnessing looks increasingly like a fundamental problem for a publisher whose upcoming release schedule is about as robust as a ghost town on Monday morning.

I've been tracking gaming industry finances since 2016, and there's a pattern I've seen before. Assassin's Creed Shadows—meant to be the company's heavyweight contender this year—has reportedly underwhelmed financially. Their new Prince of Persia roguelike (remember when that franchise was revolutionary?) is generating all the excitement of watching paint dry. Beyond that? Just an Anno game on the horizon—solid strategy title, sure, but hardly the kind of blockbuster that moves serious financial needles.

The situation reminds me of what I call a "content drought death spiral." It's vicious, really. One disappointing release leads to reduced revenue projections. This triggers decreased investment in new titles. The pipeline thins out. Revenue projections drop further... and round and round we go.

What makes Ubisoft particularly vulnerable? Scale.

The company maintains roughly 40 studios worldwide with approximately 21,000 employees on payroll. That's not just big—it's massive. We're talking about an operation burning through about €1.3 billion in annual operating expenses. You can't just coast on your back catalog with that kind of overhead. The meter never stops running.

Look, the industry has fundamentally transformed over the past decade. The days of pumping out annual iterations of franchises (remember those yearly Assassin's Creed releases?) have largely given way to fewer, bigger titles supplemented by live service games generating continuous revenue streams.

Ubisoft's competitors seem to get this. Microsoft just made the painful but pragmatic decision to lay off 1,900 gaming division employees following their Activision Blizzard acquisition. Sony has crafted a balanced portfolio of tentpole exclusives, live service offerings, and PC ports. Even EA—hardly the darling of gaming enthusiasts—has built relatively stable revenue channels through sports franchises and Apex Legends.

And Ubisoft? They seem perpetually a step behind the curve. (Remember that Ubisoft Quartz NFT experiment? About as successful as trying to pay your mortgage with Pokémon cards.)

There are historical parallels worth considering. THQ—once a publishing powerhouse—collapsed entirely in 2012 after a string of commercial disappointments and failure to adapt. I'm not suggesting Ubisoft is headed for bankruptcy tomorrow, but the warning signs are flashing in unmistakable neon.

For investors, the million-euro question becomes: is Ubisoft a bargain at these depressed levels or a classic value trap? At a market cap hovering around €1.1 billion, they're trading at less than one times annual revenue, which traditionally would signal "buy" in this sector.

But without a coherent growth strategy? That seemingly low valuation might be perfectly rational.

The company desperately needs not just a hit game, but a fundamental rethinking of their approach to the modern gaming landscape. Hoping the next Far Cry or Assassin's Creed will magically fix everything feels increasingly like digital wishful thinking.

I spoke with three gaming industry analysts last week who all expressed similar concerns about the company's direction. None wanted to be quoted directly—telling in itself—but their collective assessment was hardly optimistic.

Oh, and let's not forget Tencent now owns roughly 10% of Ubisoft. At what point does that stake start looking less like a strategic investment and more like the appetizer before a potential acquisition main course?

For a company that made its name creating worlds where players strategize and adapt to overcome challenges, Ubisoft itself seems remarkably resistant to evolving its own business approach. Unless something changes—and fast—that stock price might continue its unfortunate free-fall.