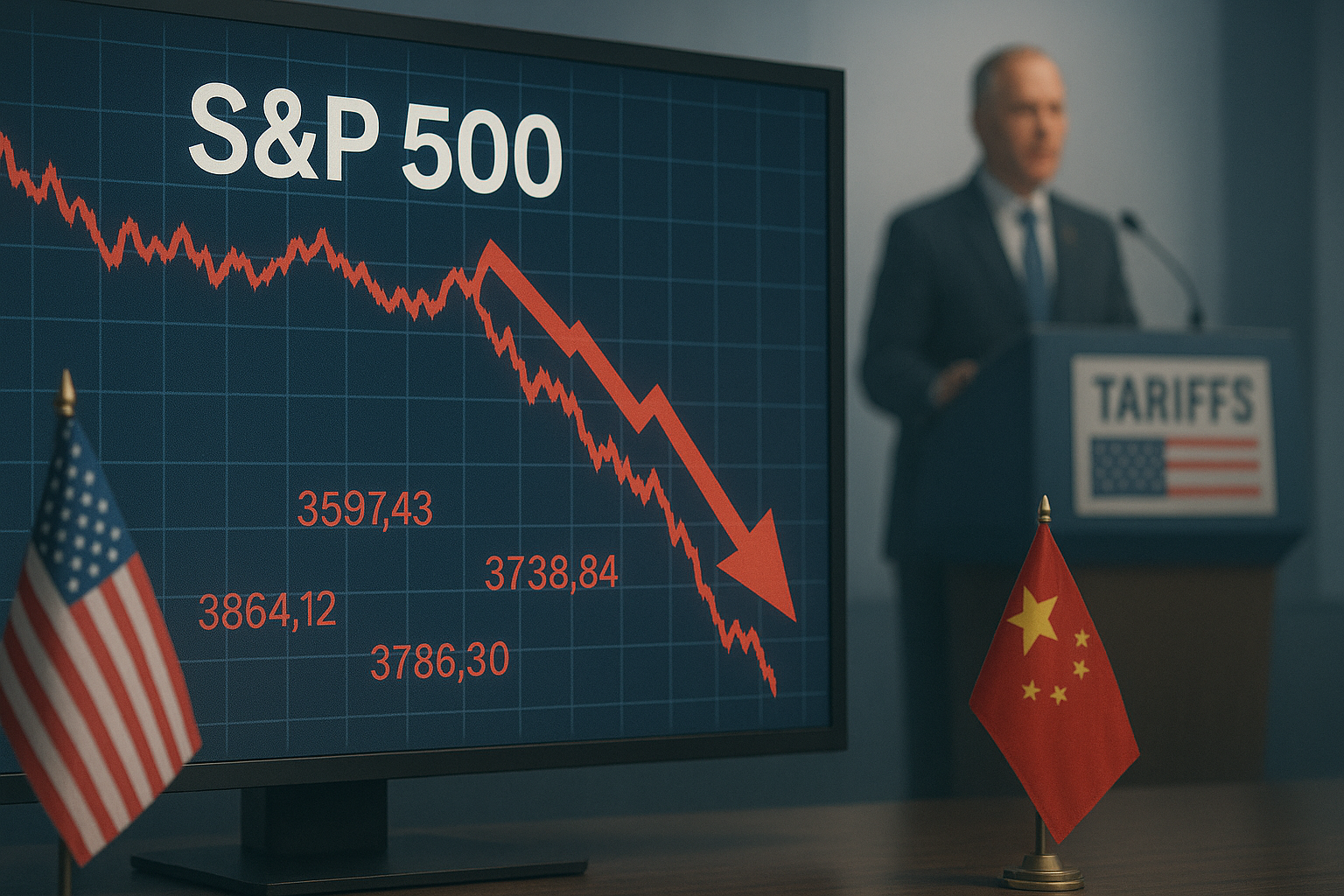

Well, here we go again. Last week's market ride started with promise and ended with a thud as Trump threatened "massive" new tariffs on China, sending stocks into a Friday tailspin that erased what had been shaping up as a decent week. The S&P 500 tumbled 2.43% weekly, with most of that damage crammed into Friday's session.

If you're feeling like you've seen this movie before, join the club. The tariff threats, market panic, eventual recovery—it's a rerun playing on Wall Street's biggest screen.

The week actually started on solid footing. Markets shrugged off Monday's announcement of a 25% tariff on imported medium and heavy-duty trucks. One targeted tariff? No big deal, apparently. By midweek, champagne corks were practically popping as the Nasdaq crossed 23,000 for the first time ever.

Then Friday happened. And suddenly we were transported back to 2018-2019.

Here's the thing about markets, though—they develop something like muscle memory. The first time Trump played the tariff card during his previous administration, investors genuinely freaked out. But as the pattern repeated itself (and it did, repeatedly), traders learned that the initial panic often created buying opportunities. The rhetoric would heat up, markets would dip, some kind of resolution would eventually materialize, and stocks would bounce back.

I've covered these cycles for years, and what I call the "diminishing shock value" effect usually kicks in. Each successive threat tends to generate a smaller reaction—unless there's something new to worry about. Friday's sharp decline suggests investors might be seeing something different this time around.

A Perfect Storm: Tariffs Meet Shutdown

What makes this round particularly interesting is the backdrop. We're in the middle of a government shutdown that's essentially created an economic data blackout. Many key releases are delayed or canceled altogether. The labor market information vacuum, in particular, means Wall Street can't tell if the economy is gently cooling or holding firm.

Nature abhors a vacuum, and markets? They positively despise an absence of trading catalysts. So presidential pronouncements fill the void—for better or worse.

Meanwhile (and this seems important), gold just blasted past $4,000 for the first time ever, while silver topped $51. These aren't just random movements. When precious metals surge like this, it usually signals some deep-seated economic anxiety lurking beneath the market's seemingly confident surface. Goldman Sachs even jacked up its gold target to $4,900 for 2026 year-end. That's... telling.

The Fed's Safety Net

The saving grace—and potentially what makes this tariff tantrum different from previous episodes—is the Fed's current easing cycle. Wednesday's minutes confirmed what most already expected: two more rate cuts likely coming in 2025, with the October 29th meeting almost certainly (98% probability) delivering another 25 basis point reduction.

This monetary cushion might explain why, despite Friday's sharp selloff, trading volumes weren't actually panic-level high—just slightly above the 20-day average. It wasn't a mad dash for the exits so much as a cautious reshuffling of positions.

Look, there's an inherent contradiction in Trump's market approach that I find endlessly fascinating. On Monday, he was bragging about stock market records as validation of his economic vision. By Friday, his own policy announcements were tanking those very same markets.

It reminds me of someone proudly showing off their immaculate living room while simultaneously tossing handfuls of glitter into the air. (I once interviewed a fund manager who described it as "taking credit for the sunshine while making it rain." Not bad, right?)

What Happens Next?

If past is prologue—and in markets, it often is—we can expect the initial shock to give way to more nuanced analysis. Tech companies and businesses with Chinese supply chain exposure will probably remain under pressure, while domestic-focused operations could outperform.

The dollar's recent four-day winning streak (pushing the Dollar Index to 99.50) suggests global capital is still seeking refuge in American assets despite the domestic uncertainty. We've seen this movie before, too.

I spoke with several traders on Friday afternoon who seemed more irritated than frightened. "Same script, different day," as one veteran put it to me. "We'll drop 3-5%, then stabilize once people realize the actual policies will be more moderate than the rhetoric."

Maybe. Maybe not.

The market made consecutive all-time highs before this pullback. A 2.5% drop feels dramatic after recent calm seas, but it's barely a ripple in the bigger picture. Since September 12, the S&P 500 is actually still slightly positive, believe it or not.

Until we see sustained selling with significantly higher volumes, this looks more like a commercial break than a cancellation of the bull market program.

I don't want to downplay the potential consequences here—serious trade tensions would indeed matter. But for now, this feels like episode 37 of a series where we've all read the spoilers online.

Things happen. Markets react. Life goes on.

And we'll probably do this all again sometime soon.