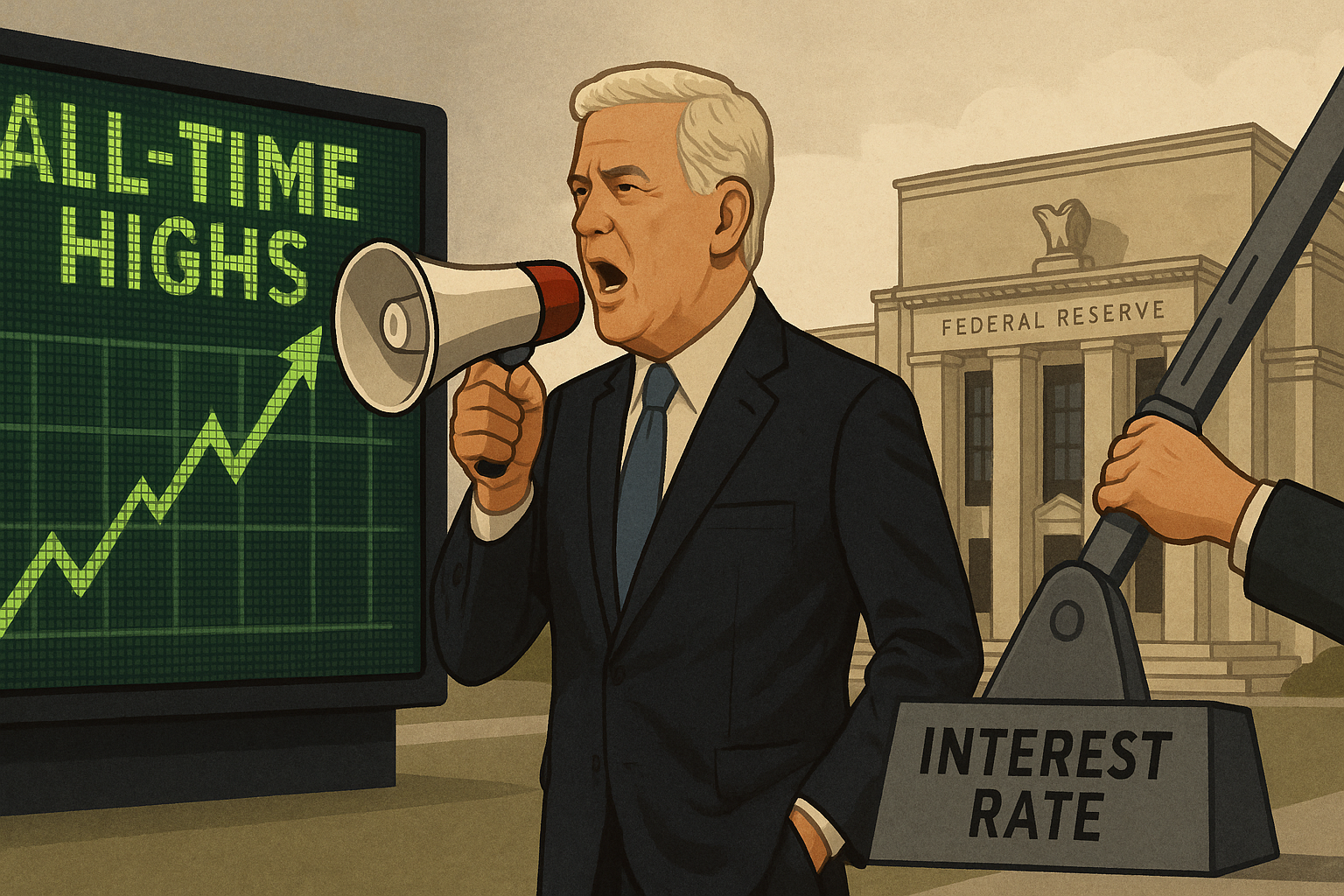

In what might be the most perfectly on-brand financial commentary of the campaign season so far, former President Trump just couldn't help himself. He's taken to social media to simultaneously celebrate "all-time high" stock markets while demanding the Federal Reserve slash interest rates "immediately."

I mean, really?

Nothing says economic coherence quite like demanding emergency monetary easing while bragging about market euphoria. It's essentially like complaining your sports car isn't going fast enough... while boasting about breaking the speed limit.

The thing is, Trump's post perfectly encapsulates the collision between political messaging and financial reality that defined his first term. And boy, does it look like we're in for a sequel.

What's Actually Happening in Markets

Look, there's truth to part of what Trump's saying. The major indices have indeed been flirting with record territory lately. The S&P and Nasdaq have had quite the run—especially the latter, which has been riding the AI wave like a Silicon Valley surfer at Mavericks.

Nvidia (have you seen those numbers?) has become the poster child of this movement, soaring about 50% since Trump started talking tariffs again. Correlation isn't causation, but try telling that to a politician with a Twitter—sorry, X—account.

But here's where it gets complicated.

This market strength? It's about as evenly distributed as wealth in a monopoly game three hours in. A handful of mega-cap tech companies are essentially dragging the indices higher while plenty of other sectors are just... existing. It's less "rising tide lifts all boats" and more "a few luxury yachts are creating a wake that's sloshing over the gunwales of the rowboats."

(Having covered market breadth issues since the pandemic recovery, I've seen this movie before.)

Rate Cut Fantasy vs. Fed Reality

Trump's demand for immediate rate cuts seems wildly disconnected from, well, everything the Fed has been carefully communicating. Powell and the FOMC have spent months meticulously crafting expectations for potential cuts later this year—and only if inflation data cooperates.

It's as if the Fed has been writing a delicate symphony and Trump just walked on stage with an air horn.

The central bank remains caught in that classic monetary policy pickle—inflation has cooled but hasn't consistently hit their 2% target. The labor market shows signs of normalizing but remains relatively tight. And despite what makes for punchy social posts, "there is no inflation" isn't quite the nuanced reality that keeps Fed officials up at night.

"Immediate" rate cuts while celebrating market highs? That's like complaining your investment portfolio is making too much money too slowly. Makes you wonder if he's actually looking at the same economic data as the rest of us.

The Great Tariff Narrative Flip

Perhaps the most fascinating bit of economic gymnastics in Trump's recent messaging is his attempt to reframe the market's reaction to his tariff proposals.

Remember when he first started talking about slapping 60% tariffs on Chinese goods? Markets didn't exactly throw a party. Companies with significant exposure to China saw their stocks take a hit as investors considered the implications.

But now? We're witnessing an attempt to create a completely different narrative—that somehow these tariff threats have actually been bullish for markets. It's a remarkable bit of after-the-fact storytelling that's getting an assist from the AI frenzy, which has conveniently papered over broader market concerns.

His claim that "the U.S. made hundreds of billions of dollars from the tariffs" deserves particular scrutiny. I've interviewed dozens of economists on this very topic, and the consensus is pretty clear: tariffs are essentially taxes paid primarily by domestic importers and ultimately passed along to American consumers. They're not checks written by foreign governments.

The evidence from Trump's previous tariff experiment showed significant economic drag while primarily shifting supply chains rather than bringing manufacturing back home in any meaningful way. But why let economic research get in the way of a good campaign narrative?

Politics and Markets: The Messaging Battleground

What we're seeing is just the opening move in what will likely become an increasingly finance-focused presidential campaign. Markets have always been a convenient scoreboard for presidential success (fair or not), and Trump seems eager to reclaim ownership of this narrative.

The contradiction at the heart of his post—demanding emergency monetary stimulus while bragging about market strength—inadvertently highlights one of the central tensions of his previous presidency. He consistently pushed for both easy money and strong markets simultaneously, with little apparent concern for the longer-term imbalances this might create.

For investors trying to make sense of it all... good luck. We're entering a period where every market movement will be filtered through increasingly partisan lenses. Separating actual economic signals from political noise will require more diligence than ever.

At the end of the day, though, markets will do what they've always done: discount future expectations while remaining stubbornly indifferent to what any single voice—even a particularly loud former presidential one—insists they should do.

Some things, at least, never change.