The news that Donald Trump has put the brakes on export controls to potentially lock in a China trade deal has set off alarm bells across Washington's security establishment. And it's not just the usual critics—several of his own former administration officials are now publicly warning that the move could be a serious mistake.

It's a classic Trump move, isn't it? Bold, transactional, and utterly pragmatic. But this time, the stakes might be higher than even he realizes.

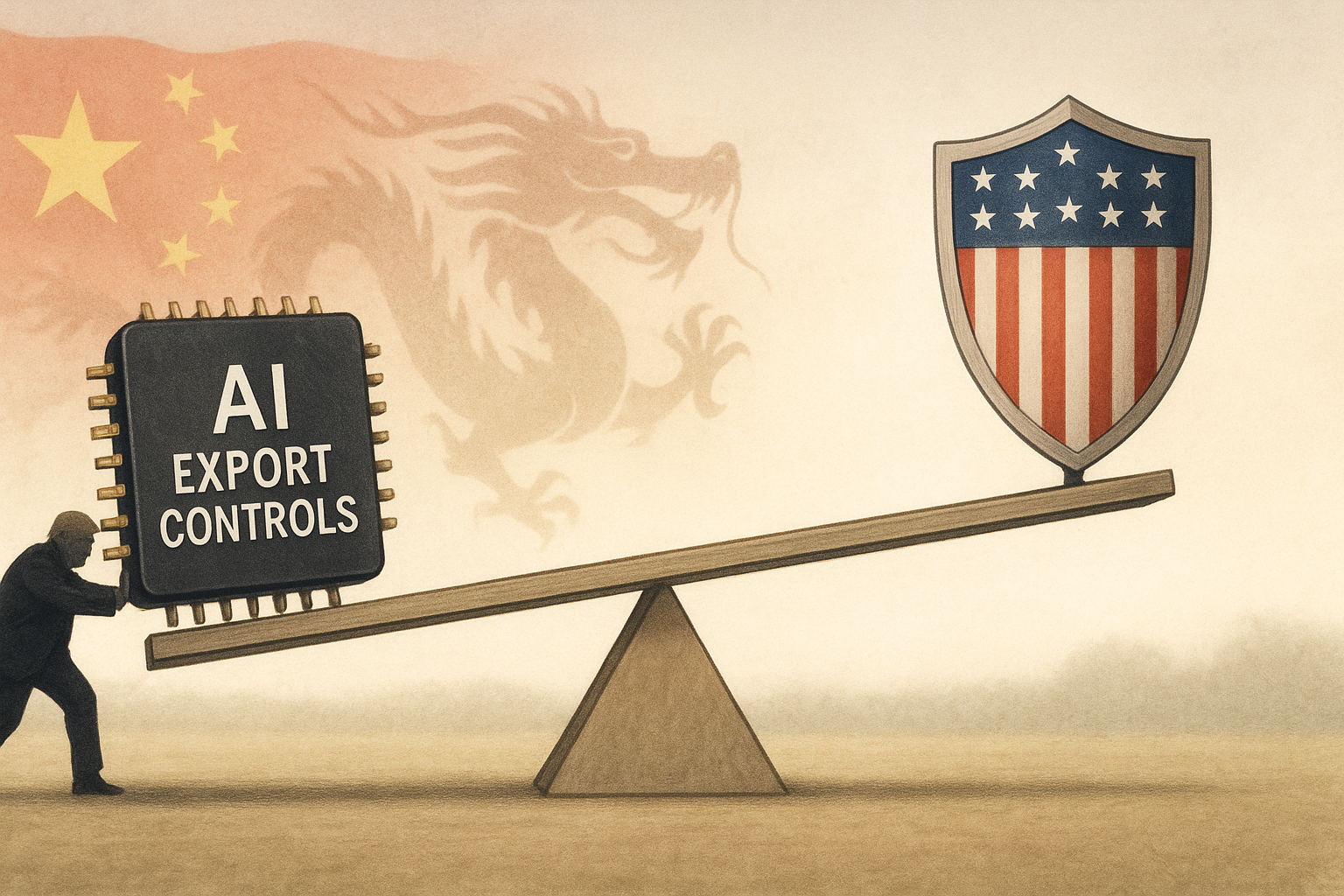

What we're seeing unfold is essentially a high-stakes battle between two competing visions of how America should handle China. In one corner: the old-school trade warrior approach that sees expanded commerce as the ultimate goal. In the other: a newer, more hawkish view that treats advanced technology—particularly AI—as a national security crown jewel that must be protected at all costs.

I've covered U.S.-China relations for years, and this particular clash feels different. More consequential, somehow.

Trump, ever the dealmaker, appears to be dusting off his first-term playbook—using restrictions as bargaining chips rather than permanent barriers. Create leverage, then trade it away for something you want more. Economics 101, right?

Except these aren't soybeans or steel we're talking about.

The letter's signatories—including David Feith and Liza Tobin, who actually served in Trump's administration—warn that Nvidia's H20 chips aren't just fancy computer parts. These processors, while designed to comply with Chinese regulations, still outperform their restricted counterparts in ways that could directly benefit military applications. Think autonomous weapons systems. Think intelligence platforms. Think... well, you get the picture.

(And if former Trump loyalists are the ones sounding the alarm, that should tell you something.)

What's particularly fascinating here—maddening, even—is the inconsistency. Throughout his presidency, Trump hammered allies like Germany and Japan for not spending enough on defense while simultaneously hitting them with tough trade talk. Yet with China—arguably America's most significant strategic rival—he seems willing to ease technological restrictions for economic gain.

It's a head-scratcher, for sure.

Look, politicians often favor immediate, tangible wins over distant, abstract risks. A trade deal delivers measurable benefits today. The potential downside of accelerating China's military AI capabilities? That's theoretical and years away. Human psychology naturally favors the concrete present over the uncertain future.

Meanwhile, Nvidia isn't exactly complaining. The company has masterfully developed a product lineup that navigates export controls while maintaining its lucrative Chinese market share. Wall Street gets it—which explains why Nvidia's stock price has remained strong despite all this geopolitical drama.

The fundamental question goes deeper than any single policy decision: How should America balance short-term economic interests against long-term strategic competition? And who makes these calls—elected officials, security experts, or corporate leaders with billions at stake?

As James Mulvenon pointedly notes in the article, these decisions will ultimately determine "which political system, which values, will ultimately control the most powerful technology in the history of the world."

No pressure, right?

The financial markets, predictably, remain focused on the next quarter's results. In both finance and politics, tomorrow's problems have a way of seeming less urgent than today's opportunities—even when those problems might reshape the world as we know it.