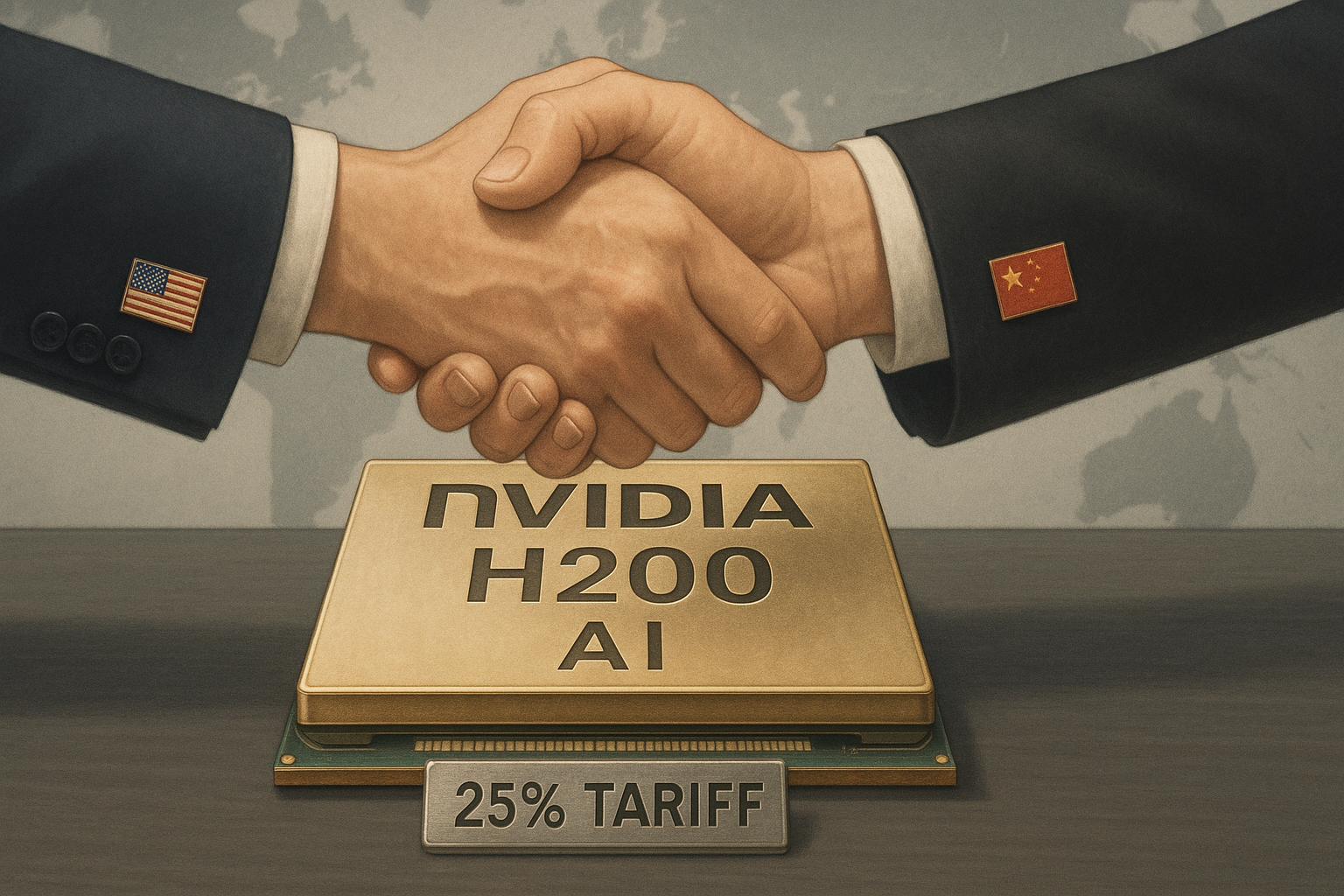

Former President Donald Trump dropped a bombshell Monday that sent ripples through both Wall Street and diplomatic circles: Nvidia's cutting-edge H200 AI chips will soon be flowing to "approved customers" in China, with Beijing agreeing to a hefty 25% tariff that lands directly in American coffers.

It was classic Trump—policy by social media post, with geopolitical implications measured in billions.

The semiconductor industry has always straddled an uncomfortable line between commerce and national security, but this announcement represents something altogether different. What Trump appears to be constructing isn't a wall, but a toll booth on the digital Silk Road.

I've covered tech policy for years, and I can't recall a precedent quite like this one. Most export controls are binary affairs—either technology crosses borders or it doesn't. This revenue-sharing model feels more like something cooked up in a private equity boardroom than a national security council meeting.

Look, the stakes couldn't be higher. These aren't just fancy computer parts we're talking about. Nvidia's H200 chips represent the computational muscle behind the AI revolution—the very backbone of technological supremacy that both Washington and Beijing have been jockeying for.

"You can have our technology, but you'll pay for the privilege." That's essentially what the U.S. is saying to China. It's geopolitical rent-seeking, plain and simple.

What does this mean for Nvidia? It's... complicated.

On one hand, regaining access to roughly a quarter of their potential market is obviously positive. China's appetite for AI accelerators is voracious, and Nvidia has been watching competitors fill the void since previous restrictions kicked in.

But that 25% tariff changes the math considerably. It effectively creates a three-way value split between Nvidia shareholders, Chinese customers, and Uncle Sam. Not exactly the profit margins Jensen Huang probably had in mind.

The market implications ripple far beyond a single chipmaker. AMD, Intel, and countless equipment manufacturers caught in the crossfire of tech nationalism will be watching closely. Is this a one-off arrangement or the template for a new approach to managing the flow of sensitive technologies?

Having attended semiconductor conferences where Chinese and American executives awkwardly navigate these tensions, I can tell you this represents a potentially massive shift in the conversation. There's a certain pragmatic clarity here that, while perhaps lacking diplomatic nuance, has a straightforward quality that business leaders can work with.

Perhaps most fascinating is the personal diplomacy at play. Trump's post suggested direct engagement with President Xi, who reportedly "responded positively" to an arrangement that amounts to a technology tax. That's... remarkable, to say the least.

(When was the last time anyone responded positively to paying more taxes?)

The questions now shift to implementation. What exactly constitutes an "approved customer" in China? Who's monitoring compliance? Will payments flow as tariffs, licensing fees, or through some other mechanism?

For investors trying to make sense of this, cautious optimism seems warranted for Nvidia and perhaps other U.S. semiconductor firms with Chinese exposure. But—and this is a significant but—technology restrictions remain wildly unpredictable, subject to the whims of geopolitics and personality-driven diplomacy.

This whole episode serves as a stark reminder that in today's global economy, the lines between diplomatic policy, corporate strategy, and national security have blurred beyond recognition. We're witnessing the real-time evolution of how nations manage technological advantage in an interconnected world.

The semiconductor saga continues. The silicon plots thicken. And tomorrow will almost certainly bring another twist in what has become the most consequential technological chess match of our time.