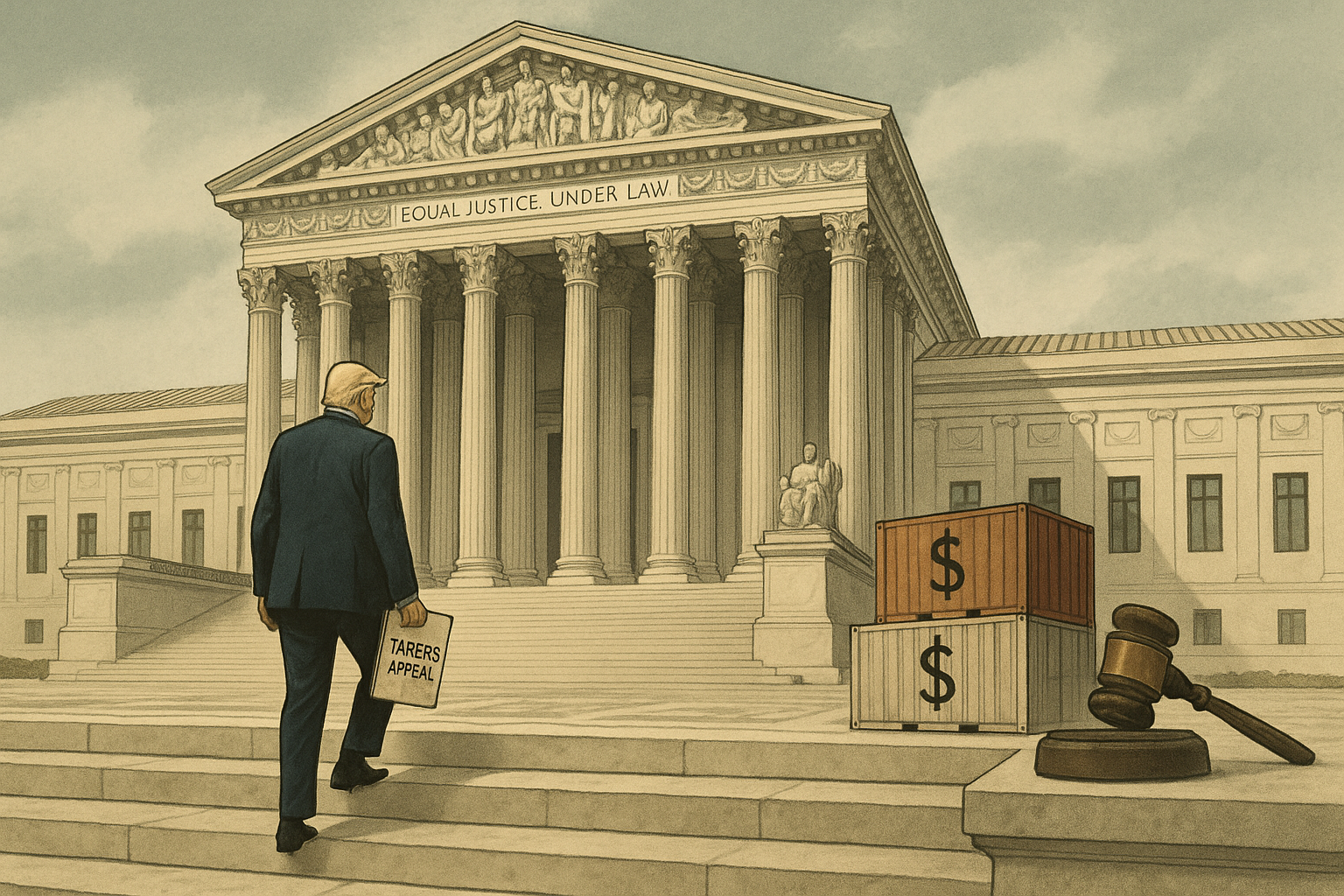

Former President Trump is planning to ask the Supreme Court for an "expedited ruling" on his administration's tariffs appeal, a move that tells us exactly where this saga is headed — straight into the murky intersection of judicial power, economic policy, and political theater.

I've watched this dance before. Tariff battles have always been messy affairs where economic theory collides with political reality. And folks, this one's no different.

What makes this particular case so damn interesting isn't just the legal questions (though those are plenty thorny). It's the timing. Markets are already jumpy — dealing with inflation worries, Fed policy uncertainty, and global tensions that seem to multiply weekly. Throwing a Supreme Court battle over trade policy into this mix? That's like deciding what your anxious dinner party really needs is a discussion about religion and politics.

Here's the deal: This whole situation creates a three-ring circus of considerations — legal precedent, economic impact, and (let's not kid ourselves) raw political calculation. The overlap between these circles isn't exactly what you'd call expansive.

From where I'm sitting, the market implications are significant but strangely muted so far. Industries with the most skin in the game — steel producers, auto manufacturers, consumer electronics companies — are showing some volatility upticks, but nothing dramatic. Either traders are underestimating the potential fallout, or they've developed calluses after years of political drama that ultimately delivered less impact than advertised.

"We've become somewhat desensitized to these legal-political flashpoints," a senior market strategist at a major investment bank told me yesterday. "The reaction function isn't what it was five years ago."

The economic stakes, though? Those aren't trivial by any stretch. When Trump's administration implemented the previous round of tariffs, particularly targeting Chinese goods, it created exactly the winners and losers you'd expect. Some domestic producers got a shield; manufacturers dealing with suddenly pricier inputs got squeezed; consumers ultimately paid more. Moody's found those tariffs cost the average American household about $831 annually.

That's not bankruptcy territory for most, but it sure as hell isn't pocket change either — especially not when folks are already watching their grocery bills climb.

There's something uncomfortably reminiscent of the 1930s Smoot-Hawley tariff disaster lurking in the background here. No, I'm not predicting another Great Depression (markets have guardrails now that didn't exist then). But there's a reason economists typically discuss trade wars with all the enthusiasm of someone describing their last colonoscopy.

What's fascinating to me, having covered corporate responses to trade policy for over a decade, is how businesses adapted to the last round of tariffs. Many companies that initially threw up their hands in despair eventually reconfigured supply chains — sometimes creating more resilient operations that actually helped them weather pandemic disruptions later. Others just shrugged and passed costs to consumers or squeezed their margins thinner. The clever ones? They found loopholes you could drive a container ship through.

The legal questions at the heart of this case concern executive authority and dusty trade legislation that's been on the books for generations. Historically, presidents have enjoyed considerable leeway on trade matters, but this case might redraw those boundaries. And asking for an expedited process? Well, the Court typically moves at a pace that makes DMV lines look like Formula 1 racing.

For investors trying to make sense of all this... good luck, honestly. The smart play isn't betting big on any particular outcome but making sure your portfolio can handle volatility regardless of which way this breaks.

Look, at the end of the day, this whole situation just hammers home what veteran market participants already know: Investing isn't just about spreadsheets and earnings reports. It's navigating a world where your investment returns might hinge on nine people in black robes interpreting a law written when computers filled entire rooms.

Which seems... perfectly sensible?

Yeah, right.