In a move that's pure Trump—equal parts strategic policy pivot and headline-grabbing maneuver—sources close to the former president say he's considering redirecting a hefty $2 billion chunk of CHIPS Act funding toward domestic critical minerals production.

The timing couldn't be more interesting.

Just as semiconductor plants funded by the $52.7 billion CHIPS Act begin breaking ground across America's industrial heartland, Trump apparently wants to rewrite part of the script. It's not that he's abandoning the semiconductor push—more like he's looking upstream in the supply chain.

And honestly? There's a certain logic to it.

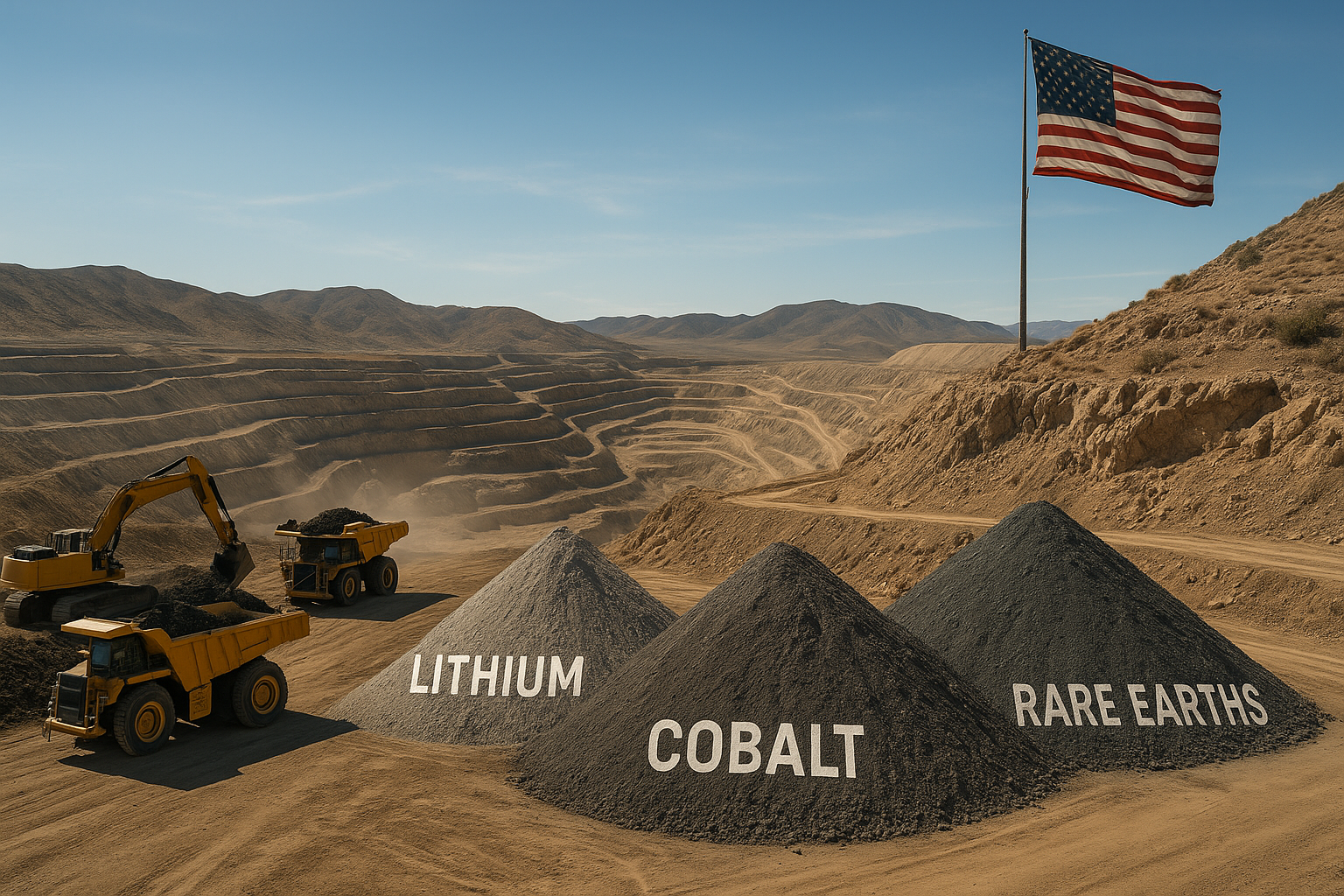

Critical minerals—think lithium, cobalt, rare earths, and a bunch of elements most people couldn't locate on a periodic table with a flashlight—form the backbone of virtually every piece of advanced technology. They're in your phone, your car, those F-35s flying overhead, and yes, those precious semiconductors everyone's been obsessing over.

But here's the rub: China dominates the processing of these materials to an almost uncomfortable degree. Having covered critical mineral supply chains since 2019, I've watched Beijing methodically tighten its grip on everything from rare earth processing (where they control roughly 85% of capacity) to lithium refinement.

It's the kind of economic leverage that makes Pentagon officials twitch.

"We've been focused on the wrong part of the supply chain," a former Trump administration official told me last week, speaking on condition of anonymity. "Fabs are important, sure, but what happens when China decides they won't sell us the processed minerals those fabs need?"

Good question.

The market reaction has been... well, exactly what you'd expect. Mining stocks got a little bounce—MP Materials jumped nearly 4% when rumors first circulated—while some semiconductor equipment makers saw investors getting slightly nervous. Nothing dramatic, just the usual algorithmic reshuffling as Wall Street tries to predict winners and losers.

But let's ask the obvious question: Is $2 billion actually enough?

(Spoiler alert: probably not.)

I visited a lithium processing facility in Nevada last year. The price tag? Just shy of $1 billion—and that's for a single operation that handles just one critical mineral. Two billion dollars might sound like serious money to normal humans, but in the world of mineral processing infrastructure, it's more like a promising start than a comprehensive solution.

The CEO of one mining company (who'd obviously benefit from this funding) put it to me bluntly over coffee at an industry conference: "It's better than nothing, but developing domestic processing capacity is a decade-long, multi-tens-of-billions kind of commitment."

There's something almost comically recursive about all this. We discovered our semiconductor dependence on Asia was a problem, so we passed the CHIPS Act. Now we're discovering our mineral dependence on China is also a problem, so we might redirect CHIPS Act money to address that. Next year, we'll probably discover some other critical vulnerability hiding further down the supply chain.

It's like opening a set of Russian nesting dolls, except each one represents another national security headache.

What makes this potential policy shift particularly noteworthy is the strange bedfellows it creates. Environmental groups—not typically Trump allies—have been pushing for more domestic processing because American environmental standards are higher than those in many countries currently handling these materials. Defense hawks love anything that reduces dependence on geopolitical rivals. And economic nationalists see mining and processing jobs as exactly the kind of blue-collar opportunities they want to create.

Look, the minerals play isn't sexy. It doesn't have the immediate visual appeal of a massive semiconductor fab rising from cornfields in Ohio. But it might actually be more important in the long run.

Whether the reallocation happens—and whether Congress would even allow it—remains an open question. The CHIPS Act was passed with specific allocations in mind, and reshuffling $2 billion would require either creative interpretation of existing authorities or new legislative action.

But the mere fact that this conversation is happening signals something important: industrial policy is back in fashion, and it's getting more sophisticated as policymakers develop a deeper understanding of how vulnerable our high-tech supply chains really are.

In Beijing, officials are undoubtedly watching closely. They've spent decades building their mineral processing dominance, and they're not likely to surrender it without a response.

The global chess game continues. Only now, we're finally paying attention to the pieces that actually control the board.