If you've been dabbling in leveraged ETFs lately—lured by those tantalizing "3x" labels—you might be experiencing what I've come to call "leverage disillusionment syndrome." Trust me, you're not alone.

I've been covering financial products for years, and the confusion around Leverage Shares' 3x AMD and 3x NVIDIA offerings keeps popping up in my inbox. Why? Because most investors are discovering, often painfully, that math in the financial world isn't as straightforward as it seems.

Let's break down this leveraged ETF mystery, shall we?

The Daily Reset Trap

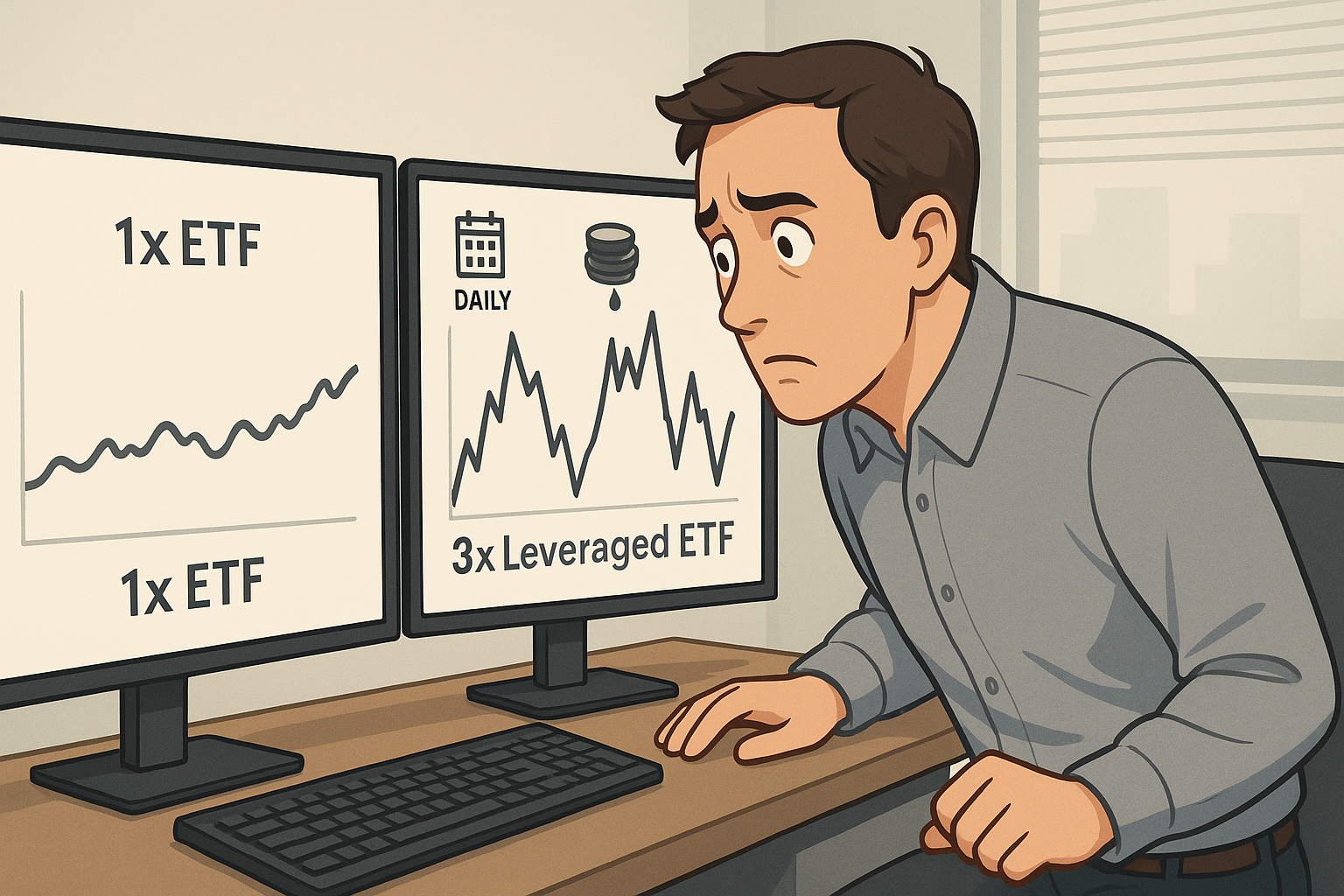

Here's the thing about leveraged ETFs that the glossy marketing materials don't emphasize enough: they reset daily. That "3x" multiplier? It applies to daily returns—not weekly, monthly, or (heaven forbid) yearly performance.

Think of it like this. Each morning, these products wake up with amnesia about yesterday's performance and start fresh. This daily compounding creates some wild mathematical outcomes that can either be your best friend or worst enemy.

Look at a simple three-day scenario with NVIDIA: - Day 1: +1% - Day 2: -1% - Day 3: +1%

After this little rollercoaster, NVIDIA ends up about 0.99% higher. But what about our 3x friend? It went: - Day 1: +3% - Day 2: -3% - Day 3: +3%

Run these numbers through the compounding calculator and you get... 2.91%. Not 2.97% (which would be precisely 3x NVIDIA's 0.99% return).

This might seem like small potatoes, but in choppier markets? The divergence can be downright shocking.

Those Pesky Expense Ratios

Then there's the cost of admission to this leverage party.

Leverage Shares typically slaps on expense ratios around 0.75% annually, plus they've got financing costs for all that borrowed money. It's like a constant leak in your investment bucket—small, but persistent.

This explains why even on a single day, your "3x" product might return something frustratingly less than the perfect multiple you expected. When NVIDIA jumped 1.23% and your leveraged ETF only climbed 2.46%, that's not randomness—it's the theoretical 3.69% return getting nibbled away by fees and tracking inefficiencies.

Volatility Decay (The Silent Killer)

This is where things get... well, mathematically fascinating (or depressing, depending on your position).

In markets that swing wildly but end up nowhere, leveraged ETFs tend to bleed value. Finance professors call this "volatility decay" or "beta slippage." I call it the "why-is-my-account-balance-shrinking-when-the-stock-is-flat" phenomenon.

Imagine a stock that rockets up 25% one day, then plummets 20% the next. Where's the stock? Right back where it started (1.25 × 0.8 = 1). But your 3x ETF? It shot up 75% then crashed 60%. Do the math: 1.75 × 0.4 = 0.7.

You've just lost 30% of your investment while the underlying stock is exactly where it began! It's like some cruel magic trick.

This explains your AMD head-scratcher. If AMD had some volatile intraday swings before settling at +0.42%, your 3x product could easily end up negative due to this decay effect combined with that relentless daily reset mechanism.

So Why Would Anyone Touch These Things?

After writing all this, you might wonder why these products even exist. Having interviewed dozens of traders over the years, I can tell you they serve specific (and limited) purposes:

- Short-term tactical trading (and I cannot emphasize "short-term" enough)

- Hedging existing positions for brief periods

- Expressing high-conviction views without tying up tons of capital

What they're absolutely terrible for? Buy-and-hold investing over extended periods—especially in sideways but volatile markets.

The Bottom Line

Next time you see that enticing "3x" in a product name, remember it's more like a daily aspiration than a mathematical promise for your entire holding period. These aren't simple multiplication machines; they're sophisticated trading instruments designed for specific circumstances.

For longer periods, your actual return depends on the path your underlying security takes—not just its overall performance from when you bought to when you sold. In finance, just like in quantum physics, how you get there matters just as much as where you end up.

Still determined to amplify your NVIDIA or AMD exposure? Maybe consider options strategies or plain old margin instead. At least then the math won't leave you scratching your head quite so vigorously.

Or as one veteran trader told me last year with a wry smile, "Leveraged ETFs are like tequila shots—best enjoyed occasionally, carefully, and with a clear exit strategy."