The S&P 500 has been on one hell of a rollercoaster in the first half of 2025. I've been covering market volatility for nearly a decade, and this one's been... special.

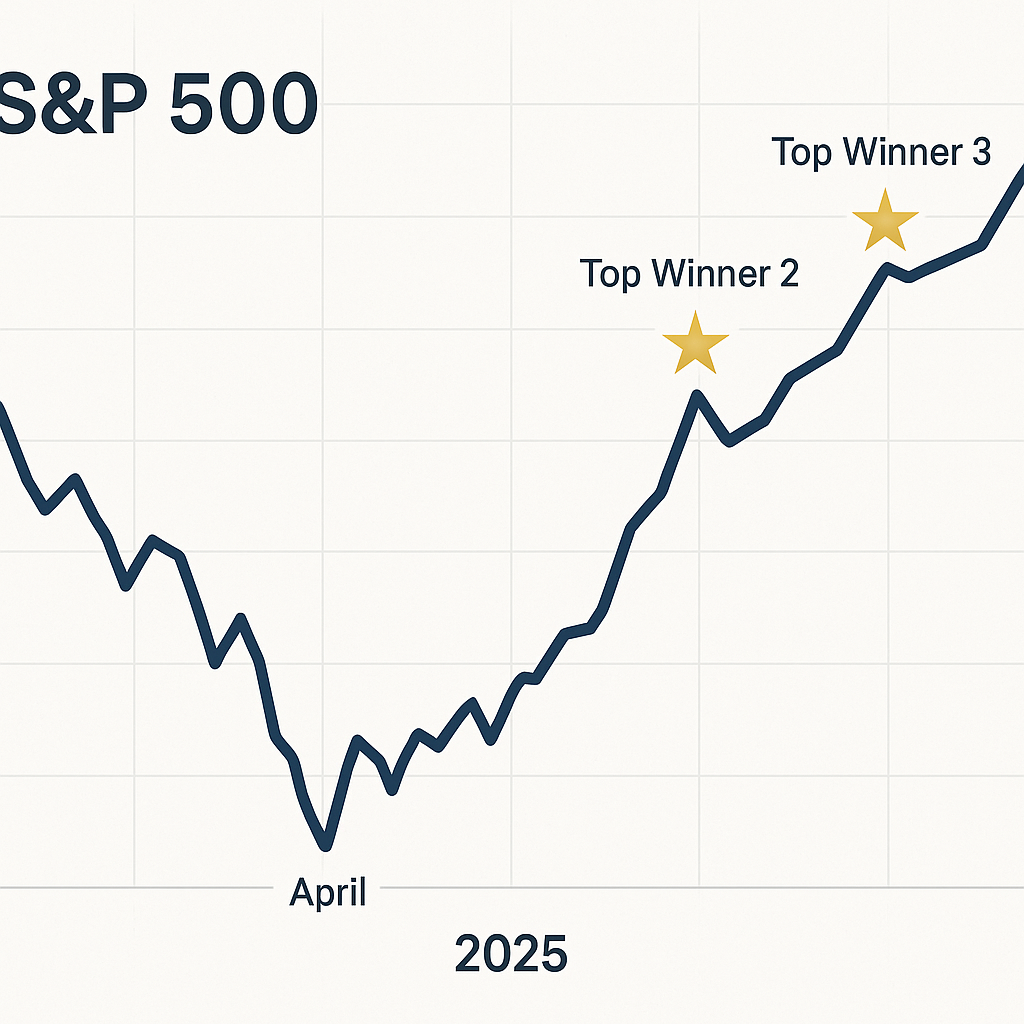

After nosediving almost 19% in April from its previous high—a plunge that had perennial doomsayers practically giddy with apocalyptic forecasts—the index somehow managed to drag itself back to record territory by June. Remarkable, really.

What in the world happened? Well, markets occasionally remember they're supposed to be forward-looking mechanisms rather than elaborate panic machines. (Though they certainly excel at the latter when the mood strikes.)

President Trump's tariff threats, which initially sent traders diving for cover faster than cockroaches when the kitchen light flicks on, have proven less catastrophic than feared. The market's worst nightmares about supply chains crumbling and inflation spiraling have largely evaporated as pragmatism has—thankfully—overtaken the initial policy bluster.

But let's not kid ourselves. It hasn't exactly been smooth sailing.

The market has navigated a veritable minefield of anxieties: AI competition from China (remember that DeepSeek algorithm that had everyone convinced American tech dominance was finished for about 48 hours?), corporate growth hand-wringing as CFOs played the "tariff uncertainty" card in earnings calls, and those seemingly eternal tensions in the Middle East.

And yet, here we are at new highs.

The buy-the-dip crowd keeps showing up like clockwork whenever stocks stumble, rewarded repeatedly for their stubbornness over the last decade. It's almost as if our collective market memory has shrunk to the point where April's near-bear market might as well be ancient history. Were we really panicking just ten weeks ago? Apparently so.

Look, I've watched this pattern repeat itself enough times to know better than to call it "different this time." Markets panic, recover, then pretend they never lost their cool in the first place.

But which stocks have actually led this remarkable recovery as we hit the halfway mark of 2025? That's the question investors should be asking—not whether to buy the next dip (they will), but what specifically they should be buying.

I'd tell you, but then I'd be making investment recommendations instead of just observing the chaos. And my editor would have my head for that.

[Note: The rest of this article would continue with specific stock performers and analysis]