The markets rallied again this week on news that the Fed might consider yet another "liquidity tool" if economic indicators weaken. Which got me thinking about our collective addiction to monetary interventions.

Remember 2009? The financial world was imploding, and the response was to fire up the printing presses. When COVID hit a decade later, we doubled down on the same playbook—print more money, flood the system with liquidity, and watch the markets bounce back like nothing happened.

This isn't just policy anymore. It's a habit. A reflex. The financial equivalent of reaching for comfort food when you're stressed.

The Crisis Response Playbook

The pattern has become predictable: crisis emerges, markets panic, central banks intervene with massive liquidity injections, markets recover, everyone celebrates the "soft landing," and we reset until the next crisis. Wash, rinse, repeat.

What's fascinating is how we've normalized this approach. The U.S. national debt has become an abstraction—numbers so large they've lost meaning. $34 trillion? Might as well be $340 trillion or $3.40 for all the emotional impact it generates in Washington.

I mean, remember when politicians at least pretended to care about deficit reduction? Now it's just a punchline. The debt ceiling debates have all the substantive drama of a reality TV show where everyone knows the contrived ending.

Even the push for stablecoins feels like an elaborate shell game—another mechanism to absorb U.S. debt while buying time. We're creating digital instruments to prop up analog problems.

The Hidden Tax on Prudence

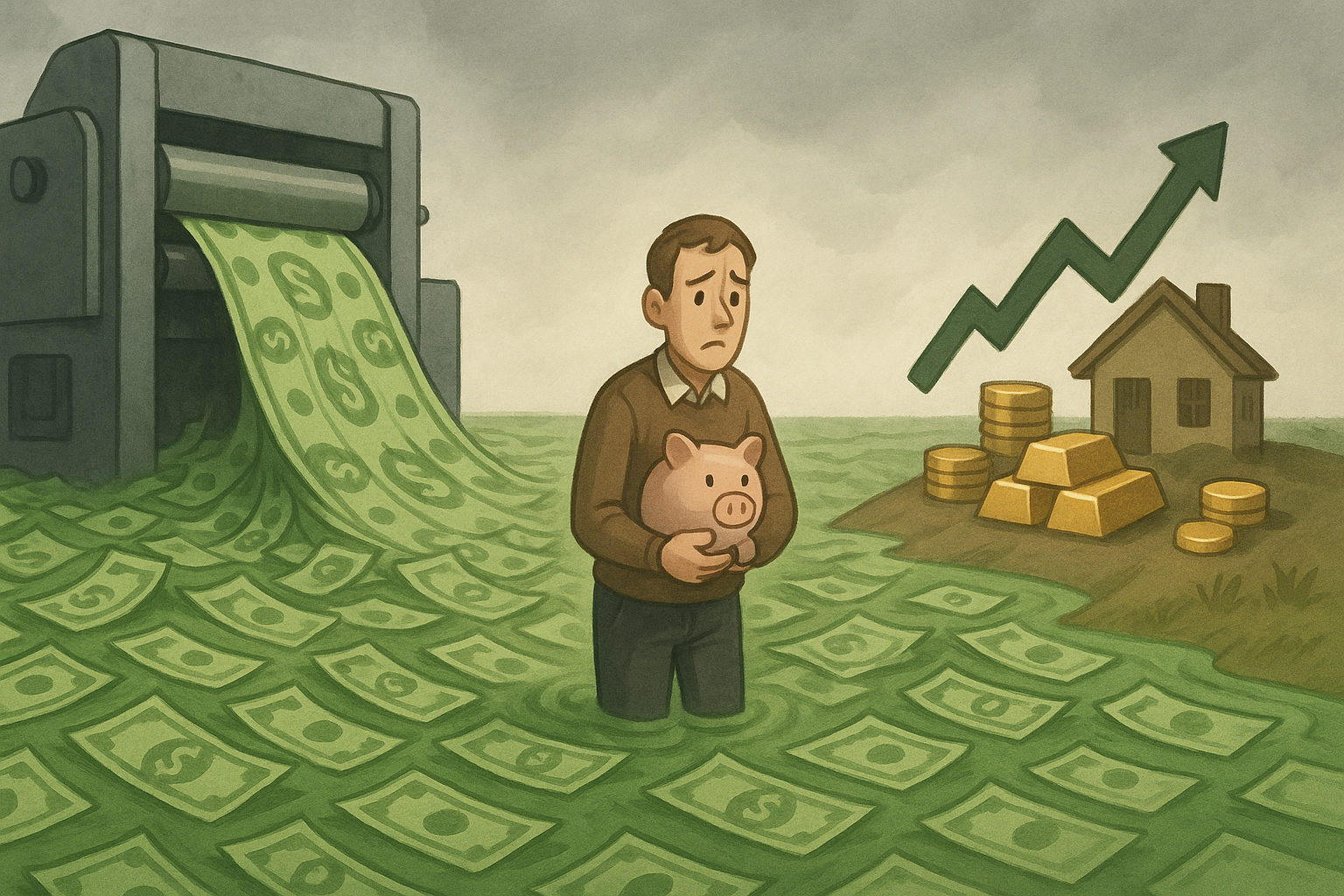

But here's where it gets interesting: in this financial ecosystem, discipline is punished. The people who followed traditional financial wisdom—save regularly, avoid debt, maintain liquidity—are getting crushed.

Just sitting still with cash means watching your purchasing power erode year after year. The 2% inflation target that central banks claim to worship? It's a 2% annual tax on savers that compounds over time. And that's when inflation actually stays at 2%, which... [gestures broadly at everything].

The model that's emerging is that cash is trash. Not occasionally, not cyclically, but structurally. In a world of persistent money printing and asset inflation, currency itself becomes the hot potato no one wants to hold.

The Asset Ownership Imperative

This creates a perverse incentive structure. Financial survival increasingly depends not on producing value or saving diligently, but on owning assets that benefit from monetary expansion—stocks, real estate, gold, bitcoin, even fine art and collectibles.

The gap between the asset-rich and the asset-poor grows with every round of quantitative easing. Those with the capital, knowledge, and risk tolerance to invest in inflation-resistant assets pull further ahead, while those holding cash fall further behind.

Look at the wealth distribution data over the past fifteen years of extraordinary monetary policy. It's not just that the rich got richer—it's that asset owners of all income levels outperformed cash savers of comparable income levels by staggering margins.

The Uncomfortable Questions

All of which raises some uncomfortable questions:

What happens to a society where prudence is punished? Where traditional virtues like saving and living within one's means become sucker bets?

What does it mean when the only rational financial strategy is to leverage up and buy assets, regardless of their fundamental value?

And most troublingly: is this sustainable? Can we indefinitely maintain an economic system where the primary growth mechanism is currency debasement?

I don't have definitive answers. Nobody does, despite what the confident voices on financial TV might tell you. But history suggests that systems built on continuous debasement eventually face reckonings.

The irony is that those reckonings tend to punish savers most severely. The prudent, who already suffered during the inflation, often bear the brunt of the correction as well.

The Investor's Dilemma

So what's the solution for the individual caught in this system? There's no perfect answer, but diversification across assets that can't be "printed into oblivion" seems like the only rational defense.

Index funds, select equities, real estate, precious metals, and yes, for the risk-tolerant, some allocation to cryptocurrencies. Not because these assets are inherently superior in all environments, but because they offer some insulation from currency devaluation.

The uncomfortable truth is that we've engineered a financial system where remaining financially liquid is almost guaranteed to make you poorer in real terms. Cash might be king during brief market panics, but it's the village idiot during the long stretches between crises.

I love investing too. But I'm not sure this situation is sane either. When disciplined savers become the financial equivalent of the person who brought a knife to a gunfight, something fundamental has shifted in our economic values.

And perhaps that's what troubles me most. Not just the mechanics of money printing or asset inflation, but what those mechanics reveal about what we truly value as a financial society.

In the meantime, the gap between currency and real assets will likely continue widening. The brutal math of inflation doesn't care about our feelings—or our savings accounts.