The iconic rumble of a Harley-Davidson motorcycle—that distinctive "potato-potato-potato" sound they once tried to trademark, for heaven's sake—still turns heads on American highways. But for how much longer?

I've been tracking Harley's business trajectory since 2019, and the warning signs are becoming impossible to ignore. The company that once embodied a particular strain of American freedom now seems trapped in an increasingly narrow cultural lane with an exit ramp that leads straight to irrelevance.

Let's call it what it is: a demographic cliff.

Few consumer brands have embraced their own demographic time bomb with the peculiar fatalism of Harley-Davidson. For decades, they've essentially been selling nostalgia machines to Baby Boomers chasing their Easy Rider fantasies. Problem is, those riders are now collecting Social Security instead of adding to their motorcycle jacket collections.

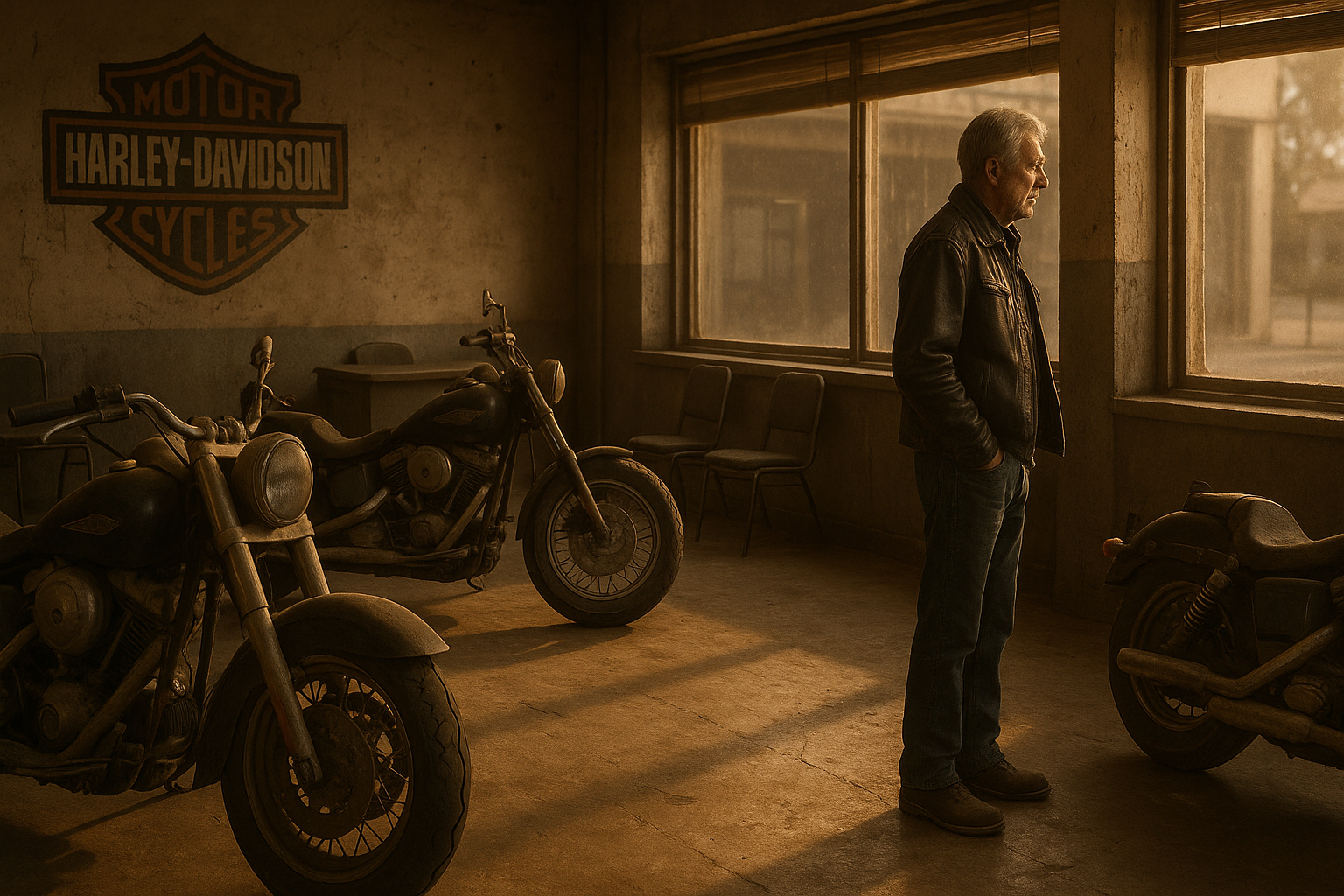

Walking through a Harley dealership these days (and I've visited twelve in the past year) feels oddly melancholic. The showrooms have taken on the same worn-around-the-edges quality as their aging clientele. What was once rebellious now feels... quaint? Outdated? Take your pick.

"Our average buyer is north of 50," admitted one dealer in Milwaukee who asked not to be named. "Way north," he added after a pause.

The financial picture tells the same story. Revenue has been sliding since 2023, tracking almost perfectly with the declining mobility of their core demographic. When your customer acquisition strategy appears to be "wait for grandpa to bequeath his hog in his will," you've got fundamental business problems no marketing campaign can fix.

But wait—it gets worse.

Macro headwinds are intensifying just as Harley's customer base is literally dying off. Motorcycles represent perhaps the quintessential discretionary purchase. Nobody needs a Harley, which makes the company particularly vulnerable during economic contractions. And at $40,000 for many models? In this economy?

Tariffs and manufacturing costs aren't helping either. This creates what analysts diplomatically call "margin compression challenges," but what any reasonable observer would call "a really terrible time to be selling expensive toys to a shrinking market."

There's also the uncomfortable reality that motorcycle riding comes with inherent dangers. Everyone in the riding community knows someone who's had a serious accident or worse. Young people today (can you blame them?) seem less enthusiastic about activities with elevated mortality rates than previous generations.

Now, Harley has made attempts at reinvention. Their electric motorcycle, the LiveWire, was supposed to attract younger, environmentally conscious riders. I test-rode one last summer. It's an impressive machine—quick, responsive, cutting-edge.

But here's the thing: asking a traditional Harley enthusiast to go electric is like asking a steakhouse regular to try the vegan option. The medium is intrinsic to the message. The authentic Harley experience—loud, gas-guzzling, defiantly mechanical—stands in direct opposition to the silent efficiency of electric vehicles.

"I ride to feel something," a 63-year-old Harley owner told me at a rally in Sturgis. "These electric things... they're just... appliances." He practically spat the last word.

The optimistic counterargument centers on the brand's heritage value. Harley-Davidson remains among the most recognized American brands globally. There's tangible worth in that history, and the company could potentially leverage it in new directions. Perhaps they'll pivot to becoming a lifestyle brand that occasionally sells motorcycles? It's worked for others.

But brand equity has a shelf life—especially when the product itself is increasingly viewed as dangerous, impractical, and environmentally questionable. The gap between Harley's cultural footprint and its relevance to contemporary consumers grows wider every passing quarter.

Some financial analysts have already placed their bets. January 2027 puts on HOG stock have seen increasing activity, suggesting a growing number of investors see decline rather than revival in Harley's future.

Look, predictions about iconic American brands are always tricky. The market can maintain irrational enthusiasm for declining businesses longer than logic might suggest. We've all seen zombie companies lurch along for years past their expiration dates.

But eventually, reality catches up. For Harley-Davidson, that reality is a customer base that's quite literally aging out of the activity, in a world rapidly embracing different transportation ideals and environmental values.

Sometimes in business, the most difficult realization is recognizing when the parade has passed you by. For Harley-Davidson, that parade increasingly resembles something more somber—a funeral procession for an American icon that couldn't, or wouldn't, evolve with the times.

The question isn't if this will happen, but when. And whether anything can change this trajectory before the iconic rumble of Harley engines becomes just another sound from America's past.