When it comes to squeezing every last cent from your investment accounts, most people obsess over the splashy stuff—options plays, sector bets, timing the market. But there's a quieter optimization hiding in plain sight at Charles Schwab that might be worth real money.

I've been tracking brokerage inefficiencies for years, and this one's a gem.

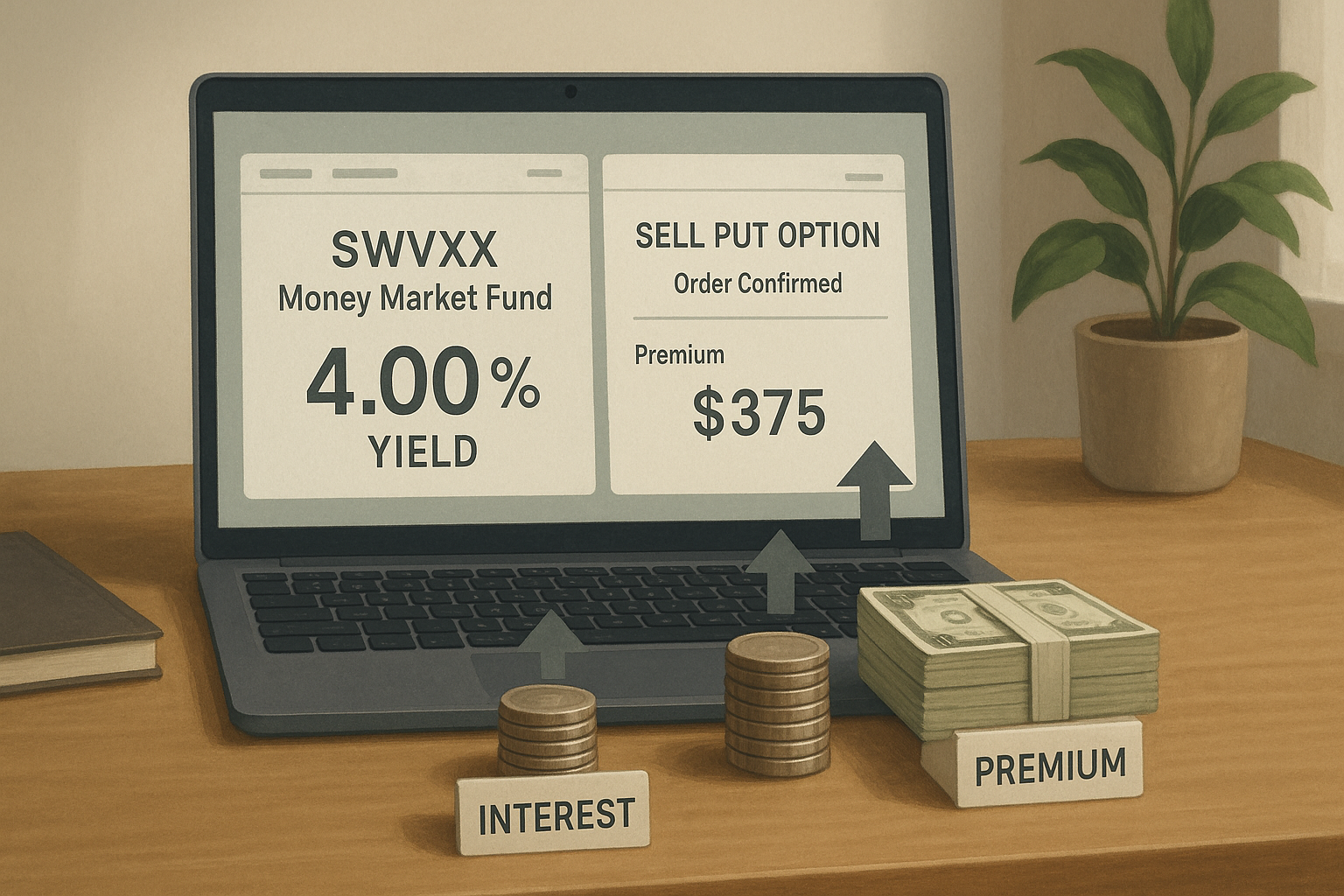

Here's the deal: You can actually keep your cash parked in Schwab's SWVXX money market fund (currently yielding a tasty 4%) while simultaneously using that same money as collateral for selling put options. It's financial multitasking at its finest.

"Wait, what?" you might be thinking. Same. I believed—wrongly, it turns out—that Schwab forced you to choose between earning interest or writing puts against that cash. Pick your poison: steady interest or options premium. Not both.

But that binary choice? It's completely artificial. A phantom restriction.

The mechanics matter here (they always do with these hidden hacks). When selling puts at Schwab, your SWVXX holdings count as perfectly good collateral. If your puts expire worthless—the happy outcome every options seller dreams of—you've pocketed both the premium AND the interest. Double-dipping, in the best sense.

Got assigned? No problem. Just liquidate enough SWVXX before settlement to cover your new stock purchase. Easy peasy.

Look, this isn't exactly like finding a suitcase of unmarked bills on your doorstep. More like discovering that extra French fry hiding at the bottom of the bag—a small but genuine pleasure. One correspondent reports making an extra $6,000 this year through this approach. Not life-changing, but certainly not nothing!

The psychology here fascinates me. Why do we create these artificial mental barriers? Humans have this maddening tendency to silo different types of returns into separate mental buckets, even though—last time I checked—money remains stubbornly fungible. We'll go to ridiculous lengths to protect what feels like "guaranteed" yield, even when it means leaving other money on the table.

(Fidelity, by the way, seems to grasp this user experience issue better. Their default cash position, SPAXX, inherently works this way, eliminating yet another decision from our already overloaded brains.)

It reminds me of that classic behavioral finance finding about investors irrationally clinging to dividend stocks. We're weird about money. Always have been.

The real lesson? The financial markets might be mostly efficient, but the interfaces we use to access them? Not so much. Understanding the operational quirks of your brokerage isn't just administrative trivia—it creates the actual boundaries of what investment moves are possible.

I've seen sophisticated investors leave serious money on the table because they didn't bother learning these seemingly mundane details. Don't be that investor.

In a world where basis points matter more than ever—especially after the brutal market we've endured—these small efficiencies compound dramatically over time.

So if you've been holding back on selling puts because you didn't want to sacrifice that sweet, sweet money market yield... consider this your permission slip to have both. Markets may be efficient, but user interfaces? That's where opportunity still lurks.