The Bureau of Labor Statistics is playing calendar hopscotch again with our economic data. You know the drill by now.

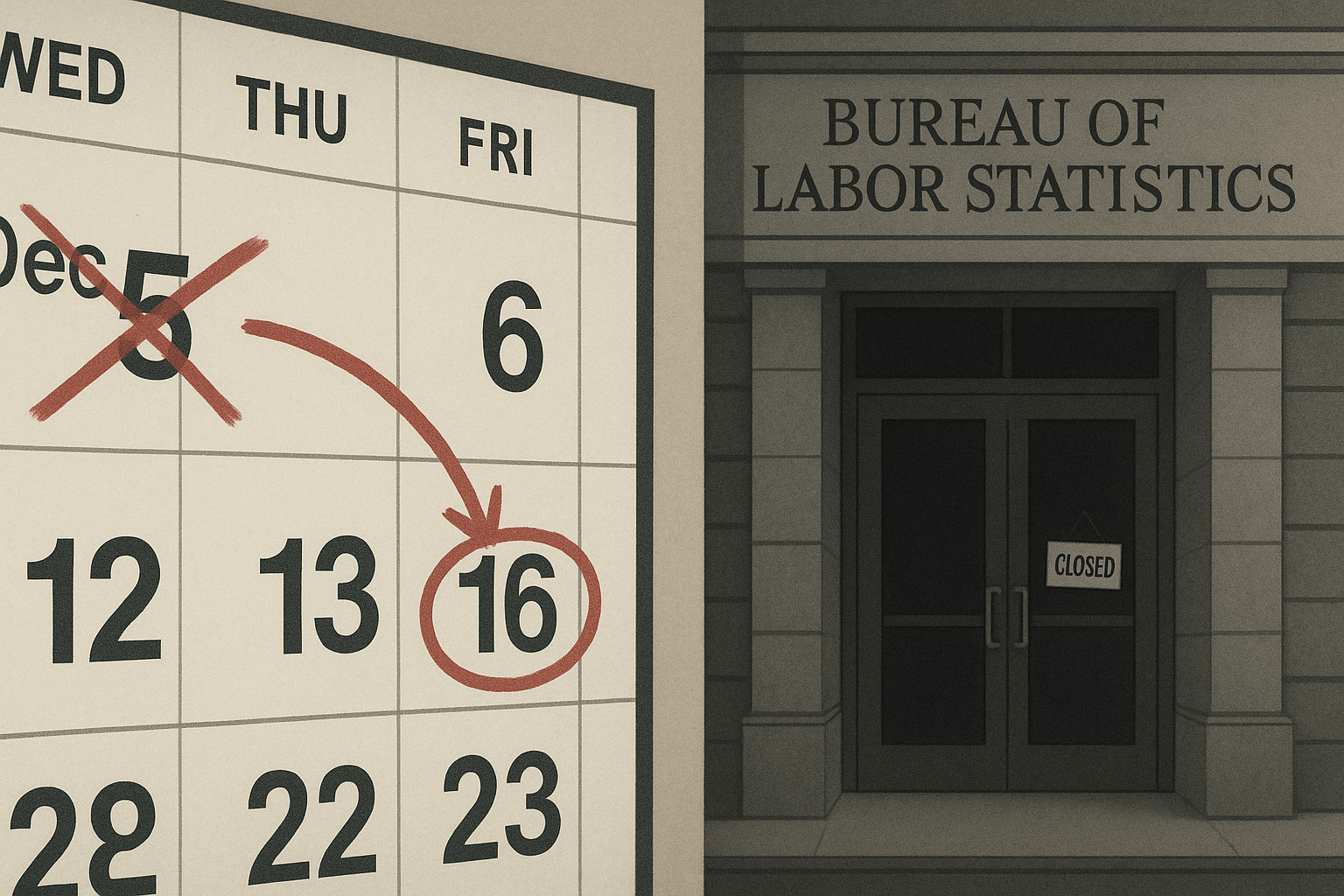

That November jobs report you were expecting on December 5th? It's been pushed to December 16th—a casualty of Washington's latest exercise in governmental self-sabotage. And when it finally arrives, it'll come bundled with October figures that economists had to hastily cobble together before everyone got sent home to watch C-SPAN and stress-eat.

I've covered enough of these shutdowns (seven and counting) to recognize the pattern. First comes the political grandstanding, then the deadline brinksmanship, followed by the inevitable data drought that makes economists twitch like caffeine addicts going cold turkey.

The problem with delayed economic data isn't just inconvenience. It's like trying to drive using only your rearview mirror—and a foggy one at that. By mid-December, we'll be making decisions based on labor conditions from Halloween. That's not just stale; it's positively fossilized in market terms.

"When we lose timely economic reporting, the markets create their own reality," explained Janet Moreno, chief economist at Capital Trust Advisors, when I spoke with her yesterday. "And that reality is usually more volatile than the fundamentals would justify."

This scheduling chaos creates what market veterans call a data vacuum—nature abhors one, and so do traders. Without official numbers, expect wild swings as algorithms and humans alike overreact to every hiring announcement, layoff rumor, or stray comment from a Fed official.

Speaking of the Fed... they're in a particularly awkward spot. The FOMC meets December 12-13, meaning Powell and the gang will be making their final rate decision of 2023 without seeing November's employment picture. They've been preaching data dependency for months, but it's mighty hard to depend on data that's sitting in unpowered government servers.

(The irony of Congress potentially triggering market instability while debating fiscal discipline isn't lost on anyone, by the way.)

Look, economic data has always been imperfect—revisions are common, seasonal adjustments are more art than science, and methodology changes can create statistical mirages. But at least when the system functions normally, everyone sees the same imperfect information simultaneously.

What makes shutdown-induced delays particularly problematic is how they tilt the playing field. Major institutions with deep pockets don't just sit around waiting for the BLS to get back online. They've got proprietary indicators, alternative data sources, and real-time metrics that give them a peek at employment trends while smaller players are left squinting into the void.

I remember covering the 2013 shutdown when a hedge fund manager—who shall remain nameless—told me over drinks, "These are the weeks when we earn our management fees." Not exactly reassuring for the average investor.

The good news? Markets have remarkable adaptive capacity. They'll process whatever information is available, price in the uncertainty, and move on. By the time we get the November jobs report, Wall Street will already be obsessing over holiday retail numbers and year-end positioning.

But for policy wonks and economics nerds who've structured their monthly routines around Jobs Friday (I know I'm not the only one who blocks off that first Friday morning), the government shutdown has robbed us of our regularly scheduled data fix. It's like having the season finale of your favorite show delayed because the actors couldn't agree on their contracts.

We'll get our numbers eventually. Thursday brings the belated September report, and the October/November package arrives December 16th. The economic story will continue its messy, unpredictable journey—government shutdown or not.

In the meantime, I'll be doing what journalists always do when official sources go quiet: calling contacts, comparing notes with colleagues, and trying to piece together what's happening in the labor market through good old-fashioned reporting. It's not as precise as BLS data, but sometimes the anecdotes tell you something the numbers can't.

Things happen: - Bitcoin blasted past $35,000 this week, causing crypto bros to dust off their "to the moon" memes from storage. - Disney earnings weren't half bad, though Bob Iger managed to mention "headwinds" six times on the earnings call. (Meteorologists report no unusual air patterns over Burbank.) - The bond market continues its wild ride, proving yet again that the real adrenaline junkies on Wall Street work in fixed income, not equities.