I've been covering market psychology for years, and nothing brings out investment paranoia quite like watching a blue-chip stock bleed value day after day. The latest conspiracy making rounds involves UnitedHealth Group—and boy, is it a doozy.

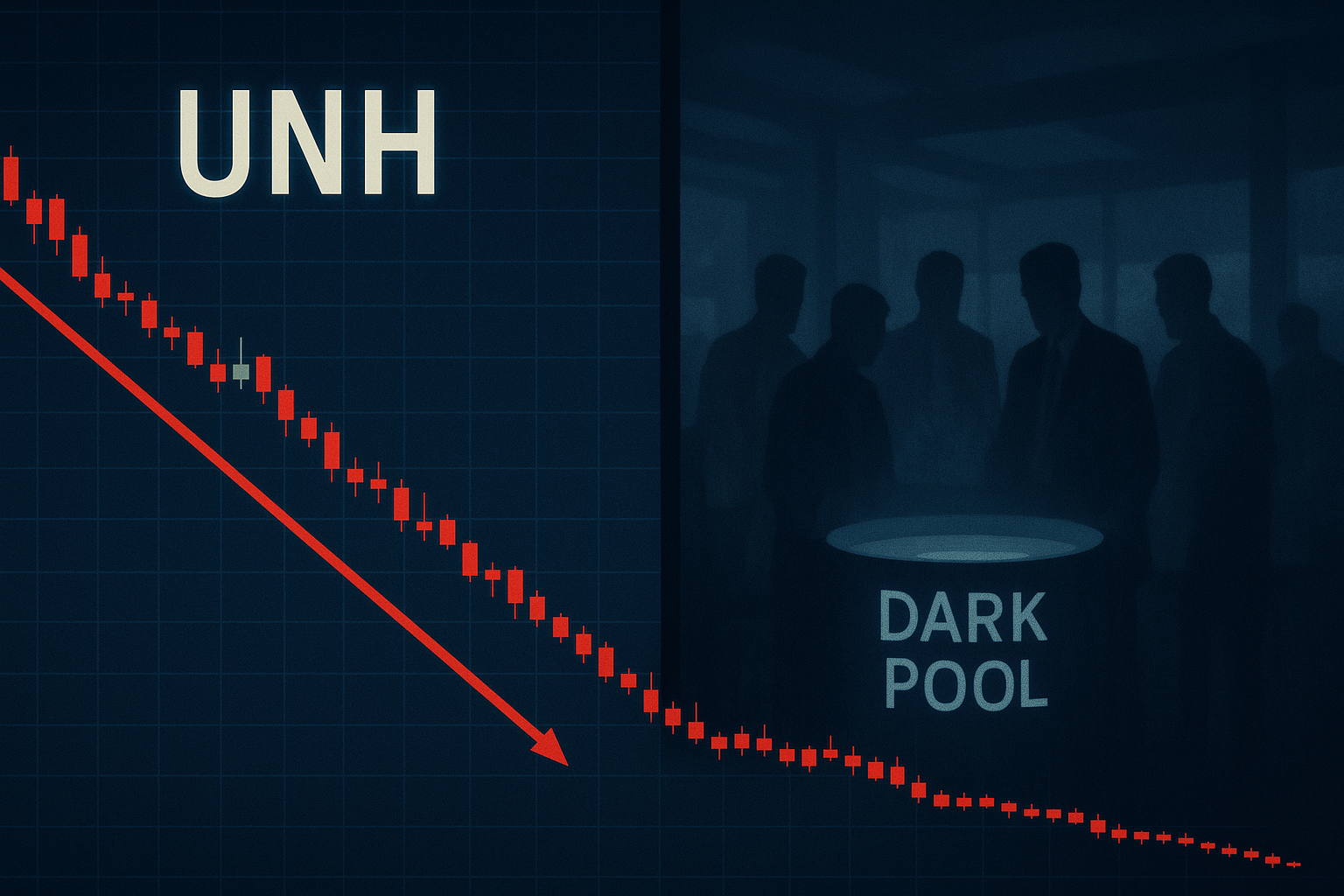

UNH has been slumping since its April highs, and now a vocal contingent of investors has convinced themselves they've uncovered a Wall Street conspiracy involving dark pools, institutional accumulation, and the oldest trick in the book: shake out the weak hands before the big move up.

It's market folklore as old as ticker tape. "They're driving down prices to accumulate shares!" The only thing that changes is which technical indicators get cited as smoking guns.

Look, I understand the appeal. When you're staring at a sea of red in your portfolio, there's something oddly comforting about believing it's all orchestrated—that your investment thesis isn't wrong, just early. Much more comforting than admitting you might have misread the situation entirely.

The Theory That Won't Die

The current narrative around UNH goes something like this:

Big money players are deliberately suppressing the stock price while quietly hoovering up shares through dark pools (private exchanges where transactions aren't visible to regular folks until after they're completed). Conspiracy theorists point to consistently high dark pool volume—about half of total trading—with a recent massive spike to 7.5 million shares, nearly double the normal amount.

With earnings coming July 29th, it has all the hallmarks of the classic "accumulation before appreciation" playbook. Wear down the retail investors, scoop up their shares at a discount, then—BOOM—the stock rockets after earnings.

Neat theory. Too bad it doesn't hold water.

Dark Pools Aren't Actually That Mysterious

First off, those "dark pools" sound like something from a financial thriller (seriously, who named these things?), but they're basically just venues where institutions can trade large blocks without immediately broadcasting their moves to the entire market.

That 50% dark pool volume for UNH? Not unusual at all. I've tracked these numbers for years, and many large-cap stocks routinely see 40-60% of volume executed off-exchange. Nothing to see here, folks.

Now, that spike to 7.5 million shares... that's at least interesting. But without knowing if those were buy or sell orders—or whether it was one institution or twenty different ones—the number alone tells us precisely nothing about direction or intent.

As for the price "mysteriously stabilizing" into the close instead of continuing its downward trend... have you watched markets before? They rarely move in straight lines. Sometimes a stock just runs out of sellers for a few hours. Not everything is a signal.

What's Actually Happening with UNH?

The entire healthcare sector has been taking body blows lately. Concerns about rising medical costs, Medicare Advantage reimbursement rates, and the broader economic environment have hammered UNH and its competitors alike.

The company faces legitimate headwinds—not shadowy market manipulators. Their Medicare Advantage business (a major growth engine) is under increasing regulatory scrutiny. Medical cost ratios are trending unfavorably industry-wide.

These are real problems requiring real analysis, not conspiracy theories about market manipulation.

(I've spoken with three healthcare analysts this week who all pointed to the same fundamental concerns, by the way—none mentioned dark pool manipulation.)

Why We Love These Theories

The "accumulation" narrative has staying power because, well, sometimes it's kind of right—institutions do occasionally build positions ahead of positive catalysts. And more importantly, it transforms the psychological burden of holding a losing position into something almost exciting.

"I'm not down 15%; I'm early to the party!" It's financial copium in its purest form.

But here's what most retail investors get wrong: Even when big players are building positions, they're doing so based on their independent valuation models, not as part of some coordinated scheme to pump your retirement holdings.

What Happens Next?

Could UNH bounce after earnings? Sure! The stock's been beaten down, expectations are subterranean, and any positive surprise might trigger a relief rally.

But if it happens, it won't be because financial illuminati executed a masterful plan to acquire shares on the cheap. It'll be because... that's how markets work sometimes. New information changes collective assessment.

So are you an idiot for holding UNH through this slump? Not necessarily. It remains a quality company with dominant market position and a history of execution.

Rather than scanning dark pool volumes and intraday candlestick patterns for evidence of manipulation, though, you'd be better served focusing on what actually moves healthcare stocks long-term: medical cost trends, membership growth, the regulatory environment, and competitive positioning.

Those factors—not some imagined cabal of dark pool operators playing 4D chess with your 401(k)—will determine whether UNH sinks or swims.

Sometimes a stock decline is just a stock decline. No conspiracy required.