Look, I've been covering tech investments for years, and something feels different about this AI boom. It's not just the eye-popping numbers—though $100 billion from Nvidia to OpenAI certainly qualifies—it's the curious circularity of it all.

The pattern is worth unpacking.

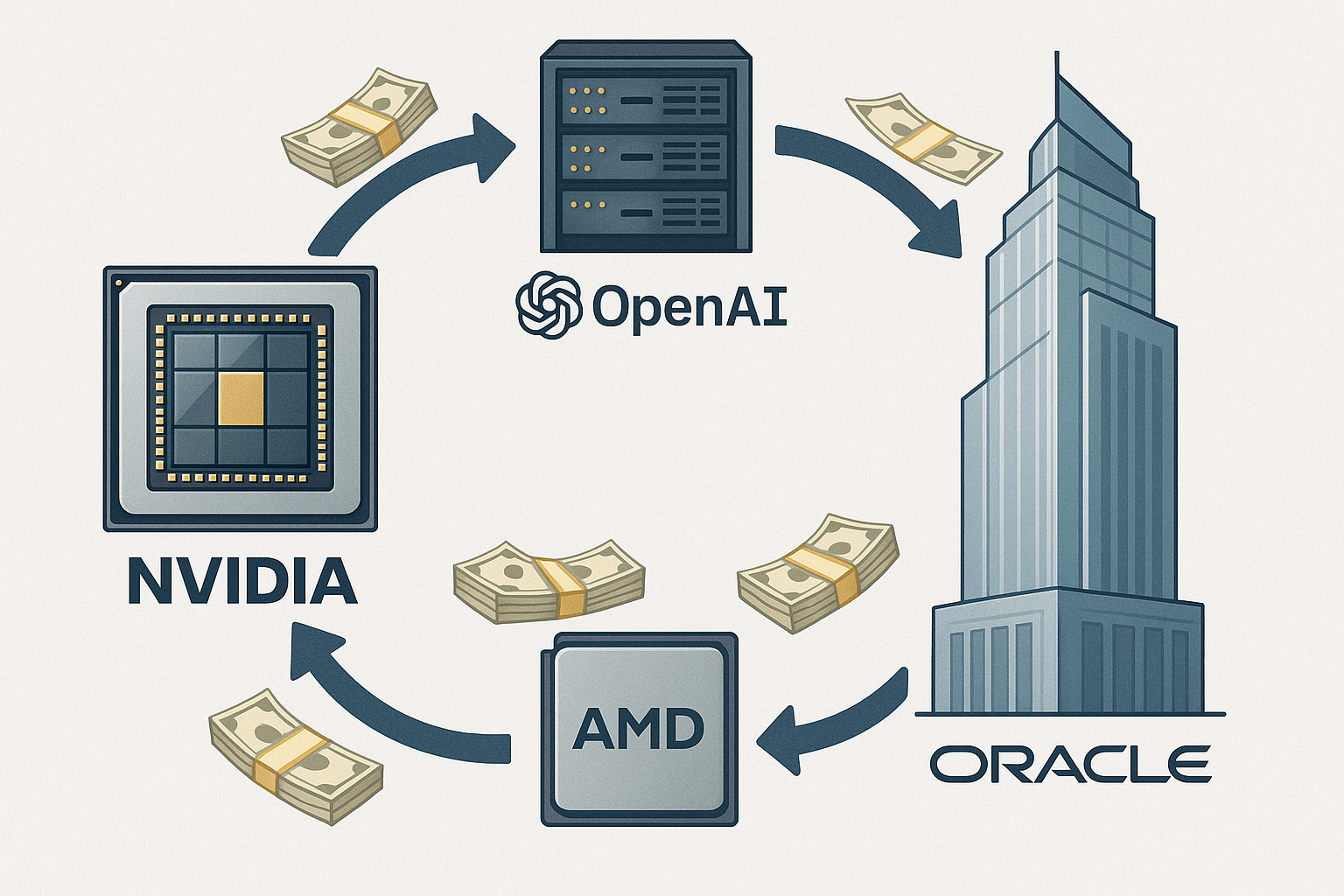

Silicon Valley has created what amounts to an elaborate financial merry-go-round: the chip makers invest in AI labs, which use that money to... buy more chips. Meanwhile, everyone's valuations keep climbing skyward like they're attached to helium balloons.

It's fascinating, really. Nvidia pumps money into OpenAI and CoreWeave. OpenAI inks massive deals with Oracle, CoreWeave, and AMD. Nvidia reportedly drops another cool $2 billion into Elon's xAI venture. Round and round it goes, money flowing in a perfect circle.

(I spent three hours mapping these relationships on a whiteboard last week—it looked like something from "A Beautiful Mind" by the time I finished.)

The question nagging at me is simple: Who ultimately holds the bag if this music stops playing? When companies become this financially entangled, risk doesn't vanish—it just gets harder to spot, like a chameleon on a Jackson Pollock painting.

There are two ways to look at this pattern of investments, and I've heard both from industry insiders who've bent my ear over coffee in recent months.

The optimistic view? Smart vertical integration. The pessimistic take? A self-reinforcing bubble.

In the bullish camp, this is just Henry Ford logic—if your customers need money to buy your products, lending them that money is enlightened self-interest. Makes sense.

But the bearish interpretation is thornier. If Nvidia invests $100 billion in OpenAI, and OpenAI turns around and spends that money on Nvidia hardware... have we actually created economic value? Or just played an elaborate shell game with the same pile of cash?

Having covered tech bubbles since the early 2000s, this particular dynamic feels both familiar and novel. The scale is different. The speed is different. But that feeling in my gut? Strangely similar.

I met with three venture capitalists last month who all used the same word to describe the current AI investment climate: "frothy." That's investor-speak for "probably overvalued but who wants to be the party pooper?"

What makes this situation particularly strange is how the circularity extends beyond financial investments. The AI narrative itself has become self-reinforcing: Companies use their own products to demonstrate why we need more of their products. It's like a snake eating its own tail, but somehow growing larger in the process.

Are these technological breakthroughs real? Absolutely—I've seen them firsthand. ChatGPT and its ilk represent genuine innovation.

But when the same handful of companies is simultaneously providing the technology, setting the valuations, and funding each other's growth... well, traditional market signals get warped. It's Economics 101 in a fun-house mirror.

The canary in this particular coal mine will be how—or if—these circular investments eventually unwind. In healthier markets, strategic investments get sold off as companies mature. If instead we see this web of cross-investments growing more complex and interdependent, that might be our warning sign.

For now, I'm just watching with a raised eyebrow. When the folks selling the shovels in this gold rush start becoming major investors in the miners, who then use that capital to buy more shovels... it's worth paying attention.

The invisible hand of the market, it seems, has taken up juggling.