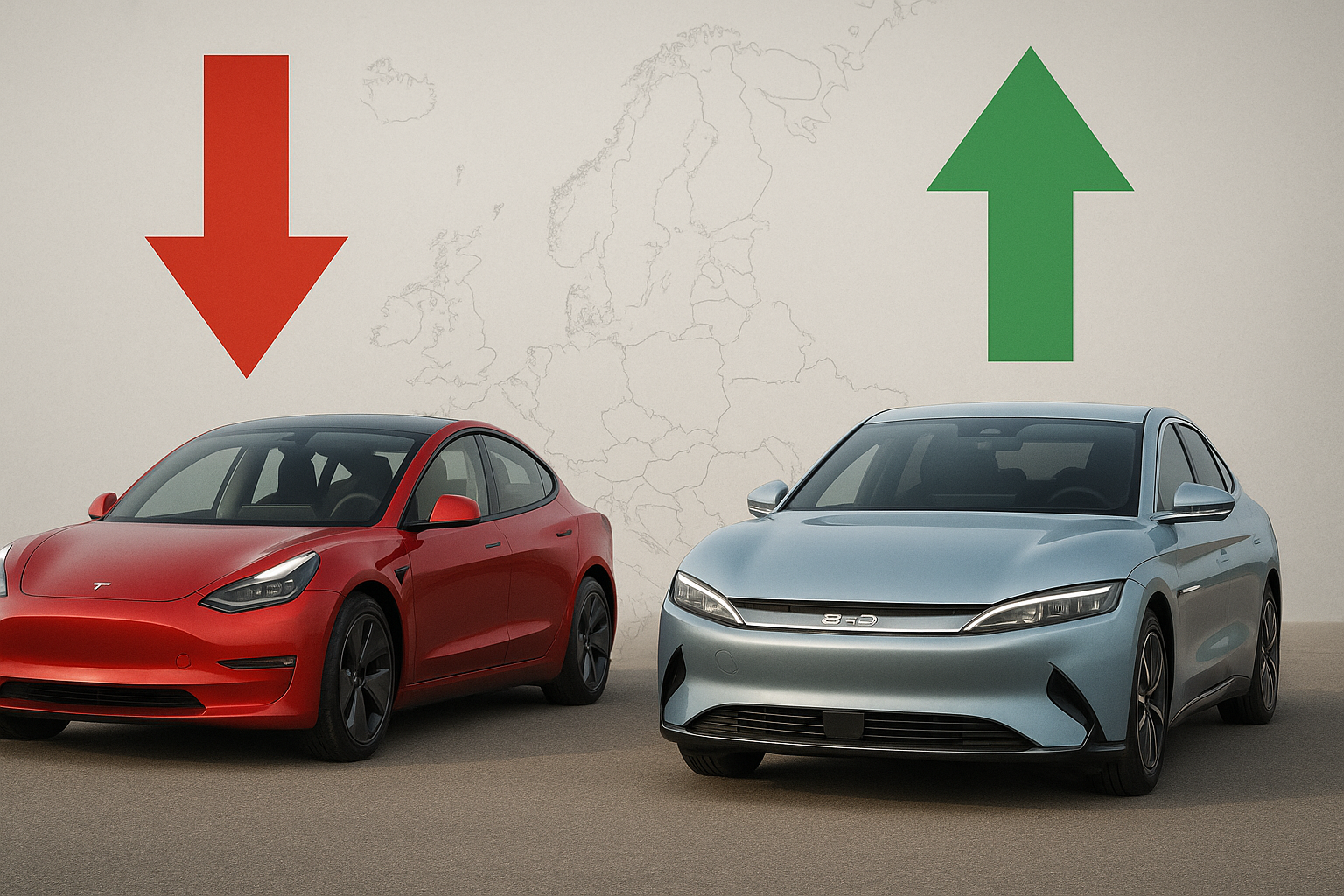

Tesla's European sales took a brutal hit this July, plummeting 40% compared to last year. Meanwhile, BYD—the Chinese competitor most Americans couldn't identify in a lineup—saw its registrations more than triple in the same market.

Ouch.

The contrast isn't just stark; it's downright alarming for Tesla investors who've bet the farm on Elon Musk's electric vision maintaining its dominance.

Europe has long been fertile ground for electric vehicles. The continent embraced the technology early, built out charging infrastructure, and implemented policies that made EVs financially attractive. Which makes Tesla's stumble there particularly telling.

Look, this storyline isn't exactly unprecedented. History's littered with innovative companies that disrupted industries, enjoyed their moment in the sun, then watched competitors with leaner operations eat their lunch. Remember BlackBerry? Palm Pilot? They were revolutionary until... they weren't.

I've been tracking EV adoption patterns since 2018, and what we're seeing fits what market analysts often call the "Innovation Lifecycle Premium." It's simple, really—early adopters gladly pay extra for cutting-edge tech, but mainstream consumers focus on value. Tesla mastered the first phase but seems bewildered by the second.

The company's European troubles aren't happening in isolation. They reflect deeper problems.

For one, Musk's attention is scattered across a universe of ventures. Running a car company is punishingly difficult (ask anyone who's tried), requiring obsessive focus on manufacturing details, supply chains, and quality control. When you're simultaneously revolutionizing space travel and buying social media platforms on a whim, something's gotta give.

Then there's the Musk factor itself. The billionaire's increasingly divisive public persona has alienated many natural Tesla customers—educated, environmentally-conscious consumers who might not appreciate his latest political pronouncements or Twitter antics.

The European market is particularly revealing because it strips away Tesla's home-field advantage. Europeans have always been more pragmatic about automotive brands than Americans (who often wrap vehicles in identity politics). They'll try Japanese, Korean, or Chinese manufacturers without the hesitation you might see in the U.S.

They're also—and this is crucial—more price-sensitive.

BYD's rise isn't accidental. Chinese manufacturers have spent years methodically building dominance in battery supply chains, securing critical minerals, and creating manufacturing efficiencies that give them structural advantages. They essentially took Tesla's playbook and executed it with greater scale and lower costs.

(Having visited several Chinese EV factories in 2022, I can attest that their manufacturing sophistication would surprise most Western observers.)

The irony? Tesla, which positioned itself as the disruptor of legacy automakers, now faces disruption from below. Classic innovator's dilemma. By moving upmarket with premium vehicles and focusing on margins rather than market share, Tesla created space for competitors to enter at lower price points.

And enter they did.

What we're witnessing might not be just a temporary setback but potentially a preview of Tesla's global trajectory. Europe often serves as a bellwether for broader automotive trends—if Tesla can't compete effectively there despite favorable EV adoption rates, challenging times likely await in other markets.

This scenario seems, uh, problematic for a company still trading at multiples that assume market dominance.

For Tesla, the path forward narrows. Can it pivot toward being a competitive volume manufacturer, or will it increasingly become a niche luxury brand with corresponding market share? The European numbers suggest the latter may not be a choice but an inevitability.

Investors, take note.