I've been watching Tesla's valuation dance for years now, and let me tell you—it's always existed in this bizarre twilight zone between utterly ridiculous and possibly prophetic. At $1.1 trillion, with a mere $7 billion in projected 2024 profits (and probably worse next year), the numbers make absolutely no sense if you're looking at a car company.

But maybe that's the point. Maybe it never was about the cars.

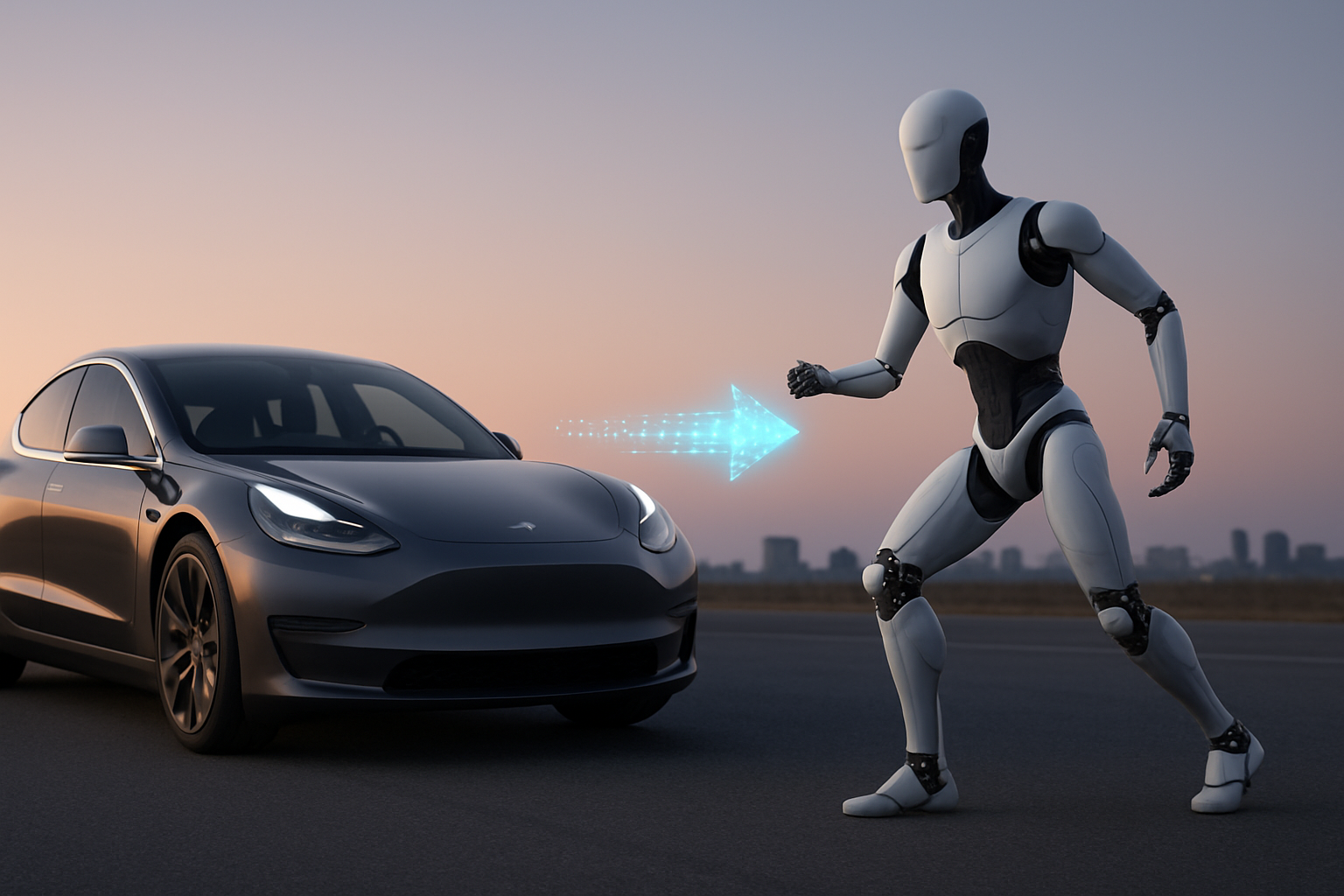

The whispers are getting louder that Elon is ready to transform Tesla from "car company with some tech aspirations" into "AI and robotics juggernaut that happens to make vehicles on the side." Not exactly a shock to anyone paying attention. The man's been telegraphing this move with all the subtlety of a foghorn at a library.

Caught Between Two Worlds

Look, Tesla has always existed in this weird quantum state—simultaneously an "absurdly overvalued automaker" and a "potentially undervalued tech platform." The bull case was never really about selling Model Ys with fat margins till kingdom come.

I mean, seriously. The company trades at roughly 157 times earnings. Ford and GM? They're hanging out in the 5-7 range. This isn't just a different neighborhood; it's a different planetary system.

Wall Street has consistently priced Tesla as if those robotaxis were already cruising down Main Street, those Megafactories were already revolutionizing energy storage, and those humanoid robots were... well, doing whatever it is humanoid robots are supposed to do. (My laundry, hopefully? A guy can dream.)

The Great Escape

What we're seeing now is Musk's attempt to finally make Tesla's actual business match its sci-fi valuation story. It reminds me of someone who realizes they can't possibly grow into clothes ten sizes too large—so they opt for radical surgery instead.

The automotive business? It's facing headwinds so strong they'd knock over a semi truck. Chinese competition is absolutely devouring Tesla's market share overseas. Those price cuts have squeezed margins thinner than my patience for another "two weeks away" FSD promise. And speaking of Full Self-Driving... it somehow remains perpetually six months from completion—a timeframe that apparently exists in some strange relativistic bubble where half a year can stretch into eternity.

Meanwhile, Musk can't stop talking about Optimus, the company's humanoid robot project. I attended their last tech event, and the man spent more time discussing actuators and neural networks than anything related to cars. The subtext isn't even subtext anymore—it's just... text.

Cars were just the opening act. They always were.

Financial Fantasy Land

The valuation gymnastics here deserve a perfect 10 from even the most critical judges. If you try to value Tesla as a car company—even with the most optimistic growth projections pulled from the rosiest corners of fantasy—you simply cannot justify a trillion dollars. Period. The math doesn't work unless you're using calculations from some parallel dimension where numbers mean different things.

But squint hard enough (no, harder than that) and suddenly Tesla is a "first-mover in general-purpose humanoid robotics"—a market that, I should point out, doesn't actually exist in any meaningful commercial sense yet. Then the sky's the limit! It's the ultimate "just trust me, bro" investment thesis.

The Short Temptation

So is this finally—FINALLY—the moment to short Tesla? History offers a sobering warning here. The financial landscape is littered with the blown-up portfolios of Tesla shorts. The stock has defied gravity, logic, and every conventional valuation metric for so long that betting against it has become the investment world's equivalent of touching a hot stove to see if it's really hot.

(Spoiler: it's always hot.)

The bear case makes perfect sense on paper: Tesla is abandoning what it actually knows how to do (building electric vehicles, albeit at premium prices) for ventures it has zero proven competency in (mass-market robotics). EV competition is intensifying daily, margins are under pressure, and even the most rose-colored scenarios can't mathematically justify the current market cap.

But the bulls? They'll remind you that Musk has pulled rabbits out of hats before. I remember when SpaceX was openly mocked as a billionaire's vanity project. Now it dominates global launch services. Tesla itself flirted with bankruptcy multiple times before becoming the most valuable car maker on the planet.

I've covered enough Musk ventures to know that betting against him is dangerous... but so is ignoring mathematical reality.

The Bottom Line

Tesla's current valuation requires absolutely everything to go perfectly—not just in the business they currently operate, but in businesses they haven't even built yet. That's a precarious position for any investment thesis, even one powered by Elon's reality-distortion field running at maximum capacity.

What seems increasingly clear is that Tesla wants out of the car business—not completely or immediately, but as its core identity. The real question for investors: do you want to pay a 157x multiple for a company having such a fundamental identity crisis?

In markets, just like physics, what goes up must eventually reconcile with fundamental reality.

The only question is when... and how hard.