Tesla's foray into the insurance world has crashed into a legal barrier in California. A freshly filed class action lawsuit accuses Elon Musk's electric vehicle juggernaut of employing one of the oldest, most frustrating tactics in the insurance industry playbook: deliberately slow-walking claims until customers give up.

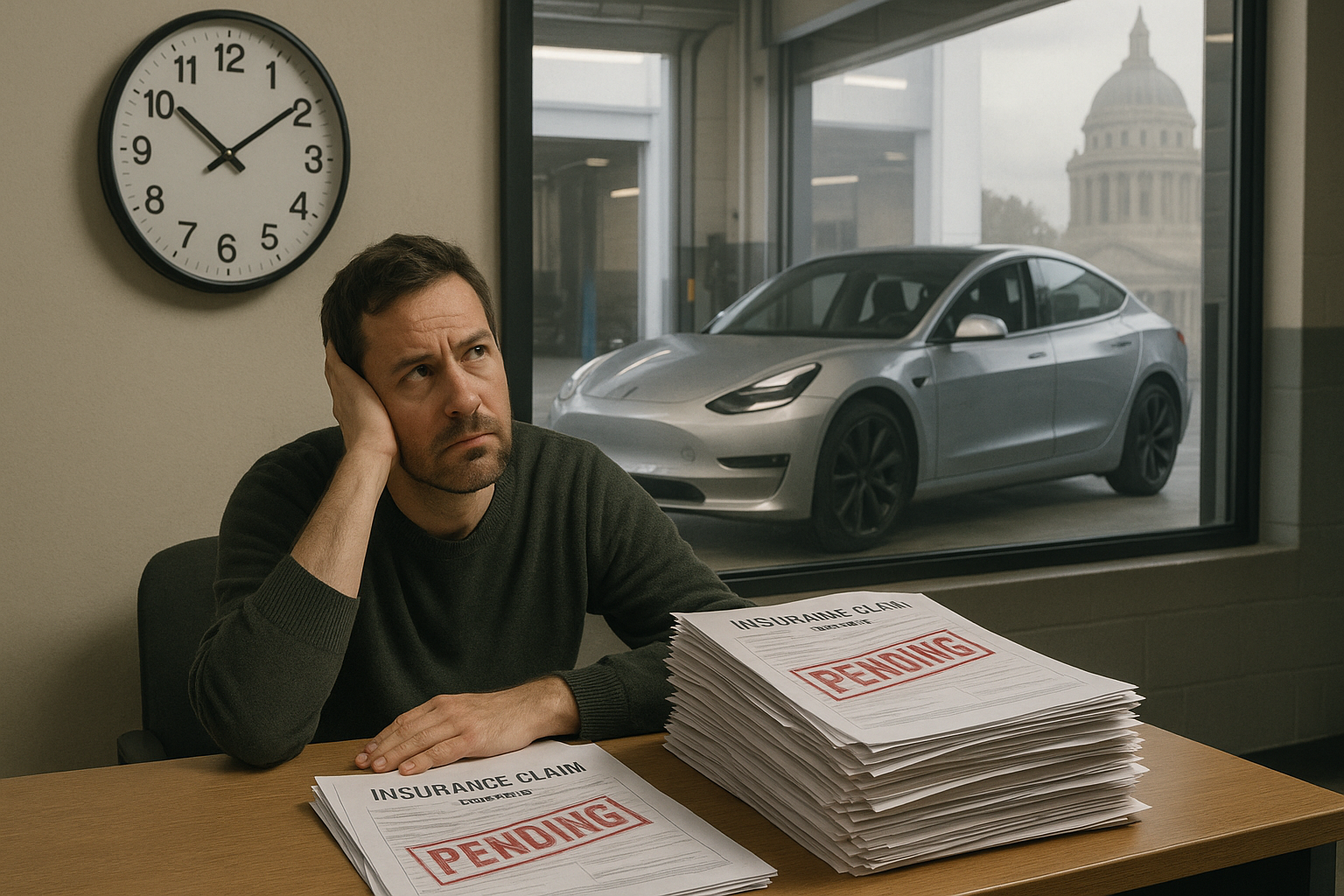

The lawsuit, filed July 11 in Los Angeles Superior Court, paints a picture that's all too familiar to anyone who's ever wrestled with an insurance company. Tesla Insurance, the suit alleges, has been dragging its feet on claims processing, offering lowball settlements, and generally making the whole experience so miserable that some policyholders simply abandon their claims altogether.

Talk about irony.

This is Tesla we're talking about—the company that promised to revolutionize everything it touches. The same innovative disruptor that sends software updates to your car while you sleep apparently can't figure out how to process an accident claim in a timely manner? C'mon.

I've been watching Tesla's insurance experiment since it launched, and this development isn't entirely surprising. Insurance is a different beast than manufacturing electric vehicles. It's heavily regulated for a reason—people depend on these policies during some of the worst moments of their lives.

The lawsuit seeks to represent thousands of California motorists who purchased Tesla insurance, including both Tesla owners and (interestingly enough) drivers of non-Tesla vehicles. Yes, Tesla Insurance covers non-Tesla cars too, something many folks don't realize.

What makes this particularly fascinating is that Tesla should—theoretically—have advantages traditional insurers could only dream about. Their vehicles are rolling data centers. They know exactly how you drive, when you drive, and where you drive. This wealth of information should make claims handling smoother, not more cumbersome.

So what went wrong?

Well, for starters, there's a world of difference between disrupting an industry and actually running the nuts-and-bolts operations that make that industry function. Tesla has discovered what many tech companies learn the hard way: financial services aren't smartphones. You can't just move fast and break things when people's financial security hangs in the balance.

"The promise of insurtech was always about improving customer experience," a former insurance commissioner told me last year during an unrelated interview. "If you're just adopting the worst practices of the industry you're trying to disrupt, what's the point?"

Look, this isn't just a problem for Tesla policyholders. It represents yet another sidetrack for a company that sometimes seems to be juggling too many balls. From solar roofs to the still-unrealized robotaxi network, Tesla has a habit of making big promises across multiple industries while struggling to deliver consistently on them.

For shareholders watching this lawsuit unfold, it raises uncomfortable questions. Was insurance ever really going to be a significant profit center for Tesla? Or was it simply another shiny object for Musk to point to during earnings calls?

The California market is notoriously difficult—strict regulations, consumer-friendly courts, and savvy customers who know their rights. If Tesla can't make it there... well, you know the rest of that old song.

What's particularly odd (and somewhat telling) is that traditional insurers have been working for years to speed up claims processing through mobile apps, AI-assisted damage assessment, and rapid payment systems. Tesla, with all its technological advantages, somehow ended up being accused of the same sluggish practices that gave insurance companies their reputation problem in the first place.

The vehicle maker that promised to reinvent the wheel seems to have instead embraced some of the industry's most worn-out tires.

This lawsuit won't sink Tesla, of course. But it does highlight a persistent challenge for the company—turning Musk's expansive vision into consistent execution across diverse business lines. And for consumers? It's a reminder that disruption sounds great in a press release, but when you're standing next to your damaged car waiting for a claims check, what matters most is simply getting what you paid for.