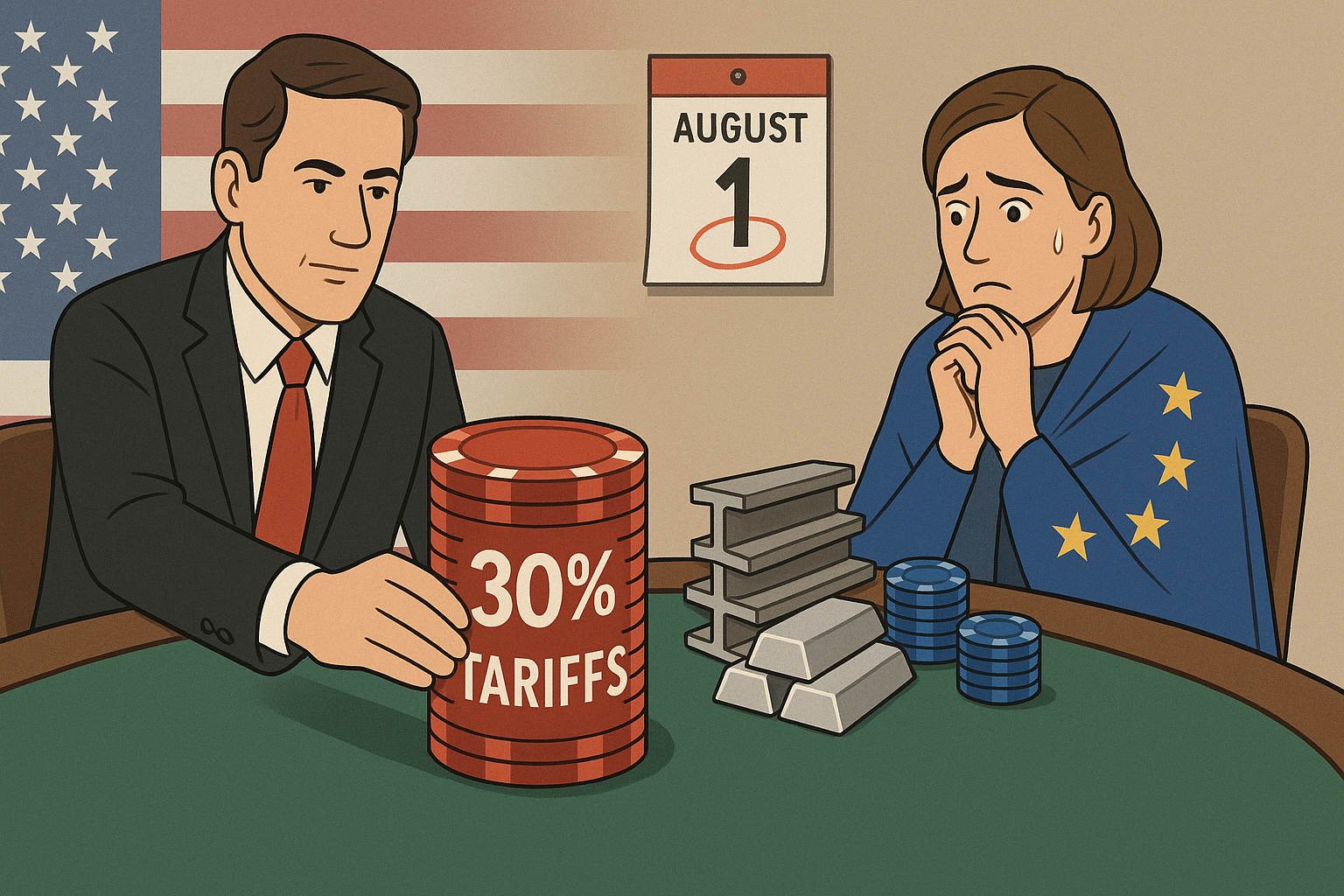

Howard Lutnick just pushed all his chips to the center of the table.

The Commerce Secretary's blunt message to the European Union this week represents perhaps the most aggressive trade ultimatum from a U.S. official since... well, since the previous administration. Deal with us by August 1st, Lutnick essentially declared, or face punishing 30% tariffs on your steel and aluminum exports.

"We're going to have a deal," Lutnick insisted with the kind of confidence that only comes from holding what you believe is a winning hand. But make no mistake — this wasn't confidence born of diplomatic harmony. This was the calculated self-assurance of someone who's just shown his opponent the economic equivalent of a loaded gun.

I've covered trade negotiations for years, and there's something almost refreshingly direct about Lutnick's approach. No diplomatic doublespeak. No pretending both sides hold equal leverage. Just raw economic realpolitik served straight up.

The fascinating part? The continuity between administrations. These aren't new tariffs — they're the Trump-era measures that Biden suspended but never eliminated. Now Lutnick (a Trump man serving in Biden's Cabinet, which is its own Washington curiosity) threatens to resurrect them in full force.

"It's like watching the same Broadway show with different lead actors," one trade analyst told me yesterday. "The script hasn't changed much."

Let's be honest about what we're witnessing. This is asymmetric warfare, economically speaking. The U.S. market matters more to European exporters than vice versa — at least that's the calculation Lutnick is making. And he might be right.

The Europeans find themselves in a bind. Their steel producers desperately want protection from cheap imports (just like American producers do), but their high-end manufacturers need access to the American consumer. Split loyalties make for weak negotiating positions, and Lutnick — with his Wall Street background — surely recognizes this vulnerability.

But will this hardball approach actually work?

History gives us conflicting answers. Sometimes pressure produces diamonds — or in this case, trade concessions. Other times it just produces resentment and retaliation.

Look, I remember covering the first round of these tariff battles. European officials privately fumed while publicly promising counter-measures. They eventually delivered some targeted sanctions while making modest concessions. Neither side really "won" that round, though both claimed victory for domestic audiences.

The timing here is... interesting. With just months until a presidential election, the Biden administration seems to have calculated that showing toughness on trade outweighs the diplomatic costs. The days when "free trader" wasn't a political insult in Washington seem distant now, don't they?

For European leaders, the August deadline looms like a storm on the horizon. Their economies — particularly Germany's industrial heartland — already face headwinds from energy costs, slowing Chinese demand, and anemic domestic growth. A 30% price shock on steel exports to America would be, as one Brussels official put it to me rather colorfully, "a kick in the teeth while we're already down."

(That same official, who requested anonymity to speak frankly, questioned whether the Americans truly understand the political bind such tariffs create for pro-U.S. European governments. "They're making it harder for their friends to stay friendly," he sighed.)

So what happens next?

My sources in Brussels suggest internal disagreements are already surfacing. Steel-producing nations want to hold firm, while export-dependent economies favor compromise. This fragmentation plays directly into Lutnick's hands.

The smart money says some deal emerges before the deadline — probably one that gives both sides enough to claim victory without resolving the fundamental tensions. That's typically how these high-drama trade standoffs end.

But there's always the chance it goes sideways.

If August 1st arrives without agreement, we'll see European retaliation, American counter-retaliation, and potentially a trade spiral that benefits nobody except perhaps political campaigners looking for economic villains to blame.

Meanwhile, businesses caught in this geopolitical chess match? They're doing what they always do — preparing contingency plans while hoping cooler heads prevail.

As one manufacturing executive told me yesterday, "We're simultaneously planning for tariffs and praying they don't happen." Been there, done that, got the spreadsheet to prove it.

In two months, we'll know whether Lutnick's bet pays off. Until then, the transatlantic economic relationship hangs in the balance — again.