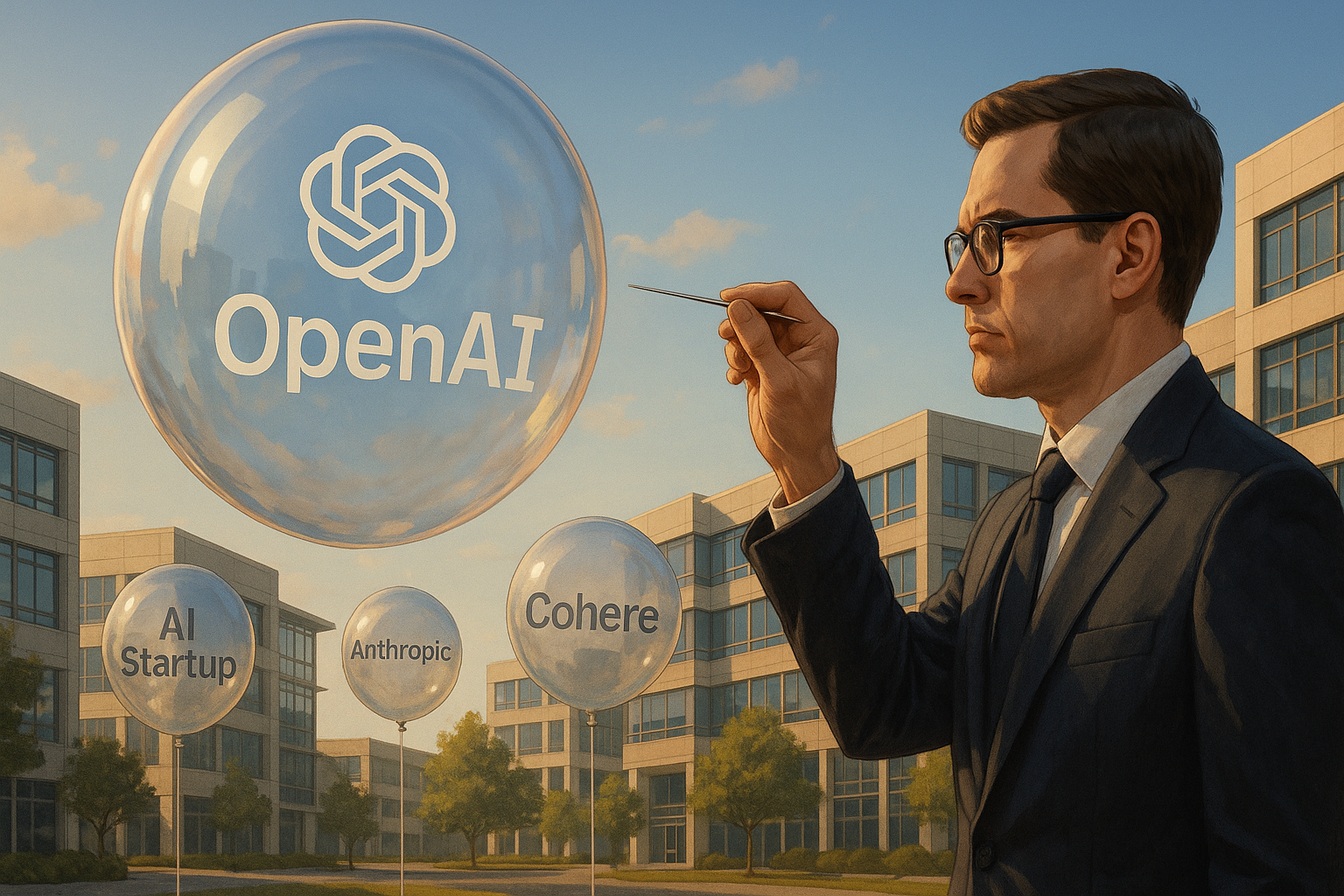

Is OpenAI really worth half a trillion dollars? That's the question keeping venture capitalists up at night—and for good reason.

The AI poster child's valuation has ballooned to stratospheric heights, reportedly hitting the $500 billion mark in recent funding discussions. This for a company burning through cash at a rate that makes even the most hardened Silicon Valley veterans wince. Their computing costs alone? I've heard from insiders they're approaching figures that would make small nations jealous.

Look, nobody's questioning OpenAI's importance. The company that brought us ChatGPT has fundamentally changed how we think about artificial intelligence. But importance doesn't automatically justify a price tag that exceeds the GDP of Norway.

In a rational market, we'd call this madness. But this is Silicon Valley during an AI gold rush—rationality packed its bags sometime in 2022 and left no forwarding address.

When the Big Domino Falls

Valuation corrections in tech rarely happen in isolation. Markets run on three things: fundamentals, vibes, and what I call "permission structures"—essentially the valuations investors think they can get away with without being laughed out of the room.

If OpenAI were to go public at "just" $50 billion (still an astronomical sum for its financial profile), it would send shockwaves through the ecosystem. Suddenly, all those AI startups with billion-dollar valuations and revenue you'd need an electron microscope to see would find themselves in an awkward position.

The logic of "we're worth billions because Company X is worth hundreds of billions" collapses pretty quickly when Company X turns out to be worth a tenth of what everyone thought.

Having covered funding rounds since before the pandemic, I've watched this movie before. The first victims would be pure-play AI companies with similar financial profiles—burning cash like it's going out of style while promising that revenue is just around the corner. Think Anthropic, Cohere, and dozens of specialized AI shops that have raised eye-watering rounds since 2022.

The second wave hits the "AI-adjacent" crowd—you know, the companies that slapped "AI-powered" onto their pitch decks faster than you can say "large language model." When the tide goes out... well, we'll see who's been skinny-dipping.

Big Tech's Calculated Gamble

Not everyone loses when the bubble bursts. Google (sorry, "Alphabet") has approached AI like someone with everything to lose—cautiously and with one foot firmly planted in their advertising cash cow. A deflation in AI valuations might actually play to their advantage. They could scoop up distressed AI assets at fire-sale prices while continuing their steady development work.

Amazon and Meta have taken similar approaches. They've integrated AI into their operations without betting the farm on it. They remain, at their core, an e-commerce/cloud behemoth and a social media advertising machine, respectively.

Microsoft is the interesting case. Their $13 billion OpenAI investment was a masterstroke that revitalized their cloud business and put them ahead of the competition. Even if OpenAI takes a valuation haircut, Microsoft has already extracted tremendous strategic value. Their stock might dip in solidarity, but the fundamental thesis remains intact.

I spoke with a former Microsoft executive last month who put it bluntly: "We already got what we needed from OpenAI. The valuation is secondary to the technology integration."

Nvidia: The Pick-and-Shovel Play That Keeps on Giving

And then there's Nvidia—the company supplying the picks and shovels for this gold rush. Their stock performance has been so stellar it makes crypto look like a stable investment (and that's saying something).

Here's the counterintuitive bit: an OpenAI valuation collapse might not hurt Nvidia much at all. Why? Because demand for AI computing isn't driven by startup valuations—it's driven by utility. Companies aren't training massive AI models to boost their stock prices; they're doing it because the technology creates genuine value.

As long as AI development continues—and there's every indication it will—Nvidia keeps selling chips. In fact, if valuation pressure forces AI companies to focus on revenue-generating applications rather than pure research, it could accelerate chip demand, not reduce it.

AMD stands to benefit from similar dynamics, though they're still playing catch-up in the AI chip space. Their latest offerings show promise, but they're not yet the juggernaut that Nvidia has become.

The Old Guard's Revenge

Meanwhile, the IBMs and Oracles of the world are sitting in an interesting position. These companies weren't born in the AI era—heck, some of them predate personal computers—but they've been steadily integrating AI capabilities into their enterprise offerings.

A rationalization of AI valuations might actually help these legacy players. Their stable revenue streams and measured AI investments suddenly look prudent rather than boring. These companies have weathered multiple tech boom-and-bust cycles. They've seen this movie before, and they've positioned themselves for the enterprise adoption phase that inevitably follows the hype.

(I still remember covering IBM's post-dot-com strategy. The parallels to today are... striking.)

VC Reset: Back to Basics

The most profound impact would be felt in venture capital, where AI has been the magic word to unlock funding at any valuation. For two years, you could raise millions with little more than a GPT demo and a Stanford connection.

A high-profile valuation correction would force a return to fundamentals: unit economics, paths to profitability, and realistic addressable markets. The horror!

This wouldn't be the apocalypse—just a return to normal venture dynamics. Companies with solid business models would still get funded, just at more reasonable valuations. The days of raising $100 million on a slide deck and a vague promise might be numbered, but that's probably healthy for everyone in the long run.

After all, venture capital functioned perfectly well before 2021. It'll function perfectly well after.

Some Perspective, Please

It's worth remembering that even a "disappointing" $50 billion OpenAI valuation would still represent one of the most valuable private companies on the planet. A correction in AI valuations wouldn't mean the technology isn't transformative—just that we collectively got ahead of ourselves on the financial side.

The technology is real. The capabilities are impressive. The potential impact on productivity is substantial. None of that changes if some zeroes disappear from valuation spreadsheets.

Markets overshoot in both directions. They always have, always will. The AI revolution will continue regardless of whether OpenAI is worth half a trillion or merely the GDP of a small European nation.

After all, the internet changed everything even after the dot-com bubble burst. Remember Pets.com? The sock puppet died, but e-commerce thrived.

AI will follow the same path, with or without the froth. Just don't tell that to the investors currently negotiating those eye-watering term sheets.