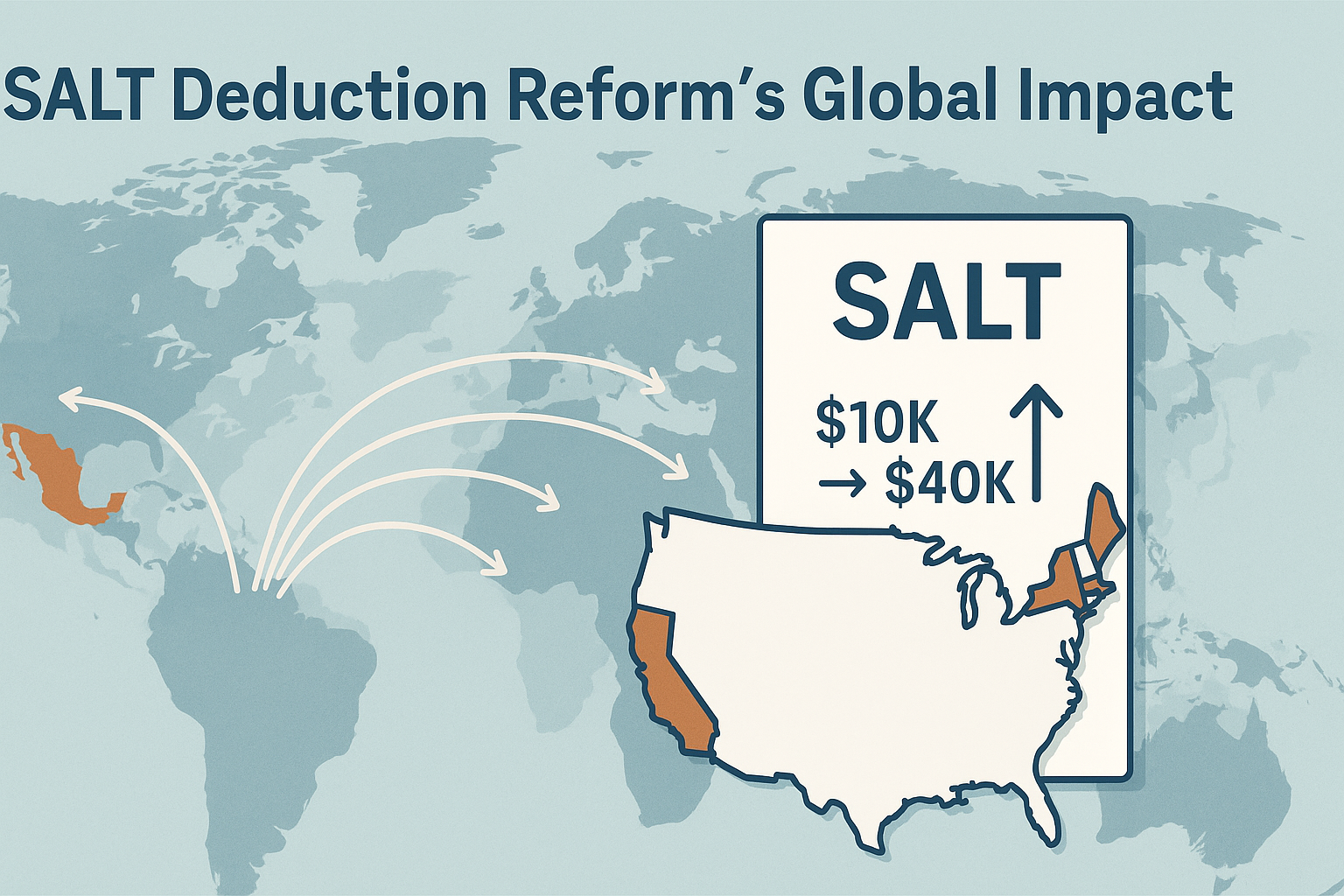

The proposed increase to the SALT deduction cap - from $10,000 to $40,000 for households earning under $500,000 - might seem like an obscure tax policy change, but its implications extend far beyond U.S. borders. As part of the "One Beautiful Bill" currently making its way through Congress, this provision has caught the attention of global investors and policy experts alike.

I spent yesterday speaking with several international fiscal policy specialists, and what struck me was their unanimous interest in how this change might affect capital flows between states and even countries. High-tax states like California, New York, and New Jersey are major players in the global economy, and policies that affect their fiscal health inevitably have ripple effects worldwide.

"This is really about maintaining the competitiveness of America's economic powerhouse regions," Jonathan Kim told me during our conversation. He advises several sovereign wealth funds on U.S. investments. "These high-tax states generate disproportionate amounts of innovation, exports, and global business connections."

The timing is particularly interesting given current housing market conditions. In my neighborhood in northern New Jersey, I've noticed homes sitting on the market longer than they would have a year ago. Real estate agents I've spoken with cite the SALT cap as one factor making high-property-tax areas less attractive to certain buyers. This proposed change could potentially reverse that trend.

There's also an interesting global competition angle here. Other countries - particularly in Europe - have been actively trying to lure high-income professionals and businesses away from high-tax U.S. states. This SALT cap adjustment could help stem that tide.

Municipal bond markets have already begun pricing in the possibility of this change, with slight improvements in the yields of bonds from high-tax states. This suggests investors see reduced fiscal pressure on these states if the bill passes.

The congressional vote is expected before the August recess, though - as anyone who follows politics knows - these timelines often slip. Global markets seem to be pricing in about a 60% probability of passage, based on movements in related sectors.

For international investors, this development represents yet another variable in the complex calculus of global capital allocation - one that potentially tilts the scales slightly back in favor of America's coastal economic hubs.