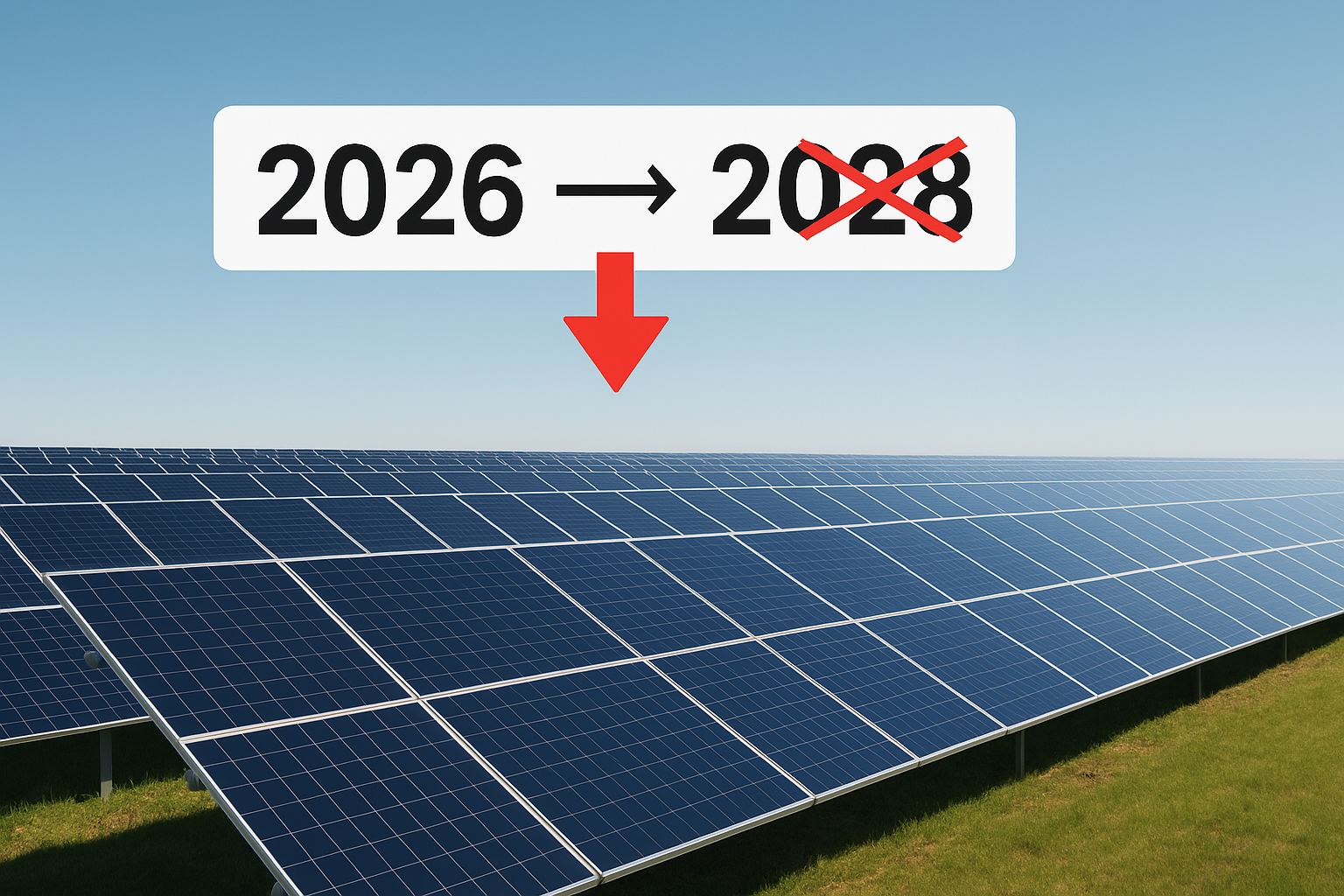

The Senate dropped a bombshell on the renewable energy sector last week with its budget proposal to eliminate federal solar tax credits by 2028. This wasn't just a minor policy tweak - it's a fundamental shift that's already sending shockwaves through solar stocks and raising questions about America's commitment to clean energy.

I've been tracking renewable policy for years, and this feels like a significant turning point. The Investment Tax Credit (ITC) has been the backbone of solar growth in the U.S., making projects financially viable for both homeowners and utility-scale developers. Cutting it from 60% in 2026 to zero by 2028 is more aggressive than anyone expected.

"This timeline gives us whiplash," a solar industry executive told me yesterday (requesting anonymity because they weren't authorized to speak publicly). "We've built business models around the previous phaseout schedule. This pulls the rug out."

What's particularly strange about this move is its timing. Solar installations hit record highs last quarter, and manufacturing capacity is finally expanding domestically. The Inflation Reduction Act seemed to signal long-term support for renewables - and now this?

The international implications are significant too. Chinese solar manufacturers are watching closely, as are European allies who've been following America's renewable energy leadership. If we back away from solar incentives, it could give other countries second thoughts about their own clean energy commitments.

Not everyone sees this as bad news, though. Proponents of nuclear and geothermal energy - which provide more consistent baseload power than solar - view this as an opportunity to rebalance the renewable portfolio. There's something to that argument; a diverse energy mix is probably smarter than putting all our eggs in one basket.

Goldman Sachs analysts noted yesterday that the solar industry has achieved significant cost reductions, potentially making it more resilient to subsidy cuts than in previous years. But they still predict "substantial market contraction" if the proposal passes unchanged.

For homeowners considering solar panels - you might want to move quickly. These credits could disappear faster than anyone expected.