The Fed is shifting gears, and you don't need a secret decoder ring to figure out why. After months of market observers dissecting every Fed statement like it contained the financial equivalent of the Da Vinci Code, the reality is refreshingly straightforward: Jerome Powell has his eye fixed firmly on the job market.

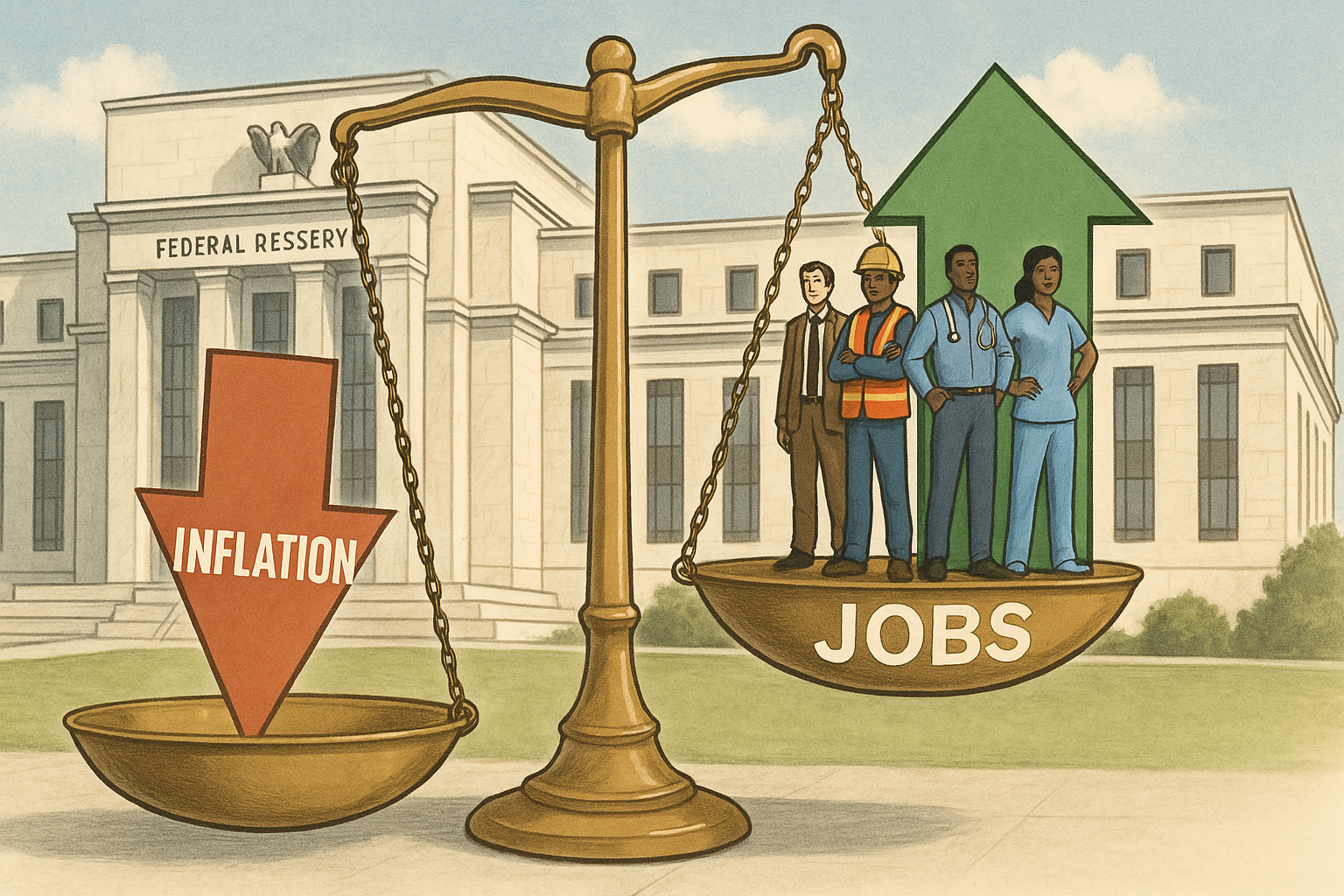

The Federal Reserve operates under what economists call the "dual mandate" – a fancy way of saying they need to keep both inflation and unemployment in check. It's a balancing act that's about as easy as juggling flaming chainsaws while riding a unicycle.

Look, the inflation panic of 2022 hasn't completely disappeared. Those 2% target zealots still have plenty to fret about. But the white-hot urgency? Gone. What we're seeing instead is Powell and company doing that subtle central banker two-step where they acknowledge one problem (inflation) while increasingly worrying about another (jobs).

I've been covering Fed policy since before Powell took the helm, and this pattern is as predictable as New England weather is unpredictable. When labor market data starts looking shaky – and those recent BLS revisions were a doozy – the Fed's attention inevitably swings in that direction.

"Remember all those jobs we thought existed? Well, about that..." isn't exactly the message any central banker wants to hear.

What's remarkable isn't Powell's pivot itself but the market's bizarre amnesia about how this typically plays out. The Fed rarely waits until unemployment is actively spiking before cutting rates. That would be like waiting to buy home insurance until your house is already on fire.

They move when they see smoke.

And there's plenty of smoke signals in the recent data.

(It's worth noting that some Fed watchers still insist Powell is bluffing about rate cuts. These are probably the same people who still believe pineapple belongs on pizza.)

The underlying psychology here isn't complicated. When forced to choose between fighting yesterday's battle (inflation) and preventing tomorrow's crisis (unemployment), the Fed almost always picks the latter once the former seems under control. It's Asymmetric Risk Management 101 – the political cost of a recession is far greater than the cost of inflation running a tad hot.

I was at a conference last month where three former Fed economists all made variations of this same point. One put it particularly bluntly: "No Fed chair wants to be remembered as the one who crashed the economy because they were fighting inflation that was already retreating."

This dynamic reminds me of 1995, when Greenspan executed those famous "insurance cuts" despite relatively solid economic growth. Powell, who's definitely a student of Fed history, knows this playbook by heart.

So why all the mystery and intrigue around Fed intentions? Part of it is the financial media's need to create drama where little exists. Part of it is traders talking their book. And part is just the natural human tendency to overcomplicate things.

Sometimes a cigar is just a cigar, and sometimes a Fed pivot is just... well, a Fed pivot.

The narrative arc here isn't particularly mysterious. The job market is cooling faster than desired. Inflation is cooling roughly as intended. The policy prescription that follows isn't exactly quantum physics.

Whether Powell's jobs-first approach proves correct – ah, there's the real question. But at least we can stop pretending there's some grand enigma about what's driving Fed decisions. They've been telling us all along, if only we'd been willing to listen.