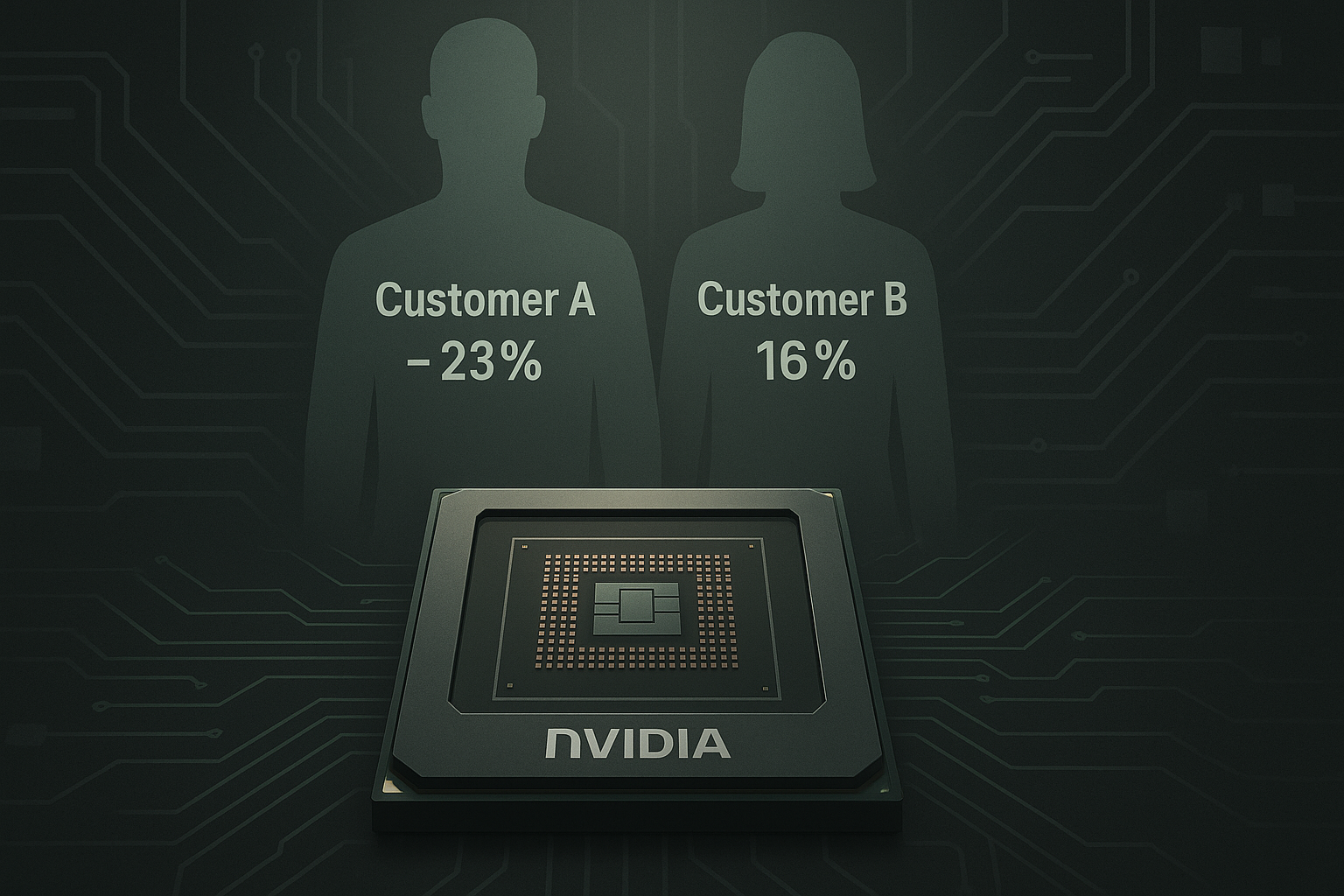

So Nvidia just dropped quite the bombshell in their earnings report. Two customers—who they're keeping mysteriously anonymous—now account for a staggering 39% of their quarterly revenue. That's right, nearly two-fifths of the AI chip giant's business is tied to just two entities they've blandly labeled "Customer A" and "Customer B."

Customer A alone represented 23% of sales. Customer B added another 16%. Last year, their top two customers combined for just 25% of revenue. That's... concerning? Impressive? Both?

I've covered tech concentration risks for years, and this one has some particularly interesting wrinkles. It's not just about the numbers—it's about the secrecy.

When CFO Colette Kress mentioned that "large cloud service providers" make up roughly half of Nvidia's data center revenue (which itself is 88% of overall revenue), everyone naturally assumed we're talking about the usual suspects: Microsoft, Amazon, Google, and maybe Oracle. These companies are snapping up H100 and H200 GPUs faster than Nvidia can make them.

But here's the kicker—Nvidia specifically declined to confirm whether these two whale customers are actually cloud providers at all.

Wait, what?

If not the cloud giants, then who exactly is dropping billions on AI chips each quarter? Defense contractors with black budgets? Musk's increasingly ambitious xAI? Apple building something in secret? Meta's reality labs? The possibilities aren't endless, but they're fascinating.

(For what it's worth, my money's still on Microsoft and one of the other cloud giants, but Nvidia's deliberate ambiguity raises questions they clearly want us asking.)

This creates what I'll call the "AI kingmaker paradox." Nvidia has positioned itself as the essential provider for the AI revolution—but that very success has made it unusually dependent on a handful of customers who themselves are racing for AI dominance. It's like being the premier arms dealer in a very exclusive war. Great business... until your clients decide to make peace. Or build their own weapons.

Look, customer concentration isn't always fatal. Apple represented over 20% of Qualcomm's revenue for years, and that relationship continues. AMD weathered the crypto mining boom and bust. But concentration always creates vulnerability.

What's particularly noteworthy is the acceleration. Going from 25% to 39% year-over-year isn't gradual—it's a fundamental reshaping of Nvidia's customer landscape. And this is happening while Nvidia's overall revenue is absolutely exploding, which means these key customers are increasing their purchases even faster than the broader market.

Frank Lee at HSBC captured the concern perfectly when he noted limited room for earnings upside "unless we have increasing clarity over upside in 2026 [cloud service provider] capex expectations."

Translation: Nvidia's future growth depends heavily on whether a few big tech companies decide to keep spending big on AI infrastructure.

I'm not predicting doom for Nvidia—they're executing brilliantly in a market they've helped create. The total addressable market for AI chips is enormous, and even some customer diversification hiccups wouldn't derail the overall growth story.

But... there's an inherent tension between being the "picks and shovels" provider for the AI gold rush and becoming dependent on a few very large miners.

The market doesn't seem worried yet. Jensen Huang, in his iconic leather jacket, certainly isn't showing concern. Perhaps everyone assumes these mystery customers will remain dependent on Nvidia's technology for the foreseeable future.

Still, in the chip business, as in investment portfolios, concentration can amplify returns—until suddenly, it amplifies risk instead.

Maybe next earnings call someone should ask about that customer diversification strategy. Just saying.