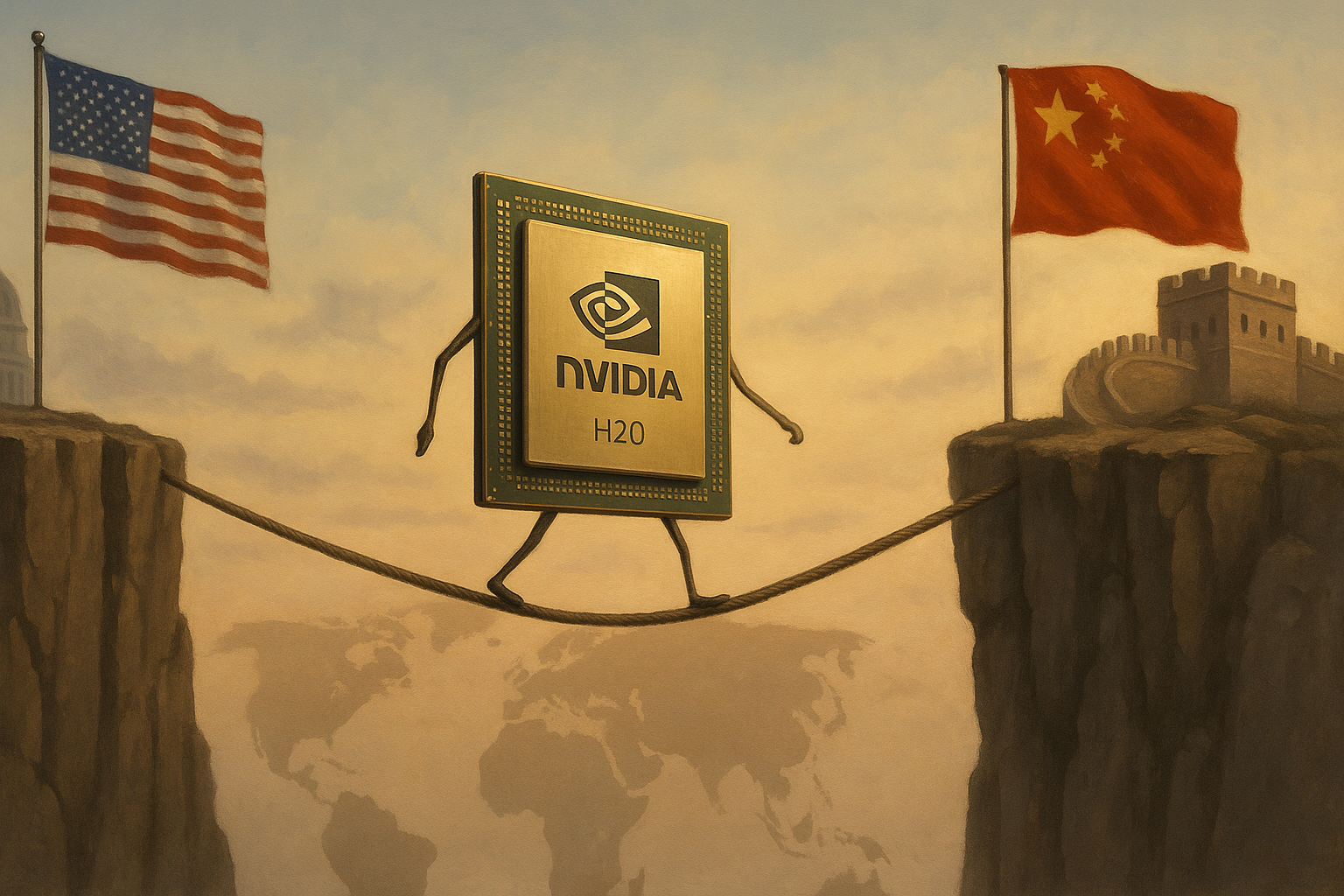

NVIDIA is walking a geopolitical tightrope. Again.

The AI chipmaker has reportedly unveiled its modified H20 chip—specially engineered to comply with Washington's export controls while still tapping into China's massive tech appetite. It's a classic corporate high-wire act that speaks volumes about our fragmented global tech landscape.

Look, NVIDIA's transformation into the crown jewel of AI computing happened practically overnight. With a market cap now exceeding $2.7 trillion (yes, with a "t"), Jensen Huang's company has become the poster child for the AI gold rush. But here's the rub—approximately $15 billion in potential annual revenue sits tantalizingly in China, a market increasingly walled off by American sanctions.

I've watched this dance between Silicon Valley and Washington for years, and this latest move might be the most fascinating yet.

The H20 chip represents a peculiar kind of innovation: deliberate constraint. It's intentionally hobbled compared to NVIDIA's premium offerings—imagine buying a Lamborghini where the speedometer has been permanently capped at 85 mph. Powerful enough to be useful, but handicapped just enough to (hopefully) satisfy U.S. regulators worried about China's AI advancement.

These chips were supposed to launch in November. They didn't. "Technical issues," the company claimed. (Translation: "We're quadruple-checking that these things won't trigger another round of sanctions.")

The timing couldn't be more critical. AMD and Intel are rushing their own China-compliant chips to market, threatening NVIDIA's dominance in what remains—despite everything—one of the world's most important tech markets.

What we're witnessing is regulatory arbitrage at breakneck speed. Companies redesigning sophisticated products in real-time, constantly recalculating what's permissible as the ground shifts beneath their feet.

For investors riding NVIDIA's stratospheric rise, this China situation casts a long shadow. Can the company really serve two masters with fundamentally opposing interests? Washington wants to limit China's access to cutting-edge AI capabilities, while shareholders expect the kind of growth that, realistically, requires Chinese buyers.

It's a precarious balancing act that grows more difficult with each new restriction.

Having followed semiconductor politics since the Trump administration first targeted Huawei, I can tell you there's a certain irony here. Every new export control potentially accelerates China's push toward semiconductor self-sufficiency—possibly undermining the very objectives these regulations aim to achieve.

The long-term implications? We're likely entering an era where chip performance directly correlates with geopolitical alignment. The global tech market is fragmenting before our eyes, with companies creating tiered product lines based not on customer needs but on passport.

For NVIDIA shareholders (and I've spoken with several major institutional investors this month), this regulatory minefield represents both significant risk and opportunity. If anyone can thread this needle, it's probably Jensen Huang—but even genius engineering has its limits when confronted with geopolitical realities.

Will this strategy work? Maybe. But in this new era of tech nationalism, even the most brilliant corporate adaptation might not be enough to overcome the fundamental forces pulling the global tech ecosystem apart.

And that's something worth contemplating as NVIDIA's stock continues its gravity-defying performance.