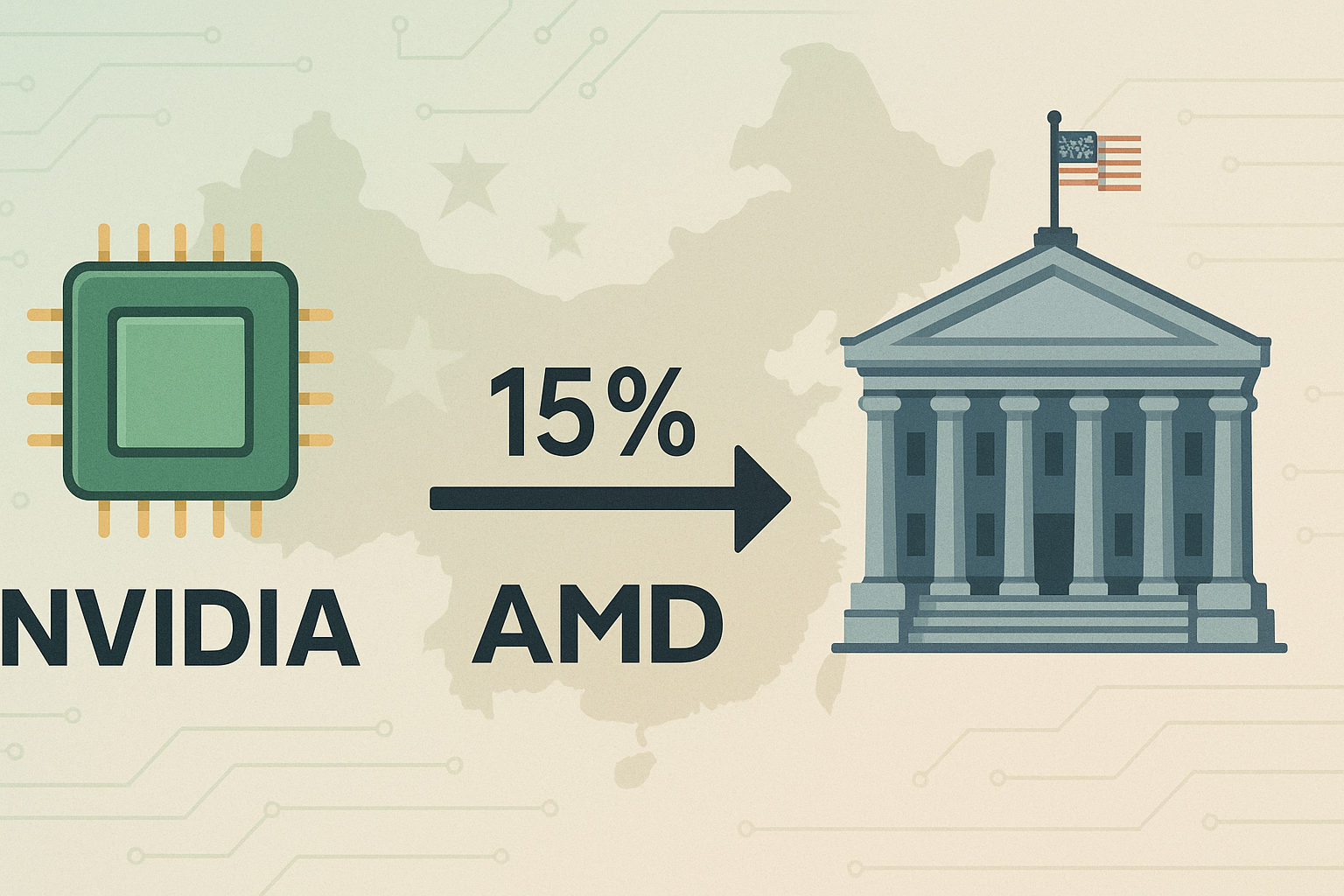

In a move that has sent shockwaves through the tech industry, Nvidia and AMD have agreed to share 15% of their revenue from AI chip sales to China with the U.S. government. This unprecedented arrangement, which I first learned about from sources close to the negotiations, represents a dramatic shift in how American tech companies operate in China.

The deal appears to be the culmination of months of behind-the-scenes discussions between the companies, the Commerce Department, and national security officials. It allows Nvidia and AMD to continue selling certain AI chips to Chinese customers - something that's crucial for their bottom lines - while addressing Washington's concerns about advanced technology transfers.

To understand the significance, you need to look at the numbers. Nvidia generated approximately $17 billion from China last fiscal year (about 13% of its total revenue), while AMD reported $6.2 billion in Chinese sales in 2024 (representing 24% of its total). With figures like these, the arrangement could funnel hundreds of millions of dollars quarterly to the U.S. Treasury.

"This is a compromise that nobody loves but everyone can live with," said a source familiar with the negotiations who requested anonymity because they weren't authorized to speak publicly. "The companies maintain market access, the government gets oversight and a revenue share, and customers in China can still access the technology - albeit at what will likely be higher prices."

What strikes me as particularly noteworthy is how this arrangement blurs the line between business and geopolitics. We're no longer talking about simple yes/no decisions on exports - we're seeing the emergence of a more nuanced approach where financial mechanisms become tools of foreign policy.

The timing isn't coincidental. With AI development accelerating globally, concerns have mounted in Washington about advanced chips potentially enabling military applications or surveillance systems. Rather than implementing outright bans (which would cede the market entirely to competitors), this revenue-sharing approach represents a middle path.

For investors in these companies, the news brings mixed implications. On one hand, continued access to the Chinese market is vital for growth projections. On the other, sharing 15% of that revenue will impact margins in what has been an extremely profitable segment.

I spoke with several industry analysts yesterday, and opinions were divided. "This sets a concerning precedent," said one. "What's to stop other countries from demanding similar arrangements?" Another took a more positive view: "Given the alternatives, this is probably the best outcome the companies could hope for. At least they can continue selling."

The Chinese government hasn't formally responded yet, but they're unlikely to welcome what effectively amounts to a U.S. tax on technology sold to Chinese companies. There's a real possibility this could prompt retaliatory measures against American businesses operating in China.

As we move through the final months of 2025, I'll be watching closely to see how this unusual arrangement plays out - and whether it becomes a template for other tech companies facing similar geopolitical pressures.