The U.S. has just thrown its hat into a rather unexpected ring: making hydrogen with nuclear power. Because apparently combining two technologies that make the public nervous is now energy policy. Go figure.

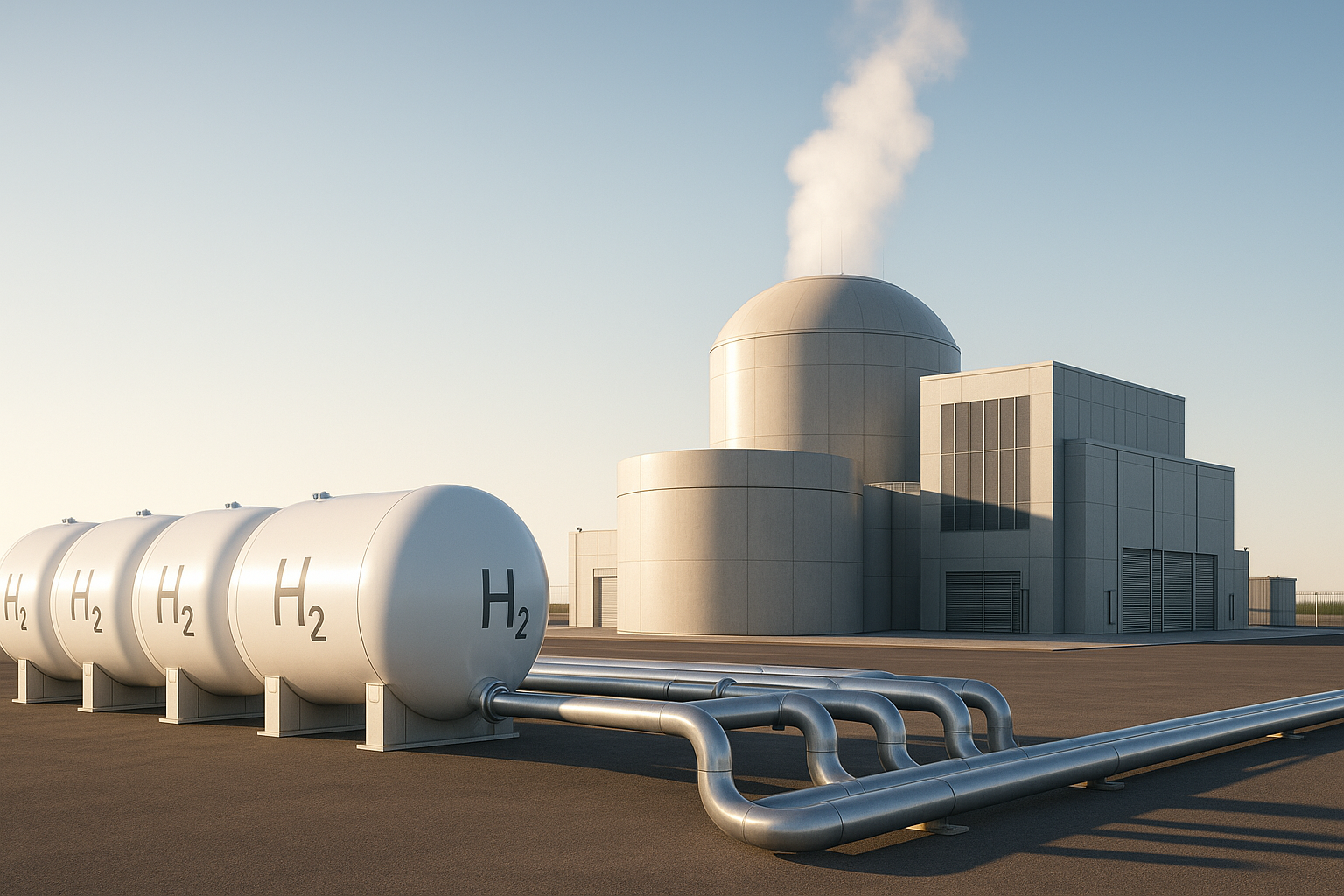

In what might be the energy equivalent of mixing peanut butter with chocolate (or maybe more like mixing nitroglycerin with matches), NuScale Power and the Department of Energy have launched what they're calling the world's first nuclear reactor specifically designed to churn out hydrogen—a whopping 200 tons daily.

Let me put that in perspective. Most hydrogen production facilities today make what amounts to a chemistry lab's worth of the stuff. This? This is industrial-scale hydrogen production that actually means something.

I've been watching energy markets for years, and there's something fascinating happening here. We're witnessing the birth of "nuclear-hydrogen economics"—a market that basically didn't exist until someone at DOE said, "Hey, what if...?"

Traditional hydrogen production has always been this weird contradiction. The cheap way to make it (steam methane reforming) pumps out carbon like nobody's business. The clean way (electrolysis from renewables) is expensive and works only when the sun shines or wind blows. Nuclear splits the difference—zero-carbon production that runs 24/7.

But here's the thing. The markets don't quite know what to do with this.

Energy investors who understand oil and gas often get twitchy around nuclear tech. Too many regulatory unknowns. Too much historical baggage. Meanwhile, the green investors who love hydrogen often have policies against nuclear anything. It's caught in investment limbo.

NuScale, though? They're playing a different game altogether.

Their Small Modular Reactor (SMR) technology has faced the usual nuclear headwinds—endless regulations, skittish financiers, and the inevitable construction delays that make developers wake up in cold sweats. By pivoting to position these reactors as multi-purpose facilities (electricity AND hydrogen AND desalinated water), they've essentially created a three-income household from a single asset.

Smart. Really smart.

The timing couldn't be better with the Inflation Reduction Act throwing around hydrogen production tax credits up to $3/kg. At 200 tons daily, we're talking about potential tax credits of—wait for it—$600,000. Every. Single. Day.

That'll buy a lot of radiation detectors.

(Sorry, couldn't resist the nuclear humor.)

Having covered renewable energy transitions since the early 2000s, this reminds me of solar's early days. Remember when everyone said photovoltaics would never be cost-competitive? Two decades later, it's literally the cheapest form of new electricity in human history. Could nuclear-hydrogen follow a similar cost curve?

Look, there are plenty of reasons to be skeptical. Nuclear projects have this nasty habit of becoming money pits. The hydrogen economy has been perpetually five years away... for about forty years now. And mixing these technologies introduces engineering challenges that would make NASA engineers bite their nails.

But...

The hydrogen economy has always suffered from a chicken-and-egg problem. No production scale without demand, no demand without production scale. If—and it's a big if—NuScale can actually deliver on this 200-ton daily capacity, they might just crack the production side of that equation.

I spoke with three energy economists last week who all said variations of the same thing: "This could actually work." Not exactly a ringing endorsement, but in the energy transition world, that's practically jumping up and down with excitement.

So will nuclear-powered hydrogen production transform American energy or become another expensive footnote in the clean energy transition? Dunno. But when technological capabilities suddenly increase by orders of magnitude, unexpected things happen.

Sometimes, the weirdest ideas are the ones that work. And this idea? It's plenty weird.