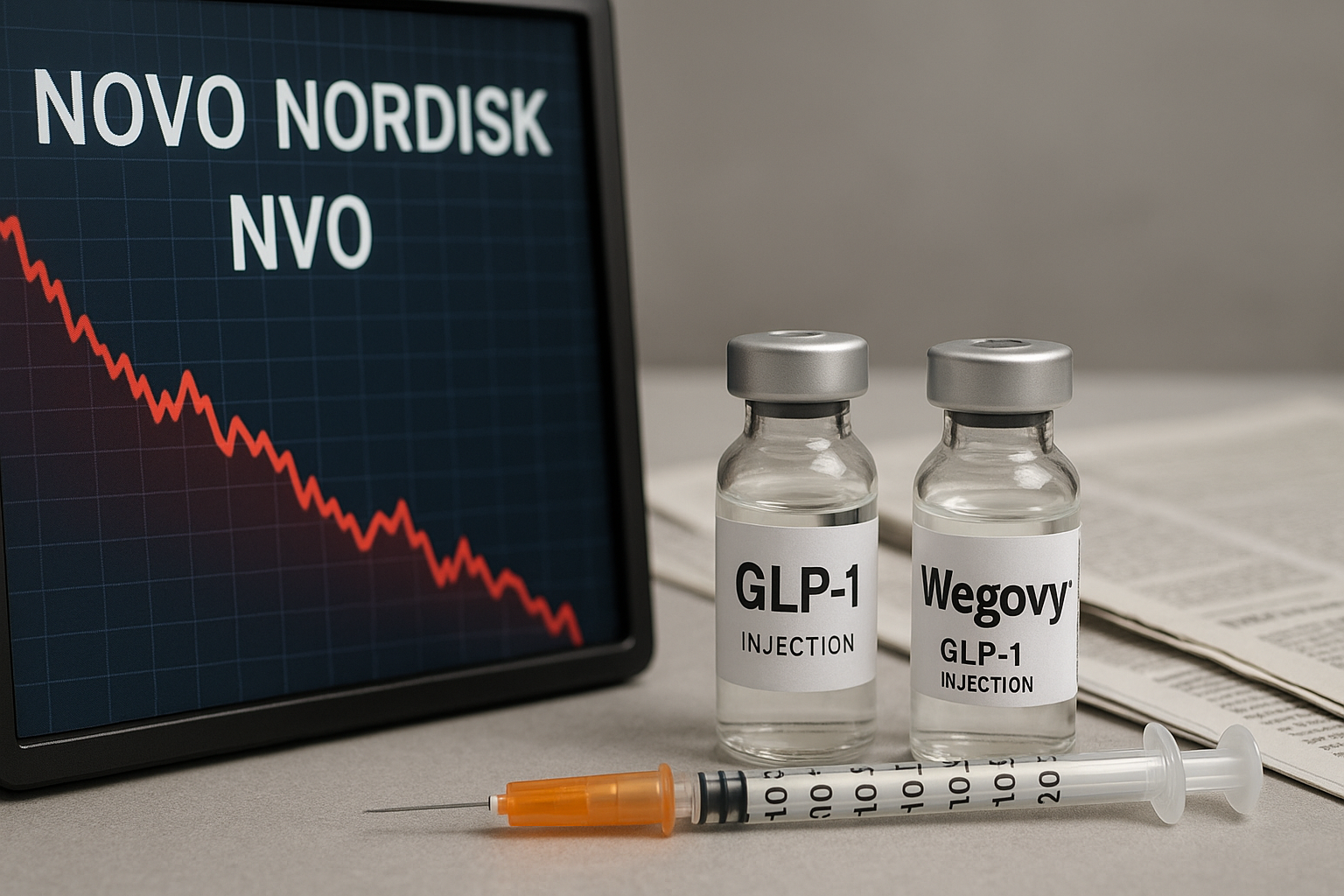

The mighty have fallen—or at least stumbled quite dramatically. Danish pharmaceutical giant Novo Nordisk has watched its stock plummet more than 50% from its peak, leaving investors scrambling to decide whether this represents a golden buying opportunity or the beginning of a prolonged descent.

I've been tracking the GLP-1 weight loss market since Wegovy first exploded onto the scene, and let me tell you, nothing gets Wall Street salivating quite like watching a former darling get knocked down a peg or two. But here's the million-dollar question: Is this an overreaction or justified fear?

The culprits behind Novo's tumble aren't particularly mysterious. Tariff concerns loom large. Competition from Eli Lilly has intensified. And the market, true to form, has responded with all the nuance of a sledgehammer—seemingly convinced that Lilly's gain must automatically translate to Novo's pain.

That logic, frankly, misses the forest for the trees.

The Obesity Gold Rush Ain't Over Yet

Look, we're not talking about some niche market here. The obesity treatment landscape isn't just big—it's absolutely massive. Over 40% of American adults qualify as obese. That's hundreds of millions of potential patients worldwide, folks.

Both Novo and Lilly are essentially selling pickaxes during a gold rush, and (this is the crucial bit) there simply aren't enough pickaxes to go around. Manufacturing constraints mean both companies are struggling to keep up with demand.

I spoke with several endocrinologists last month who confirmed they're still maintaining waiting lists for patients seeking these treatments. One doctor in Chicago told me, "I could prescribe three times what I'm able to get my hands on."

This isn't a zero-sum game. It's an expanding pie that could sustain multiple winners.

Tariffs: Real Threat or Overblown Fear?

The tariff situation definitely presents a legitimate concern. No argument there. But after a 55% stock price haircut? C'mon.

Markets have this funny habit of overshooting in both directions. Remember how they overvalued tech stocks in the late '90s? Or panic-sold everything during March 2020? Same psychology at work here.

Pharmaceutical companies have navigated tariff threats before. They adjust pricing, reconfigure supply chains, negotiate with governments. It's not as if the executives at Novo are sitting in Copenhagen wringing their hands without options.

(Having covered pharma for years, I've watched this dance play out repeatedly—companies initially stumble, then adapt.)

Danish Shares or American ADRs?

For U.S. investors contemplating a position, there's the practical question of whether to buy the Danish listing or the American ADRs. This decision hinges on three factors that many overlook.

First, there's the dividend taxation issue. Denmark slaps a hefty 27% withholding tax on dividends. Ouch. But—and this is important—U.S. investors buying ADRs typically benefit from the tax treaty between our countries, reducing that rate to 15%. You might even claim a foreign tax credit when filing your returns.

Then there's the convenience factor. ADRs trade during U.S. market hours and settle in dollars. No need to wake up at odd hours or deal with currency conversion headaches.

On the flip side, buying directly on the Copenhagen exchange gives you exposure to the Danish krone. That might diversify your currency risk... if that's something you're after.

For most of us regular folks with day jobs, the ADRs simply make more practical sense.

The Uncomfortable Bottom Line

Investing in Novo after such a significant drop might represent value, but let's not kid ourselves—it's not without considerable risks.

The obesity treatment market is undeniably poised for substantial growth. Novo has a solid pipeline, established manufacturing capabilities (though stretched thinner than my patience during tax season), and a proven track record in diabetes care.

But catching falling knives requires both timing and a high pain threshold. The market rarely bottoms exactly when you decide it's a good entry point. Trust me on this one—I've got the scars to prove it.

The obesity treatment narrative remains compelling for both Novo and Lilly. Sometimes the market's either/or thinking completely misses the potential for "and" solutions. This is especially true in rapidly expanding markets where demand far outstrips supply.

In the end, the decision isn't just about whether Novo is cheap compared to its previous highs, but whether its future prospects justify its current valuation. After a 55% discount? That proposition certainly looks more appealing than it did a year ago.

Just don't expect a smooth ride. The pharmaceutical industry never offers those... not even with a prescription.