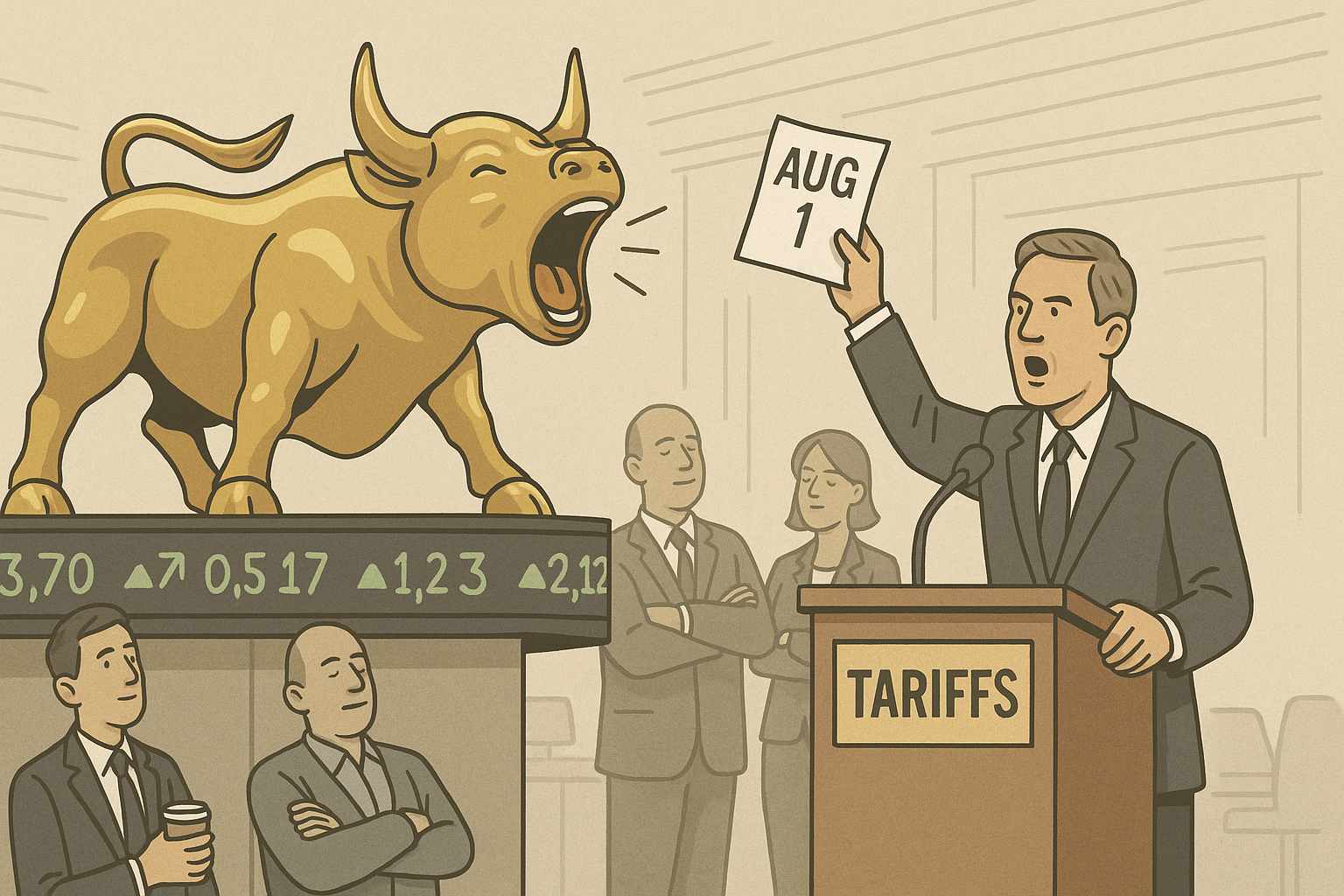

There's something almost comical—and maybe a bit concerning—about watching markets shrug off tariff threats with all the concern of a cat ignoring its owner's pleas to stop scratching the furniture. As Trump ramps up his economic saber-rattling ahead of that looming August 1 deadline, threatening to slap new duties on everyone from Brussels to Jakarta, Wall Street just keeps... well, Wall Street-ing.

The major indexes aren't just holding steady. They're climbing.

What we're witnessing appears to be the resurrection of what traders (at least the ones I've spoken with over whiskey at those midtown bars where real financial gossip happens) have started calling a "TACO market"—Trump Always Chickens Out. It's market shorthand for pricing in the probability that these threats evaporate faster than ice cream on Coney Island in August.

The collective memory on Wall Street isn't just long; it's detailed. Traders remember the first Trump administration's tariff playbook: big announcement, market jitters, eventual walk-back, repeat.

Meanwhile, the White House spin machine is churning out a narrative so divorced from reality it deserves its own divorce attorney. They're suggesting—with straight faces!—that markets have developed some kind of Stockholm syndrome-like affection for tariffs. This interpretation requires the kind of mental gymnastics that would make Simone Biles dizzy.

Let's be real about what's happening. There are three possibilities here:

First, markets genuinely believe tariffs would boost corporate profits (about as likely as finding fiscal responsibility in Congress).

Second, investors are betting these threats are primarily campaign-season performance art (bingo).

Or third—and this is where things get interesting—markets think Corporate America has developed enough pricing power and supply chain flexibility to weather whatever tariff storm might materialize.

I've been covering earnings calls for the better part of a decade, and the choreographed confidence from CEOs when analysts press them on potential tariff impacts is something to behold. "We have contingency plans in place" is the new "synergistic opportunities"—corporate-speak that sounds reassuring while saying precisely nothing.

But behind those rehearsed lines? You can bet your last dollar that CFOs are running nightmare scenarios they'd never dream of sharing on an investor call.

That recent CPI print of 2.7% might be worth paying attention to, though. It's like that first small crack in your windshield—easy to ignore until suddenly it's not. If tariffs actually materialize, companies operating on razor-thin margins could find themselves caught in a vise grip of rising input costs and resistance to price hikes.

Look, markets have been surprisingly dismissive of tail risks lately. Whether it's Middle East tensions that would've sent oil skyrocketing a decade ago or inflation concerns that would've spooked bonds, the buy-the-dip crowd has been richly rewarded for their optimism. It's created a feedback loop where skepticism about bad outcomes becomes the default position.

And yet...

Consensuses in markets have this nasty habit of setting up those "oh shit" moments (technical term) when reality finally diverges from expectations. If Trump actually follows through this time—whether because his political calculus has changed or he's genuinely committed to the policy—we could see a late summer reality check that stings.

I'm reminded of market reactions to the initial China tariffs back in 2018. First came disbelief, then dismissal, and finally—once implementation became reality—genuine concern. The script might read differently this go-round, but markets tend to process shocks in familiar emotional stages.

For now, traders seem content betting this is mostly campaign trail chest-thumping. But as any decent poker player knows, sometimes the guy you think is bluffing actually has the cards.

And sometimes, the house gets cleaned out.