The financial world is bracing for what could be a pivotal week—one where tech giants show their AI cards, economic data might reveal the first whispers of tariff impacts, and yes, a certain meme stock reports earnings on Friday the 13th. Sometimes you can't make this stuff up.

Apple's AI Moment of Truth

When Tim Cook takes the stage at Apple's Worldwide Developers Conference today, he'll be carrying more weight than just the next iOS update. The company that revolutionized smartphones has somehow found itself playing catch-up in the AI race—a position Apple rarely occupies.

For months now, Wall Street has given Apple a remarkable amount of slack on AI. While Microsoft, Google, and even Facebook's parent Meta have been tripping over themselves to showcase their AI capabilities, Cook has mostly offered vague promises and knowing smiles. That patience is wearing thin.

"Apple's whole thing has always been letting others make the mistakes first," a tech analyst told me last week. "But AI is moving so fast that the 'wait and perfect it' strategy might not work this time."

The stock has lagged behind other tech heavyweights this year—not dramatically, but enough to raise eyebrows. What Cook announces today could either reassure investors that Apple has been quietly building something extraordinary (as they've done before) or confirm fears that the company has genuinely fallen behind.

I've covered Apple events for years, and there's a rhythm to them. The question is whether today breaks that rhythm or reinforces it.

Inflation Data Gets Political

Wednesday's Consumer Price Index report wouldn't normally generate political headlines, but these aren't normal times. This release marks the first inflation reading that might—and I stress might—show early effects of Trump's tariff policies.

Look, economics and politics are colliding in fascinating ways right now. We have a President pushing for lower interest rates while simultaneously implementing policies that economists widely agree are inflationary. It's like complaining about your weight while ordering a second dessert.

The Federal Reserve finds itself in an unenviable position. After engineering what many consider a masterful soft landing, Powell and company now face new inflationary pressures from policy decisions outside their control.

One month of data won't tell the whole story (it never does), but any uptick in goods inflation could signal trouble ahead. The market, which has been remarkably resilient despite trade tensions, might finally have to confront economic reality.

"The collision course between tariff policy and monetary policy was inevitable," said James Kirkland, chief economist at Meridian Advisors. "The question was always when, not if, we'd start seeing it in the data."

Musk's Divided Attention

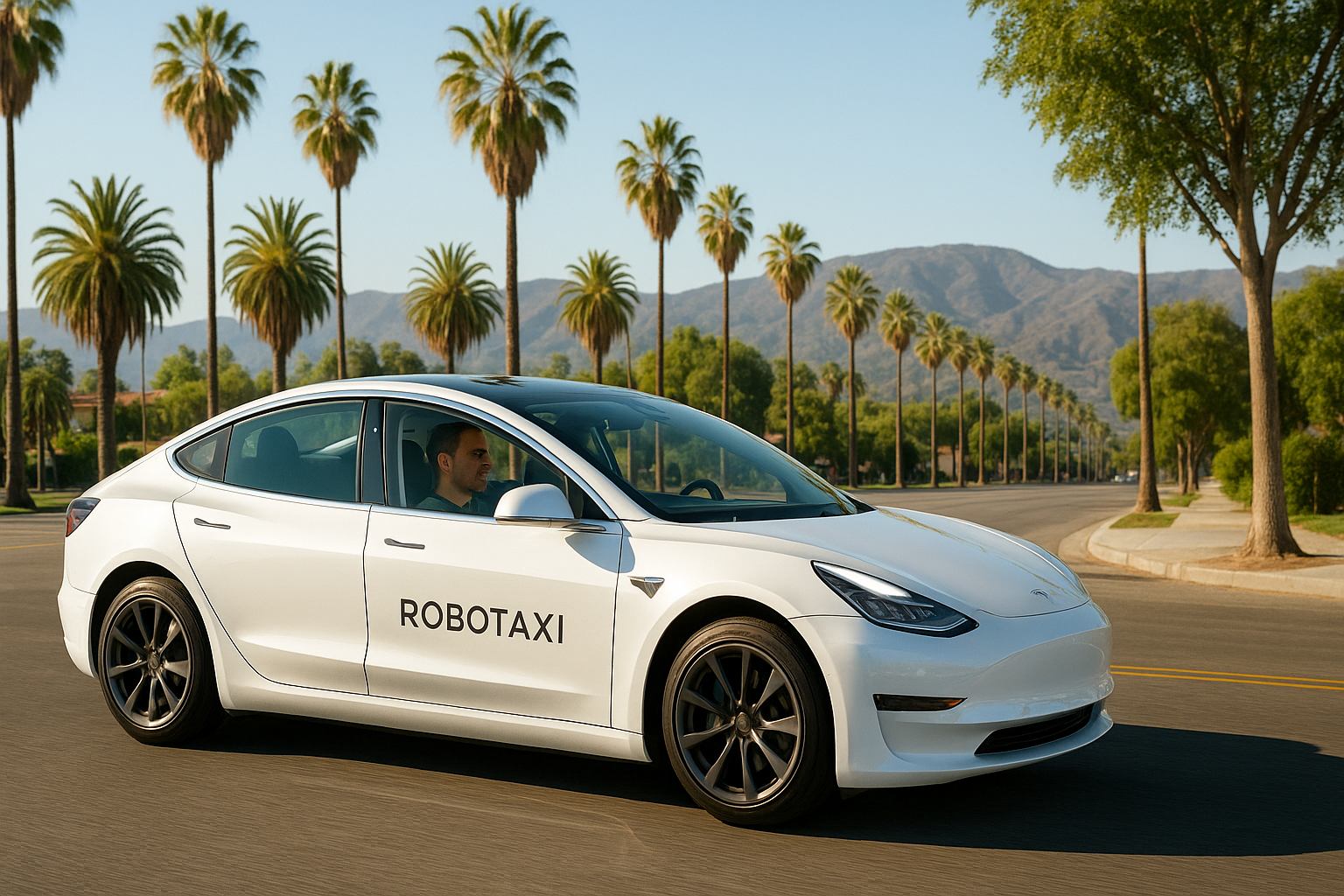

Thursday brings us Tesla's long-promised (and repeatedly delayed) robotaxi unveiling, an event that feels particularly strange given Elon Musk's new role advising the incoming administration on government efficiency.

The timing couldn't be more... interesting. While Musk publicly critiques government spending as Trump's efficiency czar, he'll be showcasing a product first promised in 2019 that still hasn't materialized. There's something almost poetic about it.

Tesla shareholders have grown accustomed to Musk's split focus—between SpaceX, Twitter/X, and now government advisory roles. The robotaxi reveal serves as both a potential catalyst for the stock and a convenient distraction from Tesla's increasingly competitive position in the EV market, where Chinese manufacturers are gaining ground daily.

Having tracked Tesla since its early days, I've noticed the company functions best when underestimated and worst when overconfident. Which version shows up Thursday remains to be seen.

The Meme Stock Finale?

And then there's GameStop. Reporting earnings on Friday the 13th. You can't make this up.

What began as a financial curiosity has morphed into something approaching folklore. Each quarterly report serves less as financial disclosure and more as a tribal gathering—where what matters isn't whether the brick-and-mortar retailer is actually succeeding, but whether the community of believers remains intact.

With AMC (the other pillar of 2021's meme stock mania) showing increasing signs of financial strain, GameStop stands as perhaps the last true standard-bearer of that era. Its continued defiance of conventional financial gravity makes it the perfect company to report on a day associated with superstition.

I spoke with several retail investors who still hold positions from the original squeeze. Their reasons vary wildly—from genuine belief in a turnaround to simple stubbornness to what one candidly described as "spite investing."

"At this point, it's not even about the money," one investor told me. "It's about proving a point."

What It All Means

As markets hover near record highs despite—or perhaps because of—political uncertainty, this week offers multiple inflection points that could either reinforce or challenge the current narrative.

The disconnect between Wall Street's optimism and Main Street's economic anxiety persists. Friday's consumer sentiment report might provide the most honest assessment of where things stand—American consumers have proven surprisingly perceptive about economic shifts, sometimes before economists catch on.

Has the market fully priced in Trump's trade policies, or are we still in the denial phase? The answer probably lies somewhere between the headline numbers and the market's reaction to them.

One thing seems certain: in a week featuring Apple's AI ambitions, inflation's response to tariffs, Tesla's moonshot promises, and GameStop's continued existence, there's no shortage of storylines to follow.

And isn't that always the way? Just when you think markets might provide a clear narrative, they remind you that clarity is rarely part of the financial equation.