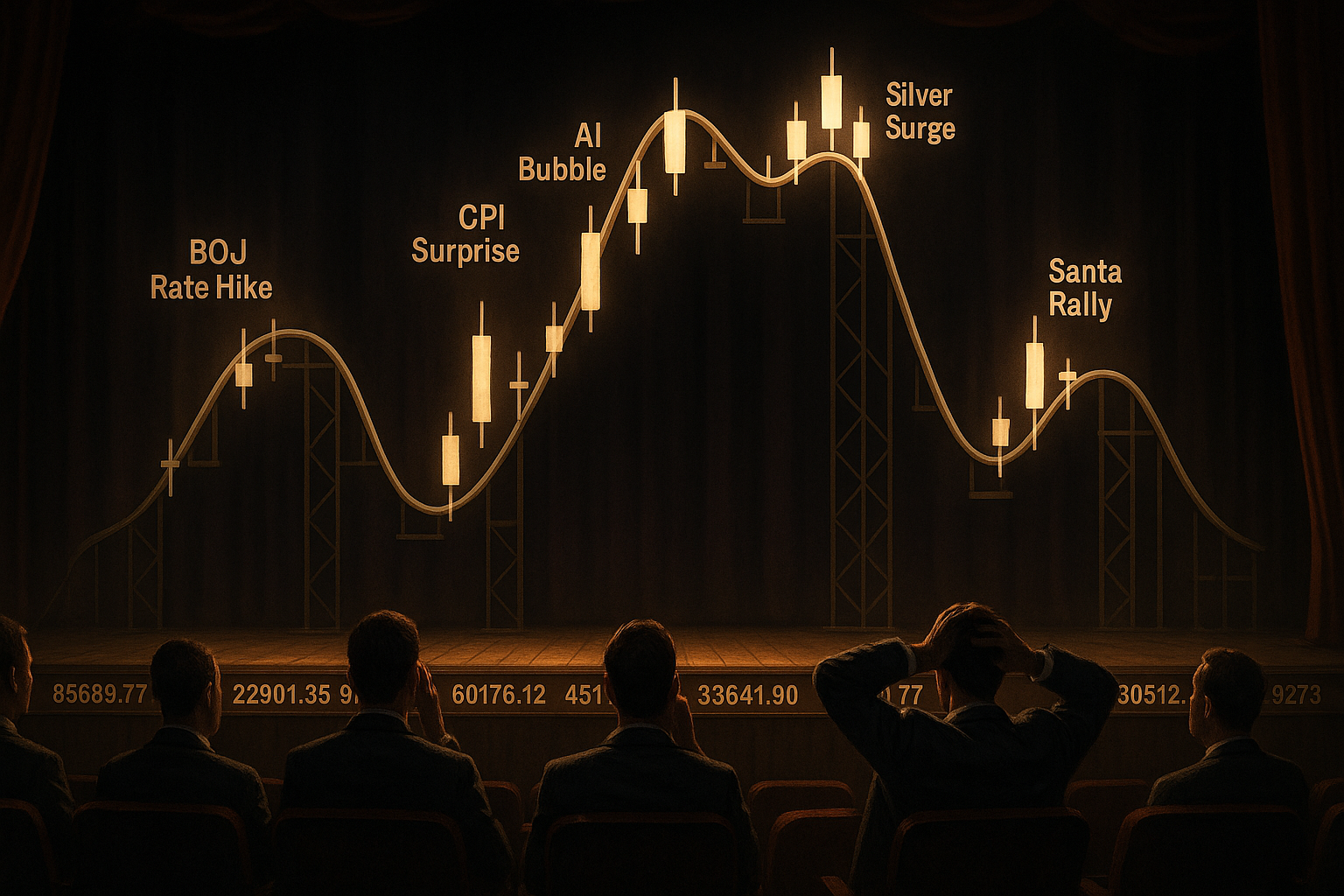

The Bank of Japan just hiked its interest rate to a dizzying 0.75% - which, in Japan's distorted monetary reality, practically qualifies as usury. Meanwhile, inflation numbers stateside managed to undershoot expectations, delivering an early Christmas gift to markets desperately seeking their Santa Rally. Let's unpack the market's increasingly manic mood swings.

Japan's Cautious Tightening: End of an Era?

Japan raising rates to 0.75% might seem trivial to the uninitiated, but context is everything. This marks the highest Japanese benchmark rate since 1995 - back when "Macarena" topped the charts and Steve Jobs hadn't yet returned to Apple. The hike triggered a predictable surge in JGB yields, with the 10-year breaching 2% for the first time since 1999.

I've long believed that Japan serves as the laboratory rat of monetary policy experimentation. The rest of the developed world watches nervously, wondering if Japan's economic ailments might be contagious. After decades of yield curve control, negative rates, and monetary gymnastics that would make Houdini blush, Japan's cautious normalization represents something like a controlled demolition of the world's longest-running monetary experiment.

The model to consider here is what I call the "monetary hangover thesis" - extraordinary accommodation creates dependencies that make withdrawal painful, even when administered in homeopathic doses. Every central banker's nightmare is becoming addicted to their own medicine.

Inflation's Holiday Surprise

Wednesday brought an unexpected gift for markets in the form of CPI coming in at 2.7% versus the anticipated 3.1%. This single data point managed to shift the market's Fed rate cut expectations from June to March, despite not changing the total expected number of cuts for 2026.

There's a delicious irony here. For years, inflation was the market's bogeyman, causing paroxysms of selling at the slightest hint of upward pressure. Now, disinflation is greeted like a long-lost relative at Christmas dinner. The collective market psychology has fully pivoted from inflation anxiety to rate cut fantasy.

The market's reaction highlights what I call "pendulum sentiment" - the tendency for market narratives to swing from one extreme to another with minimal middle ground. Yesterday's inflation terror becomes today's disinflation celebration, even though the fundamental economic challenges remain largely unchanged.

Oracle's AI Bubble Warning Shot

Perhaps the most revealing moment this week came when Blue Owl decided to pull funding from Oracle's data center initiatives, sending the stock plummeting 15%. This single corporate financing hiccup managed to drag down the entire tech sector, with Nasdaq shedding 1.8% in sympathy.

The episode offers a perfect miniature of the current AI investment mania. Companies have been competing to announce the most ambitious (read: expensive) AI infrastructure plans, each trying to out-promise the other in a kind of capital expenditure arms race. Oracle's stumble suggests lenders might be developing some belated skepticism about the immediate profitability of these massive outlays.

This is a classic "emperor's new clothes" moment. As long as everyone agreed to pretend AI investments would yield immediate returns, the party continued. The minute someone questions the timeline or magnitude of returns, the collective hallucination becomes vulnerable.

Silver's Stealth Bull Market

While most investors remained fixated on equities and rates, silver quietly assembled a four-week, 30% gain, including an 8% surge this week alone. Silver reaching new all-time highs with relatively little mainstream attention illustrates what I call the "attention arbitrage" - assets sometimes perform best when ignored by the investment herd.

The precious metal's outperformance likely reflects a complex cocktail of industrial demand, inflation hedging, and the peculiar dynamics of a market far smaller than gold. But it's also a reminder that the most significant moves often happen in markets where the smart money positions before the narrative becomes obvious.

Santa Rally: Not Quite Canceled

After a mid-week scare, the S&P 500 managed to close the week up 0.11%, breaking a four-day losing streak and preserving hopes for the fabled Santa Rally. Market participants' desperation for year-end performance enhancement is palpable.

The psychological phenomenon at work is what behavioral economists call "narrow framing" - the tendency to evaluate investments in isolation rather than as part of a portfolio. Calendar-year returns have no inherent economic significance, yet they dominate investment psychology simply because they're how performance is conventionally measured.

Look, I'm not saying markets are entirely irrational. But the amplified importance of December trading patterns reveals the underlying humanity of markets - creatures of habit who find comfort in seasonal narratives, even when those narratives have limited empirical support.

Things Happen

Delayed November jobs report showed 64K additions, exceeding the 40K expected. Oil continued its remarkable descent, touching $55 for first time since February 2021. Bessent claimed China is meeting trade negotiation commitments. Fed's Waller suggested continued rate cuts based on labor market conditions. One-year inflation expectations dropped to 4.2% from 4.5%. U.S. launched review of advanced Nvidia AI chip sales to China.

The market remains an exquisite mechanism for translating human psychology into price movements - sometimes rational, occasionally profound, and frequently absurd. Just how we like it.