Intel just pulled off a neat little trick with Uncle Sam's checkbook.

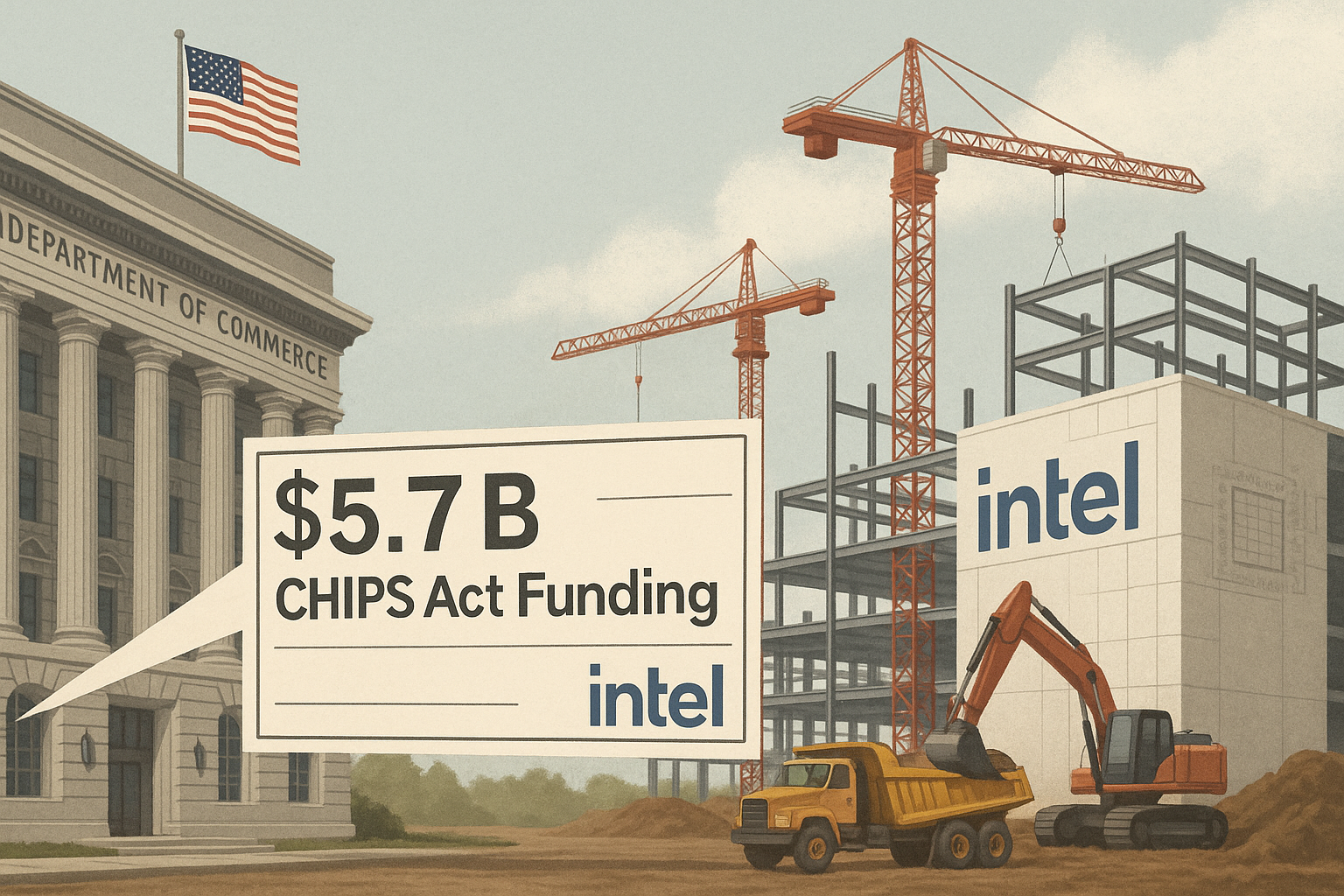

The once-dominant chip maker—struggling to regain its footing after years of manufacturing stumbles—has convinced the Commerce Department to front-load $5.7 billion in CHIPS Act funding earlier than originally planned. It's a fascinating development that tells us as much about the practical realities of industrial policy as it does about Intel's financial maneuvering.

I've been watching the CHIPS Act implementation since the legislation passed, and this marks the first major recalibration of how the money actually flows to recipients. That's not insignificant.

The original deal was structured with the typical government caution you'd expect when handing over billions in taxpayer dollars—milestone payments triggered by specific production achievements. Intel apparently made a compelling case that this timeline created a dangerous cash crunch precisely when their capital needs were highest.

Look, building chip factories isn't like opening a corner store. The upfront costs are astronomical.

(I toured TSMC's Arizona construction site last year, and the scale of initial investment is mind-boggling—massive earth-moving equipment reshaping the desert landscape before a single chip can be produced.)

This renegotiation suggests the Commerce Department is being more flexible than critics expected. Some business-as-usual skeptics warned the CHIPS Act would be hamstrung by bureaucratic rigidity, but this amendment points to a more adaptable approach.

What makes this particularly interesting is the timing. Intel's CEO Pat Gelsinger has been on something of an apology tour with investors lately, repeatedly pushing back timelines for technological advancements. The company desperately needs this infusion to maintain momentum on its ambitious foundry strategy.

Is it a bailout? Not exactly. But it's certainly a vote of confidence from the feds at a moment when Intel could use the boost.

The elephant in the room—or perhaps the dragon—is competition. While Intel struggles to right its ship, TSMC and Samsung are plowing ahead with their own American fab projects. Both Asian manufacturers bring decades of contract manufacturing expertise that Intel is still trying to develop.

"This adjustment helps align our capital needs with the project timeline," an Intel spokesperson told me when I asked about the change. Reading between the lines: we needed the money sooner than later.

The irony isn't lost on semiconductor veterans. Intel, once so dominant it faced antitrust scrutiny, now depends on government support to fund its comeback attempt. Times change, don't they?

For the Commerce Department, there's likely a political calculation at work too. With an election year approaching, having visible progress on the CHIPS Act implementation provides useful talking points about American manufacturing resurgence. Nothing says "policy success" quite like massive construction projects sprouting in swing states.

Intel's Ohio "mega-site" has been particularly emphasized in political messaging. The massive project—which broke ground in late 2022—represents the kind of heartland manufacturing renaissance that plays well across the political spectrum.

The amended agreement presumably includes alternative oversight mechanisms to replace the milestone-based approach, though details remain frustratingly vague. I've requested the specific terms but received only general assurances about "robust accountability measures."

But here's the thing that keeps nagging at me. Money helps, absolutely... but Intel's core challenges are technological, not financial. The company has repeatedly missed manufacturing targets while competitors surge ahead. The accelerated funding improves their cash position without necessarily solving their execution problems.

It reminds me of the old Silicon Valley adage that you can't solve fundamental engineering problems by throwing money at them. Sometimes you can, sure. But often you can't.

For now, Intel gets its money sooner, the government gets to show progress on a signature initiative, and taxpayers have to trust that the accountability measures are sufficient to protect their investment.

Will it work? We'll see. The chips, as they say, are down.