In a week where tech stocks performed their usual roller coaster impression, I found myself thinking about the investment strategies of the man who built one of the world's most valuable companies from an online bookstore. Jeff Bezos, with a net worth fluctuating around $200 billion depending on how Amazon shares feel on any given day, has assembled a fascinating investment portfolio that deserves closer examination.

Look, when you've amassed enough wealth to fund a private space company and still have change left over to buy The Washington Post as something of a side hobby, your investment choices become more than just personal financial decisions—they're market-moving signals worth decoding.

The Bezos Investment Philosophy: Optionality and Long-term Thinking

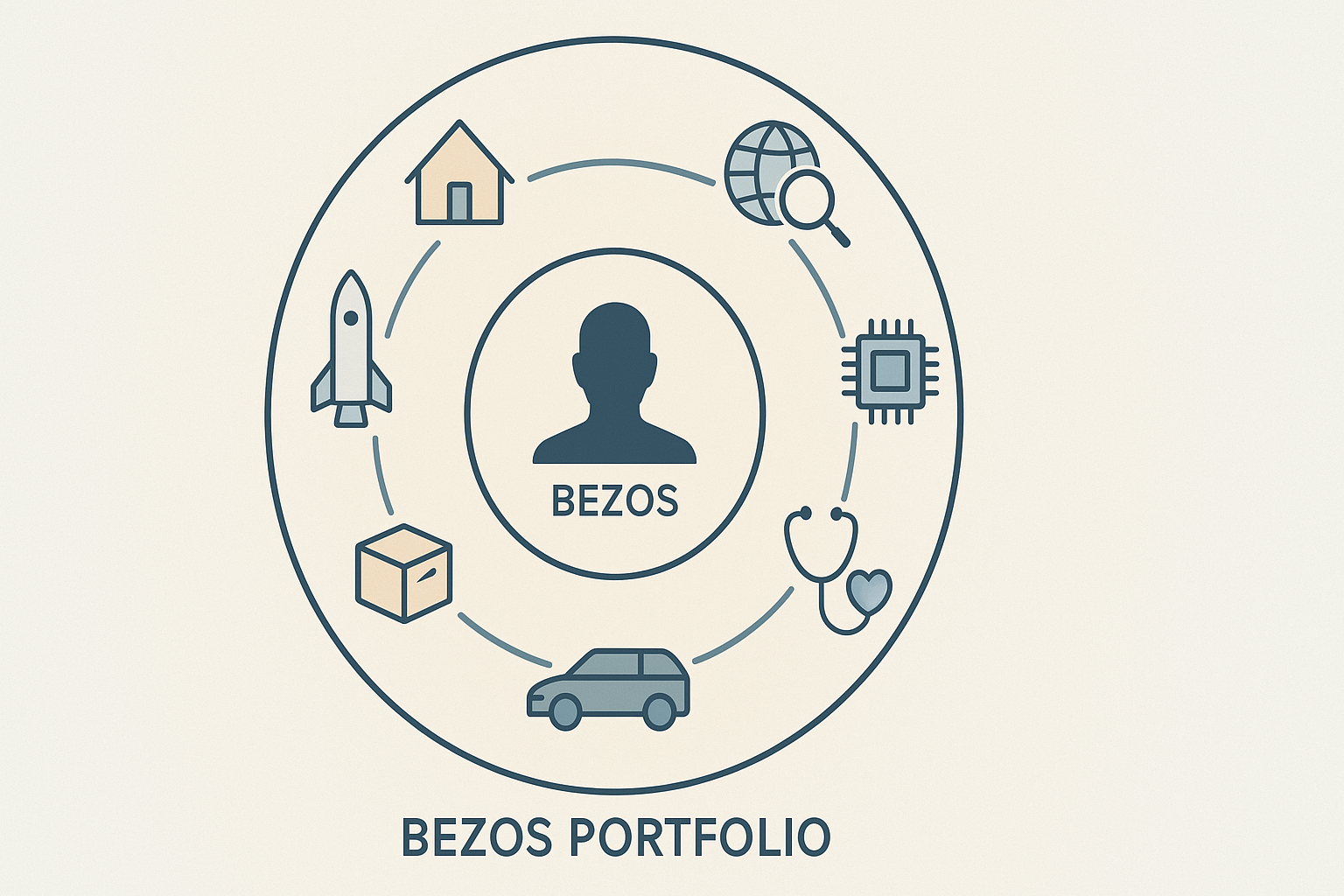

The thing about Bezos is that he's essentially running two separate but related investment operations. There's Amazon itself, which continues to be his primary wealth engine, and then there's Bezos Expeditions, his personal investment vehicle that manages his increasingly diverse array of bets.

A model I often use when looking at billionaire portfolios is what I call the "concentric circles of conviction." The innermost circle represents their core business—for Bezos, that's Amazon. The next ring contains directly adjacent businesses that leverage similar expertise or infrastructure. The outer rings represent increasingly speculative bets that might seem disconnected but often reveal deeper strategic thinking.

Bezos Expeditions has made investments across a remarkably wide spectrum, but there's an underlying logic that becomes apparent when you examine the portfolio as a whole. The man clearly values:

- Companies with massive potential markets

- Founders with unusual clarity of vision

- Business models that improve with scale

- Technologies that create new capabilities

In other words, he's looking for more Amazons—businesses that can grow from seemingly modest beginnings into category-defining behemoths.

The Space and Transport Cluster

Perhaps the most visible component of Bezos' portfolio is Blue Origin, his space exploration company that competes with Elon Musk's SpaceX. While technically not an investment but a company he founded, it represents his largest financial commitment outside of Amazon.

But the aerospace theme extends beyond Blue Origin. Bezos was an early investor in Uber, seeing the potential for transportation disruption long before ridesharing became ubiquitous. The investment, made through Bezos Expeditions, has likely returned several multiples despite Uber's occasionally turbulent path to profitability.

What's interesting here is the theme of infrastructure and logistics—the unsexy but essential backbone of modern economies. Amazon itself started as a retail operation but evolved into a logistics giant. Bezos clearly recognizes that moving people and things efficiently represents enormous economic value.

The Platform Play Cluster

Another clear pattern emerges around platform businesses. Airbnb stands out as a particularly successful Bezos Expeditions investment. The home-sharing platform embodies several Bezos-friendly characteristics: it's capital-light, improves with scale, and transforms an enormous existing asset class (housing) into something more valuable through better utilization.

Then there's Google—or Alphabet, if you insist on the parent company name that nobody actually uses in conversation. Bezos recognized early that the search giant represented a fundamentally new way of organizing information and connecting users with what they seek. The investment has grown substantially as Google expanded from search into a constellation of services that touch virtually every internet user daily.

What links these investments? They're all platforms that connect supply and demand in transformative ways, much like Amazon's marketplace evolved beyond direct retail into a platform for third-party sellers.

The Future Tech Cluster

Bezos has also placed substantial bets on technologies that might reshape the future. His investment in quantum computing company IonQ reflects a willingness to look beyond immediate commercial applications toward fundamental technological shifts.

Similarly, his healthcare venture Maven Clinic suggests an interest in using technology to transform massive, inefficient sectors—healthcare being perhaps the ultimate example. Amazon itself has made several forays into healthcare, most recently with the acquisition of One Medical.

The pattern here reveals Bezos thinking in decades rather than quarters. These investments may take years to mature, but their potential upside is enormous if they succeed in transforming their respective industries.

The Bezos Effect

When Bezos invests in a company, he brings more than capital. His involvement signals to other investors that a business has genuine long-term potential, often leading to what I call the "Bezos premium"—an immediate valuation boost simply from his association.

But there's an irony here. While Bezos is known for his patient capital and famous quote that "In the short run, the market is a voting machine, but in the long run it's a weighing machine," his mere presence can create short-term market distortions as investors rush to follow his lead.

The Anti-Portfolio

Equally interesting are the areas where Bezos hasn't invested heavily. Despite Amazon's ventures into entertainment, he hasn't made major personal investments in content creation companies. He's been relatively quiet in financial technology despite Amazon's various payment initiatives. And while he bought a newspaper, he hasn't invested broadly in media properties.

These gaps suggest either sectors he views as less promising or areas where he feels Amazon itself is the appropriate vehicle for his involvement.

Things Happen

- Interestingly, despite being an early cloud computing pioneer through AWS, Bezos has made relatively few personal investments in enterprise SaaS companies.

- His investment in Business Insider through Bezos Expeditions provided an early exit when Axel Springer acquired the digital media company.

- Despite his interest in logistics, Bezos hasn't made significant investments in autonomous vehicle technology outside of Amazon's own initiatives.

The Bezos portfolio reveals a mind that's simultaneously practical and visionary—focused on businesses that solve real problems while imagining how the world might function decades in the future. For investors looking to divine where innovation might create the next trillion dollars of value, following Bezos' money remains an imperfect but fascinating strategy.

But remember, we mere mortals lack both Bezos' information advantages and his ability to weather extended periods of negative returns. The man can literally burn billions on moonshots (sometimes literally) while the rest of us worry about beating the S&P this quarter. I guess that's the ultimate luxury asset: the freedom to be right in the very long run.