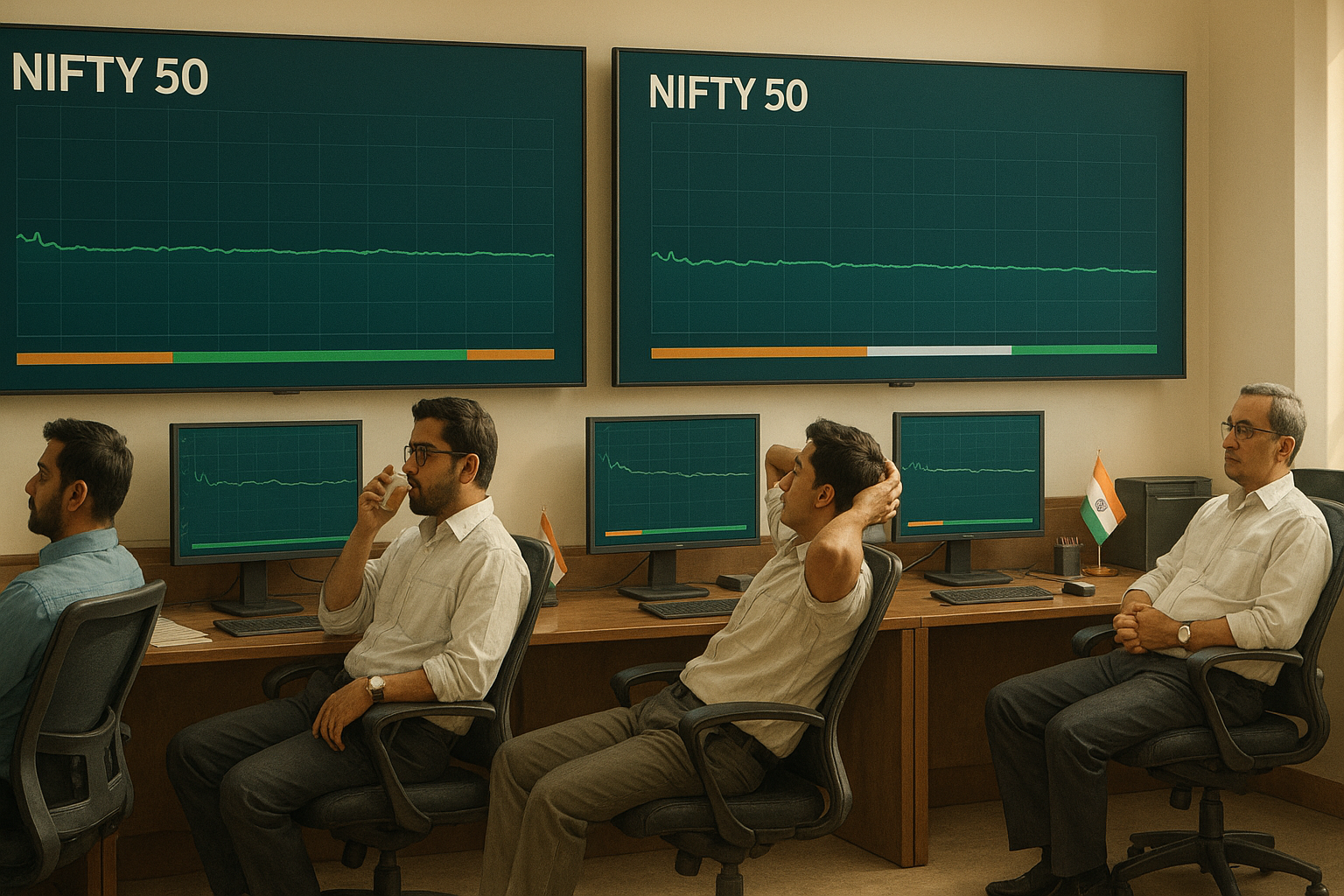

The Indian stock market has gone eerily quiet lately. Too quiet, if you ask the traders who make their living off market swings.

The NSE Nifty 50 has been moving with all the excitement of a sloth on sedatives, even as global markets twitch and gyrate around it. And it's not just a feeling—the numbers back it up. The India NSE Volatility Index recently bottomed out at an all-time low. Not just a post-pandemic low or a ten-year low. We're talking the lowest volatility ever recorded.

Let that sink in for a moment.

This is happening while the world is, well, being the world—geopolitical tensions flaring up, central banks playing musical chairs with interest rates, and enough economic uncertainty to fill a small ocean. Yet India's market barely shrugs.

I've been watching markets for years, and there's something almost unnatural about this calm. Markets aren't supposed to behave this way. They're supposed to react, overreact, panic, celebrate—you know, show some personality.

What's causing this strange phenomenon? There's a compelling explanation that some market analysts (myself included) have started calling the "Domestic Liquidity Dampening Effect." It's not terribly complicated: when domestic money—both institutional and from everyday retail investors—dominates the market, it creates a kind of internal buffer system against external shocks.

Add to this India's relatively strict derivatives trading rules that limit how traders can bet on volatility, and you've essentially created a market that moves with all the urgency of a government clerk before his third tea break of the day.

Options traders are particularly frustrated. These folks—the math wizards of the financial world—make their living in the spaces between certainty and uncertainty. Their business model depends on the market having opinions, disagreements, and nervous twitches about the future.

"It's like showing up to work and finding out your job has been automated," one Mumbai-based derivatives trader told me last week, requesting anonymity because he wasn't authorized to sound so defeated in public.

Think about it this way: options are essentially insurance contracts against future price movements. When nobody expects anything interesting to happen, that insurance gets dirt cheap. Great if you're buying protection, absolutely terrible if you're trying to sell it.

The weird thing is, this stability might actually be creating its own form of risk. Markets don't stay calm forever. That's not how they work. That's not how anything works.

So what happens when volatility inevitably returns? After this extended period of unnatural calm, are India's markets structurally prepared for the shock?

There's a historical parallel that keeps nagging at me—the so-called "Great Moderation" in the U.S. before 2008, when everything seemed so stable that risk models essentially discounted the possibility of extreme events. We all remember the ending to that story, right? (Hint: it involved a global financial crisis.)

Now, maybe—just maybe—India has actually engineered a genuinely more stable market structure. Perhaps the dominance of domestic money really does create a natural shock absorber. Maybe those derivatives trading restrictions are working exactly as designed.

I'm skeptical, though.

In my experience, markets are like water—they find a way. Dam them in one place, and pressure builds up elsewhere. Suppress volatility in the formal market, and it typically resurfaces somewhere else—maybe in periodic market dislocations, private markets, or in creative new financial instruments specifically designed to work around existing rules.

All this raises a more fundamental question that market philosophers have debated forever: what's a market actually for? If it's supposed to discover prices and efficiently allocate capital, then some level of volatility isn't just acceptable—it's necessary. A market that never moves is like a conversation where nobody speaks.

For the moment, India's traders are left contemplating an existential riddle: how do you profit from nothing happening?

Perhaps there's wisdom in learning to appreciate the sound of one hand not trading. Or perhaps—and I suspect this is more likely—we're witnessing the calm before a storm.