The global economy in mid-2025 feels like it's being pulled in a dozen different directions simultaneously. As someone who's been watching markets for over two decades, I can't remember a time when regional divergences were quite so pronounced.

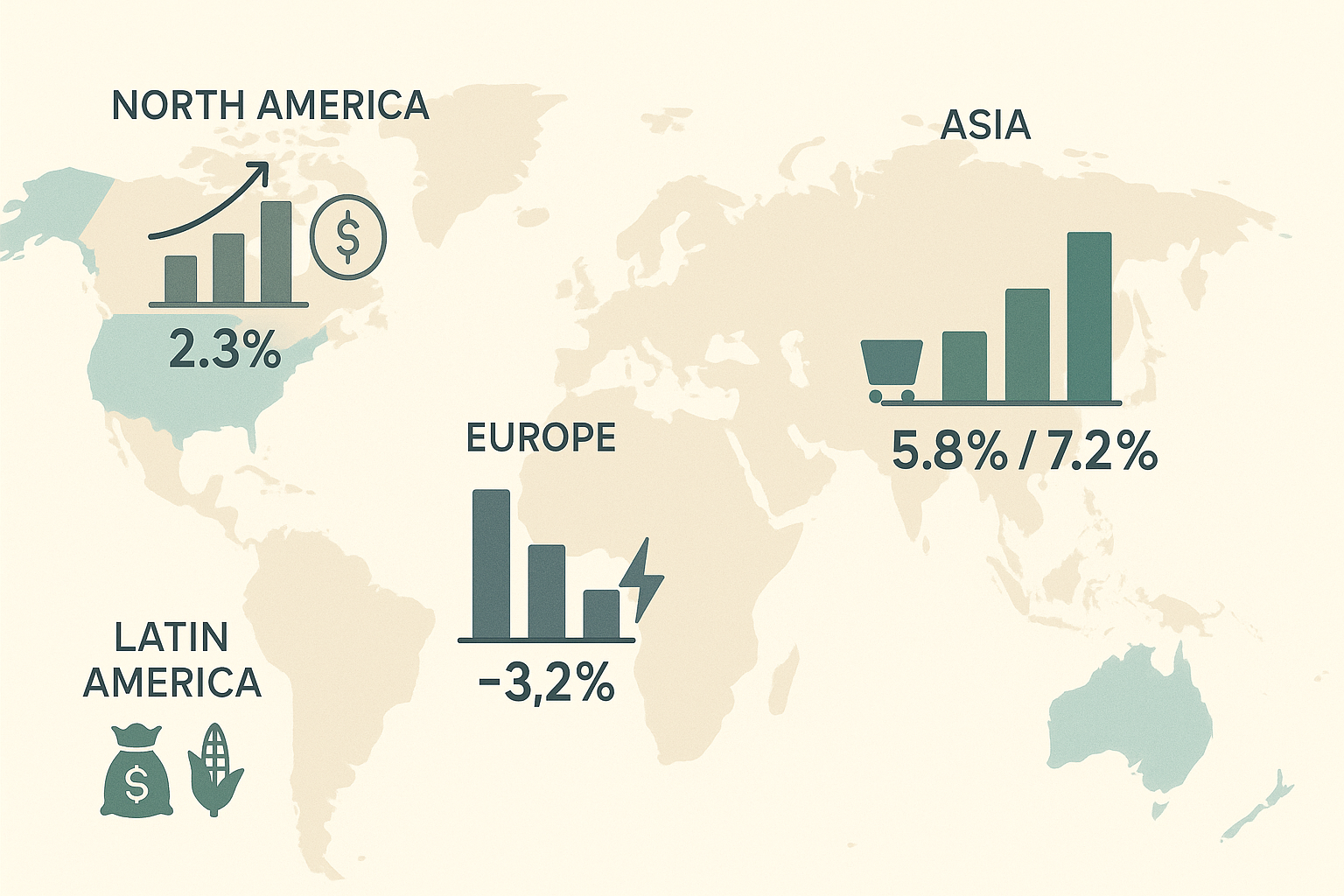

Let's start with the numbers: U.S. GDP grew at a modest 2.3% in Q1, while inflation remains stubbornly high at 5% year-over-year. The Fed's latest rate hike (their third this year) signals their continued concern about prices, even as manufacturing indicators show signs of weakness. It's a delicate balancing act, and the markets reflect that uncertainty.

Asia tells a completely different story. China's economy has finally emerged from its post-COVID slump, posting 5.8% growth last quarter, while India continues its remarkable expansion at 7.2%. What's driving this? Consumer demand, primarily - the Asian middle class is flexing its economic muscle in ways that are reshaping global trade patterns.

"We're seeing a fundamental shift in economic gravity," David Brown told me during a recent economic forum. "Western economies are dealing with demographic headwinds and debt concerns, while Asia benefits from favorable population trends and infrastructure investment." He's right - the contrast becomes clearer with each new data release.

Europe, meanwhile, is dealing with its own unique set of challenges. The energy crisis that many predicted after the Russia-Ukraine conflict has materialized in different ways than expected. Germany's industrial production dropped 3.2% in May, largely due to high energy costs that show no signs of abating. France is doing somewhat better, thanks to its nuclear power capacity, creating interesting divergences even within the Eurozone.

Latin America presents perhaps the most mixed picture. Brazil's economy is showing surprising resilience (inflation finally under control, commodity exports booming), while Argentina continues to struggle with fiscal imbalances and social unrest.

For investors, these divergences create both opportunities and risks. The "set it and forget it" approach to global allocation doesn't work in this environment - you need to be much more selective about where and how you invest.

I've been gradually increasing my exposure to Asian markets over the past year, focusing particularly on consumer-facing businesses that benefit from rising incomes. That said, I'm keeping a close eye on geopolitical tensions that could disrupt even the strongest economic fundamentals.

The coming months will test whether these regional divergences persist or begin to converge. Either way, we're clearly in a new economic era - one that requires a more nuanced understanding of global markets than ever before.