The S&P 500 hit another all-time high yesterday, and I found myself staring at my screen with that familiar mixture of FOMO and dread. Where exactly does one put money when everything seems priced for perfection?

It's a question landing in my inbox with alarming frequency lately. "Help," wrote one reader last week. "My cash is burning a hole in my portfolio, but I break into hives every time I look at tech valuations."

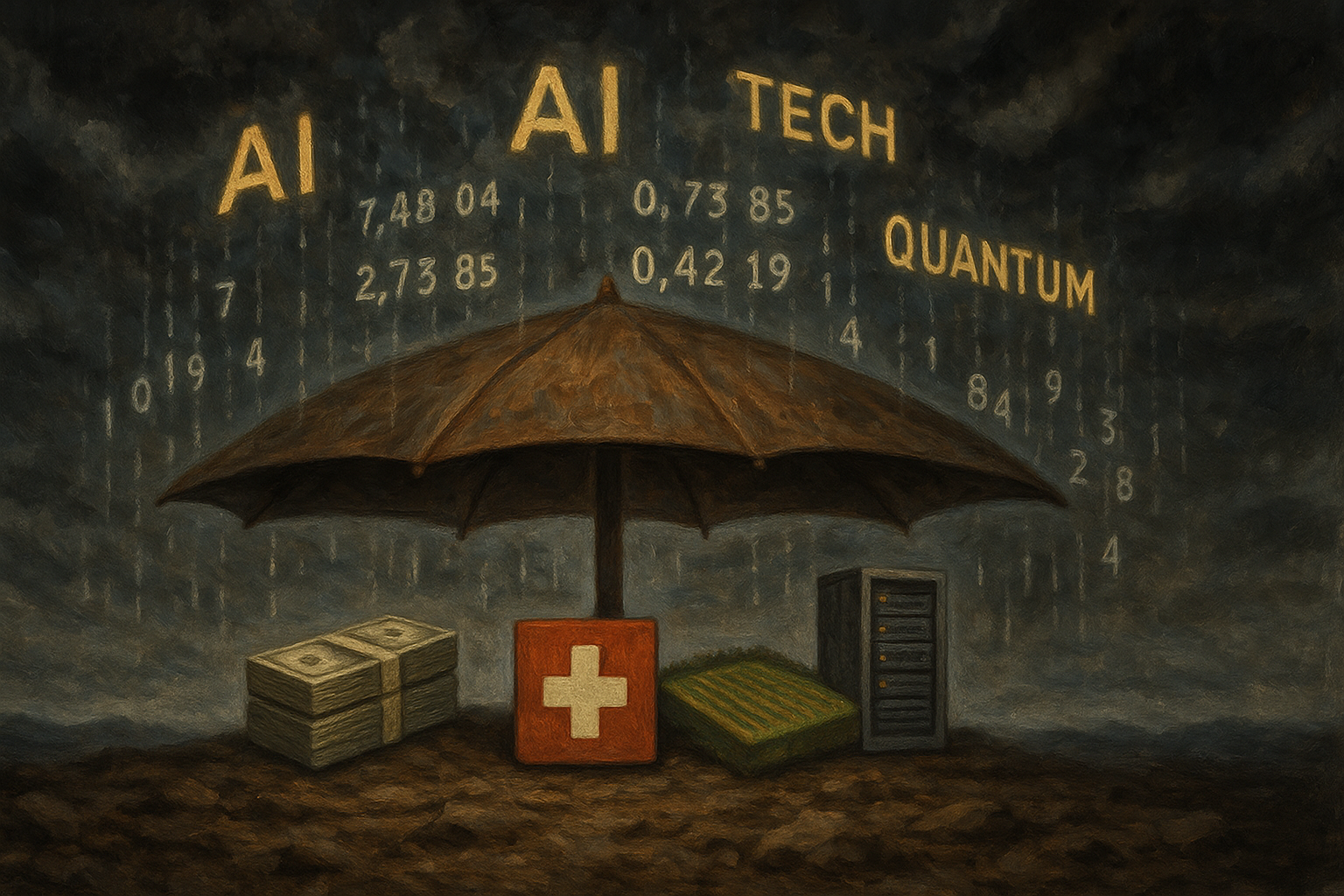

I get it. Tech stocks are sporting multiples that would make a 1990s dot-com analyst blush. AI companies are trading on promises and PowerPoints. And don't get me started on quantum computing stocks that surge whenever two qubits manage to stay coherent for more than a millisecond.

Welcome to what I've started calling the "Expensive Everything Model."

The premise isn't complicated: in today's world, where capital moves around the globe faster than ever, relative value matters more than absolute value. Everything can be expensive simultaneously—but some things are rationally expensive, while others are just... nuts.

Let's break it down.

Tech stocks? Yeah, they look stretched by conventional metrics. But I've spent fifteen years watching investors miss out on Apple, Amazon, and Microsoft because they seemed "obviously overvalued" back in 2015. Those skeptics are now nursing their regrets aboard slightly smaller yachts. Traditional valuation models keep failing to capture the tech growth story.

That said, there's expensive and there's EXPENSIVE. When I see pre-revenue companies with little more than an AI-adjacent name commanding billion-dollar valuations, my spidey sense tingles. We might be entering what market veterans delicately call the "greater fool" phase—when you're buying solely because you think someone else will pay even more later.

Healthcare presents an interesting alternative. Having tracked the sector since the pre-pandemic days, I've noticed it's lagging the broader market rally. Aging demographics across developed economies provide a tailwind that doesn't hinge on whether the next AI chatbot can write marginally better haikus. The recent breakthroughs in weight loss medications, gene therapies, and immunology treatments suggest we're entering something of a golden age in medicine.

Then there's China. The ultimate contrarian play (or the contrarian's contrarian play, if you want to get meta about it). Chinese equities have been absolutely hammered by regulatory crackdowns, property sector meltdowns, and geopolitical arm-wrestling. The valuations? Indisputably cheap.

But as anyone who's covered emerging markets knows, "cheap" can always get cheaper when policy uncertainty enters the chat. Remember the old Wall Street adage: markets can stay irrational longer than your portfolio can stay intact.

What about cash? It's not sexy. It doesn't make for good dinner party conversation. "What am I investing in? Oh, you know... nothing." But it deserves serious consideration.

Warren Buffett's Berkshire Hathaway is sitting on roughly $157 billion in cash and equivalents. When the world's greatest investor decides that "not investing" is the best investment, it's worth pondering. Cash gives you options—the freedom to pounce when genuine opportunities emerge from whatever market dislocation comes next.

(And something always comes next. I've covered enough market cycles to know the pattern.)

Maybe we need to think beyond traditional asset classes altogether. I'm increasingly drawn to what I call the "Pick and Shovel" approach: instead of betting on which AI company will win, invest in the infrastructure that ALL AI requires. Data centers, cybersecurity firms, semiconductor equipment manufacturers—the companies selling essential tools often outperform the gold-rushers themselves.

Or perhaps consider the "Scarcity Premium" model... What's genuinely limited in supply but growing in demand? Quality farmland. Water rights. Rare earth minerals. Intellectual property with strong moats. These tend to preserve wealth when financial assets hit the skids.

Look, market timing is a fool's errand—a game played enthusiastically by professionals and amateurs alike, with the professionals just using fancier words to describe their guesswork. The historical data suggests that staying invested according to your risk tolerance and time horizon beats tactical shifts for most of us mere mortals.

But if you're determined to adjust your portfolio in today's environment, perhaps ask a different question. Not "what will make me rich fastest?" but "what will hurt least if I'm wrong?"

In markets where everything seems expensive, not losing money deserves equal billing with making it.

So what am I buying personally? A little of everything, but with an increasing tilt toward quality companies with strong balance sheets, reasonable valuations, and the kind of boring business models that won't impress anyone at your next dinner party. And yes, I'm holding more cash than usual—not because I know what's coming, but precisely because I don't.

The best investment strategy has always been the one you can stick with through turbulent markets. In 2024, that might mean sacrificing some upside to ensure you remain both solvent and sane when the inevitable recalibration occurs.

But hey... I could be completely wrong. Maybe those quantum computing stocks are actually the bargain of the century. Just don't bet your retirement on it.