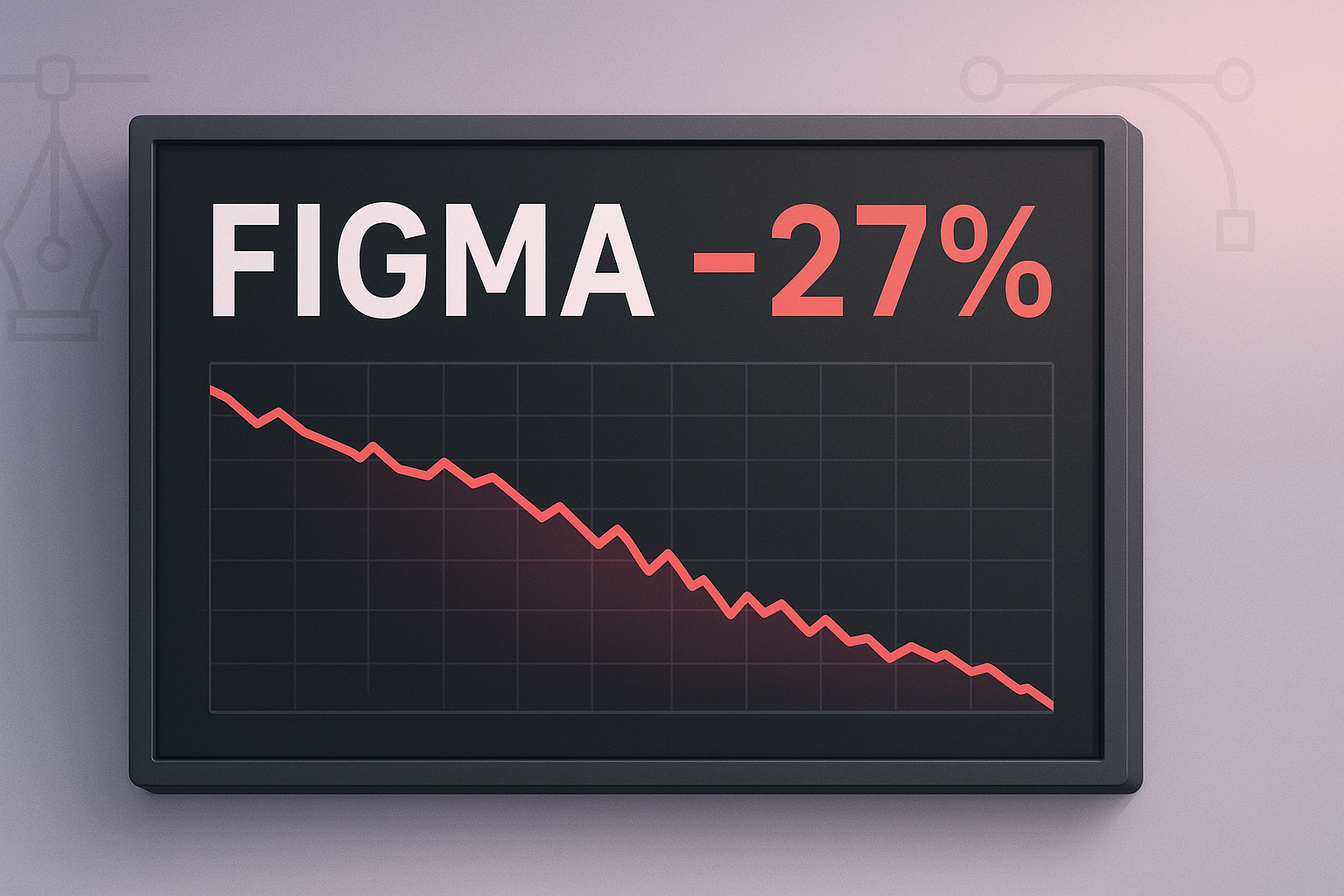

Well, that didn't take long. Figma's stock plummeted 27% on Tuesday, giving investors a textbook example of what happens when IPO euphoria crashes headfirst into market reality. The design software darling that everyone was gushing about last week just got a harsh lesson in public market physics.

I've covered tech IPOs since the dot-com days, and this pattern is as predictable as Silicon Valley's obsession with Allbirds and Patagonia vests. A promising tech company goes public. Investors, who've been sitting on the sidelines during this IPO drought, rush in like it's the last chopper out of Saigon. The stock shoots up. Then—bam!—reality hits.

But Figma's case feels different somehow.

The company initially priced its shares at $27 last Thursday, already above its expected $23-$25 range. By closing bell on its debut day, the stock had skyrocketed to $47, representing a 74% pop that valued the company at a whopping $14.2 billion. After Tuesday's bloodbath, it's trading around $34—still above the IPO price, but nowhere near last week's euphoric heights.

Here's the thing though: Figma ain't no flash-in-the-pan startup with a PowerPoint and a prayer. Their collaborative design platform has become the industry standard for product teams everywhere. Revenue grew 40% year-over-year to $620 million for the twelve months ending in June. Their net dollar retention rate sits at 133%, which is finance-speak for "customers love us so much they keep spending more money with us."

And get this—they're actually profitable. On GAAP terms! In 2023! I know, shocking concept for a tech company these days.

So what the heck happened?

First off, we're seeing the classic IPO correction playbook. Investment bankers (who, let's be honest, do this for a living) typically price offerings slightly below expected market value to ensure that coveted first-day pop. But 74%? That's not a pop—that's a cannon shot. Either the bankers were absurdly conservative or investors temporarily lost their minds. Tuesday's drop suggests it was probably a bit of both.

Second—and this is fascinating to me—we're witnessing what I call the "tech drought premium." The IPO market has been dead as a doornail, with only 31 tech IPOs in the U.S. this year. When a legitimately promising company like Figma finally comes along, all that pent-up investor demand comes rushing in at once.

There's also the Adobe factor. Remember when Adobe tried to swallow Figma for $20 billion back in 2022 before antitrust regulators stepped in? Some investors might've been pricing in either a future acquisition (at a premium) or Figma's continued success in eating Adobe's lunch. Tuesday's drop suggests the market is reassessing those bets.

The whole situation reminds me of covering Reddit's and Astera Labs' IPOs earlier this year... same story, different logo. Initial irrational exuberance followed by a cold shower of reality.

What does this mean going forward? For long-term investors, these post-IPO gymnastics are mostly meaningless. The real question is whether Figma can keep its growth engine humming while fending off Adobe and other competitors. Their collaborative-first approach clearly resonates with customers, but maintaining that edge requires continuous innovation.

For day traders... well, I hope you enjoyed the rollercoaster. Buy the ticket, take the ride, as Hunter S. Thompson might say.

The bigger question—one that's keeping a lot of startup founders and VCs up at night—is what Figma's rocky post-IPO journey means for other tech companies eyeing public offerings. Does this relatively modest correction (let's remember, the stock is still up from its IPO price) give confidence to others waiting in the wings? Or does it reinforce the notion that public markets remain wildly unpredictable?

My bet? The IPO window is opening, but cautiously. Companies with solid fundamentals like Figma will still find their way to Wall Street, but they'll be pricing their offerings with Tuesday's lesson in mind.

Meanwhile, Figma's leadership is probably reminding themselves of that age-old Wall Street wisdom: "The stock is not the company, and the company is not the stock." They'd do well to focus on building great products while letting the market sort itself out.

After all, in the long run, gravity comes for everyone—even design software darlings.