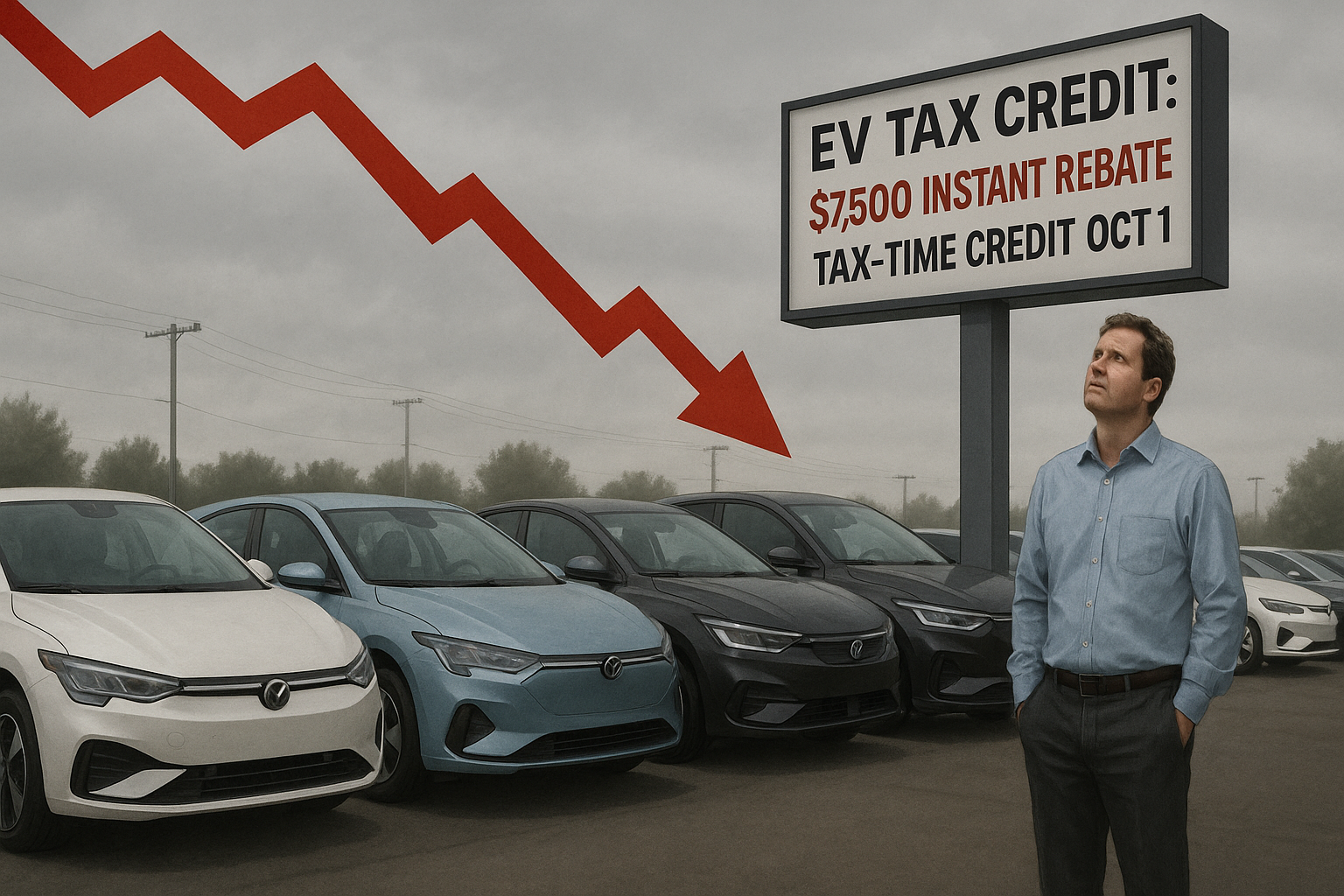

Electric car sales might soon hit what some industry experts are calling a "tax credit cliff" – and the potential fallout has automotive executives reaching for the antacids.

A fresh analysis circulating among industry insiders suggests EV sales could nosedive by as much as 50% when U.S. tax credit structures change this September. Tesla, GM, and Ford stand directly in the path of this approaching storm, yet investors seem oddly unconcerned about what could be a seismic shift in the market.

I've covered automotive incentive programs since 2019, and this pattern is nothing new. Government incentives create these artificial demand bubbles, and when the bubble pops—well, you don't need an economics degree to predict what happens next.

Here's the situation: Right now, EV buyers can claim up to $7,500 at the point of sale. It's essentially an instant rebate. Starting October 1st, that switches to a tax-time credit.

The difference? Night and day.

It's the equivalent of a store clerk saying "here's your discount now" versus "file this paperwork with the IRS in several months and eventually you might get some money back." Which would motivate you to buy? Exactly.

And let's be honest—the EV market was already showing serious strain. Ford has hemorrhaged $4.7 billion on its electric vehicle division over two years. GM pushed back production timelines for electric pickups. Tesla (the canary in the coal mine for the EV market) has been slashing prices so aggressively it's making dealers of traditional vehicles nervous.

I spoke with three dealership owners last week who all said variations of the same thing: "The only EVs moving quickly are the heavily discounted ones."

This creates what one analyst I follow calls an "incentive elasticity curve." In plain English: how many people are buying EVs because of the tax break, and how many would buy them anyway?

If the prediction of a 50% sales collapse holds water, that suggests half of today's electric vehicle purchasers are primarily motivated by financial incentives rather than environmental concerns or technological enthusiasm.

The upcoming change offers us a fascinating real-world experiment. We'll finally see what genuine EV demand looks like without the government's thumb on the scale. It'll be like when someone flips on the lights at closing time—suddenly revealing what's really been happening all along.

Several scenarios could play out:

First, we might actually see that cliff-dive in sales, validating that tax credits were indeed propping up an otherwise reluctant market.

Or manufacturers might slash prices even further, sacrificing what little profit margins they had to maintain sales volume.

Maybe the market splits—luxury EVs selling steadily while affordable models struggle—showing wealthy buyers don't care about credits while middle-market consumers absolutely do.

Or (and this seems least likely to me, having tracked consumer behavior in the sector), nothing much happens because buyers weren't factoring the credit into their decisions anyway.

The likely outcome? Probably a messy combination of sales declines and desperate discounting.

Look, the conventional wisdom has been that electrification is inevitable—a straight-line journey toward an all-electric future. But markets don't work that way. They respond to incentives, both financial and practical. And right now, the practical incentives (think charging infrastructure and vehicle selection) remain challenging while the financial ones are about to take a serious hit.

There's a certain irony here that I can't help but point out. This tax credit change was baked into the Inflation Reduction Act—legislation specifically designed to accelerate EV adoption. Instead, it might temporarily kneecap it. Classic Washington, right? Helping you across the street by first pushing you into traffic.

For investors watching this space, the dynamics create some tricky currents. Tesla has the most to lose by volume but remains the only consistently profitable EV maker. Ford and GM are already deep in the red on electric vehicles, so fewer sales might actually improve short-term financials while throwing a wrench in their long-term strategies.

And let's not forget about those Chinese manufacturers... they're watching from the wings, perhaps seeing market disruption as the perfect moment to make their big American push (assuming trade tensions don't build an insurmountable wall).

The next few months will tell the tale. We'll finally see what EV demand truly looks like when stripped of some of its policy support.

My prediction? A significant sales drop followed by a frantic price war followed by auto executives having some very uncomfortable conversations about the timeline for profitable mass-market electric vehicles.

The EV revolution will continue—but with considerably more financial drama than those sleek commercials with their perfectly lit vehicles gliding through urban landscapes would have you believe.

After all, revolutions rarely follow the script. Even ones powered by lithium-ion batteries.