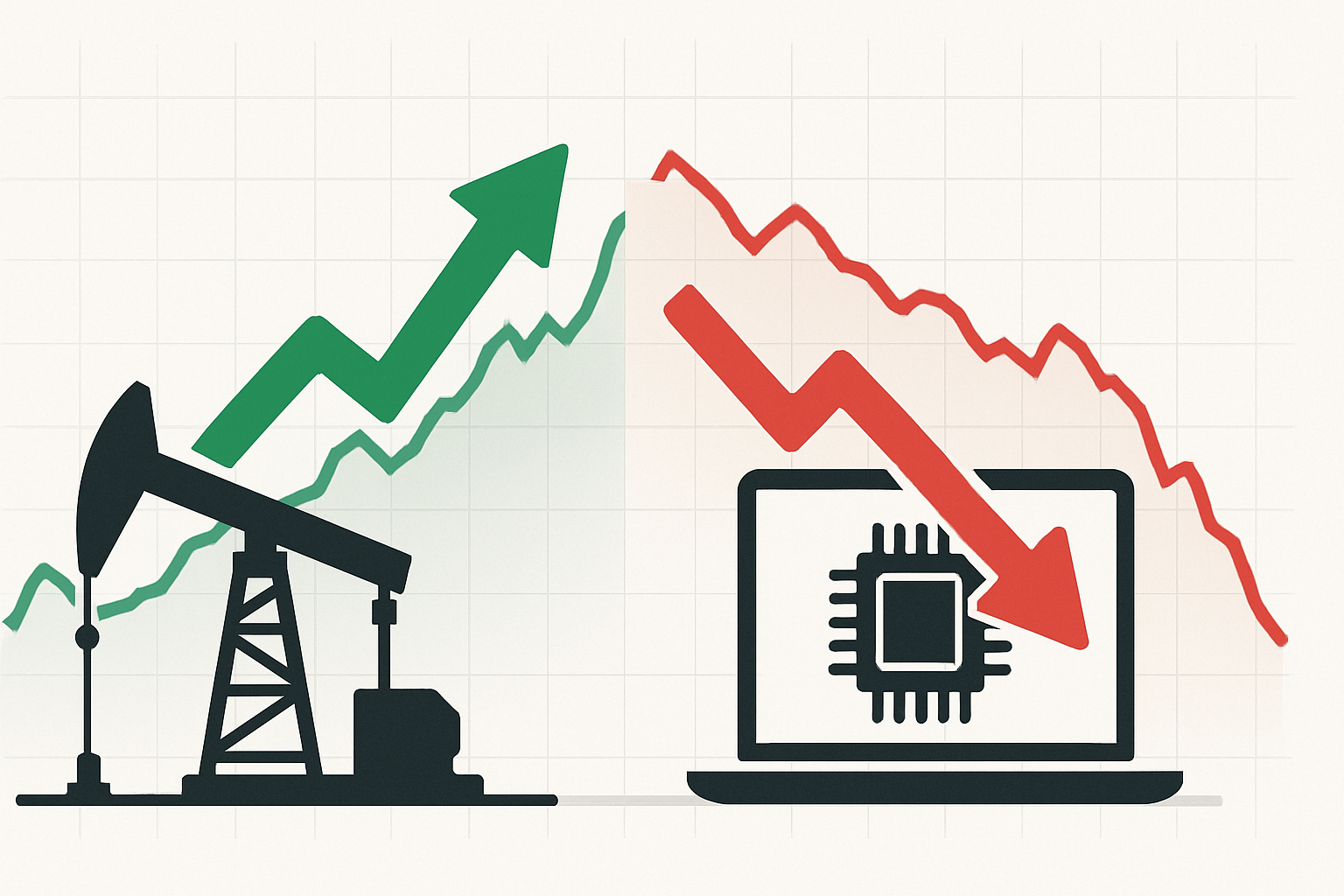

The market's latest game of musical chairs ended Friday with energy stocks comfortably seated in the winner's circle. The sector jumped 4.7% for the week through August 22, 2025, continuing its positive monthly momentum even as technology shares—the market's perennial prom kings—finally took a much-needed breather.

I've been covering these sector rotation patterns since the post-pandemic recovery, and let me tell you: watching institutional money slosh between sectors has all the predictability of a cat on espresso. One week it's "tech or bust," the next everyone's suddenly discovered dividend yields exist.

Money in Motion: The Hot Potato Effect

What we're seeing resembles what veteran traders call sector rotation, though I prefer thinking of it as financial hot potato. Big money managers pass capital around from sector to sector, desperately trying not to get caught holding yesterday's favorites.

This week's shift toward energy didn't happen in isolation. Crude has stabilized north of $80 following that mess in the Gulf (a diplomatic nightmare I won't get into here), while tech valuations had simply reached levels where even the most starry-eyed growth investors started muttering about "valuation concerns" at cocktail parties.

The utilities sector tells an interesting side story—sitting there in the chart's upper right quadrant with modest gains. Nobody's abandoning their defensive playbook entirely, despite the energy enthusiasm. It's not so much risk-on as it is... risk-adjacent?

Size Matters: The Market Cap Distortion

Look at those bubble sizes on the chart. They reveal something financial television rarely acknowledges—tech's modest pullback probably matters more to your portfolio than energy's impressive percentage gain.

The sheer size disparity is staggering. Tech sneezes and the S&P 500 reaches for tissues. Energy could have its best week in years and barely register in the broader index. (I checked the math on this with three different portfolio managers yesterday, and they all confirmed my suspicions with varying degrees of frustration.)

The Consumer Conundrum

What's really got me scratching my head is consumer discretionary's Jekyll-and-Hyde act—down for the week but still positive for the month. Something doesn't add up.

Are those higher-than-expected credit card delinquency numbers finally catching up with retailers? Or is this just normal profit-taking after a strong July?

I had dinner with a fund manager last week who can't stop talking about the "bifurcated consumer"—luxury brands setting sales records while discount stores warn about stretched customers. We've seen this movie before, and historically speaking, the ending isn't great. The last time this pattern emerged was... well, 2008 comes to mind. Though today's fundamentals are undeniably stronger, so maybe hold off on that panic room construction.

Reading the Tea Leaves

The street's conventional wisdom says energy's moment in the sun is just that—momentary—before investors inevitably rush back to their tech darlings. But I'm not totally convinced.

The five-year performance gap between energy and tech has created valuation disparities that are becoming difficult for even the most committed growth investors to ignore. We're talking single-digit P/E ratios versus... whatever multiple investors have decided to assign AI-adjacent companies this week.

What's particularly strange is real estate's failure to launch despite Treasury yields trending down. That sector should theoretically benefit from a more favorable interest rate environment, yet it's stuck in neutral. This suggests deeper structural issues that rate cuts alone won't solve.

These rotation visualizations aren't so much economic indicators as they are mood rings for thousands of portfolio managers—all simultaneously trying to beat their benchmarks without straying too far from them. It's like trying to win a race while staying tethered to the starting line.

In the end, these sector movements reveal more about positioning and sentiment than fundamental change. Energy companies didn't discover massive new oil fields this week, and tech firms didn't suddenly forget how to code. But for now, at least, energy holds the hot potato.

The million-dollar question: how long before they toss it to someone else?