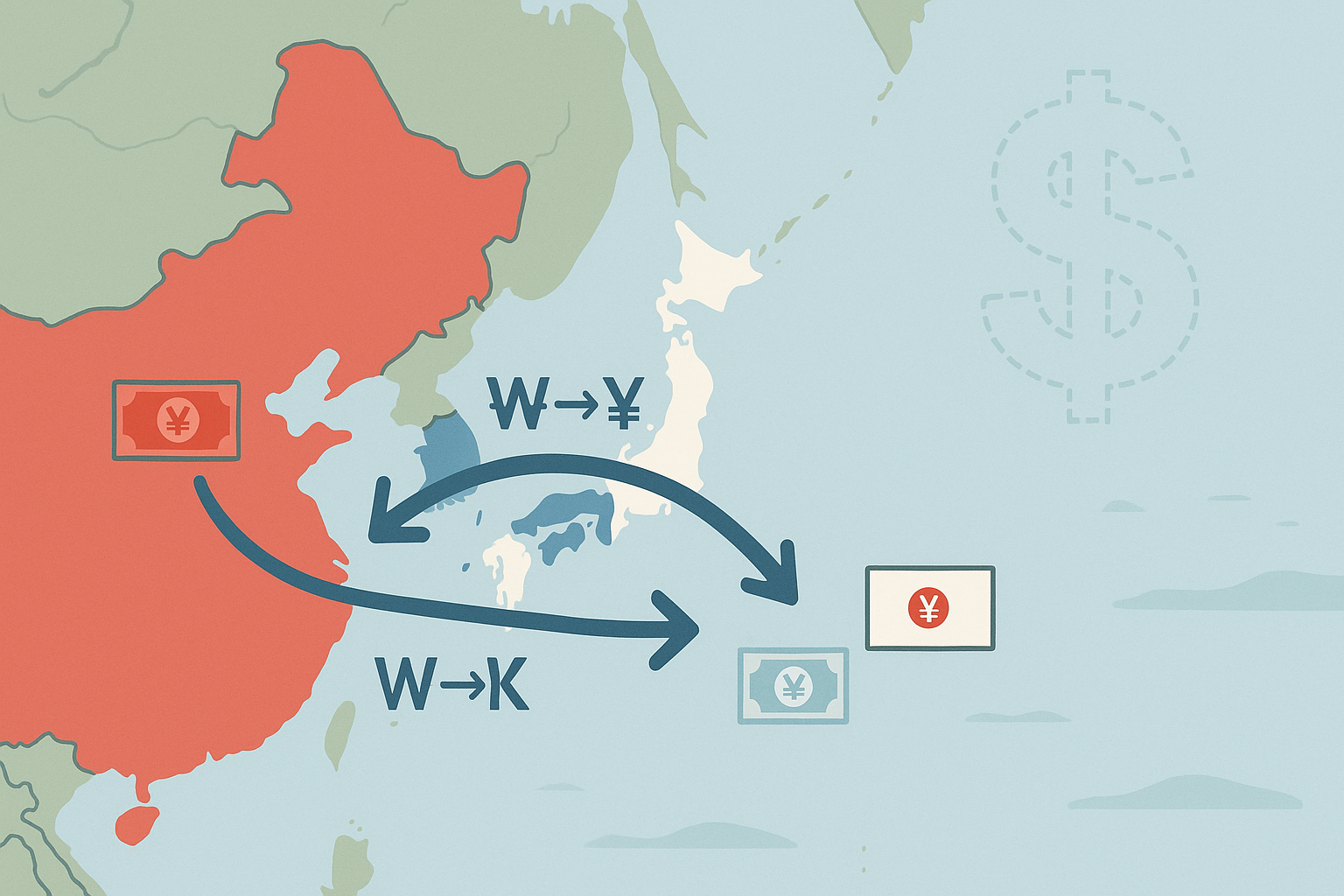

Beijing is making moves in the financial world that deserve your attention. China has reportedly begun exploring currency swap arrangements with Japan and South Korea—a development that's flying under most people's radar but could reshape regional economics in profound ways.

Look, currency swaps sound mind-numbingly technical. They are. But they're also fascinating little windows into geopolitical positioning that tell us volumes about how countries see their futures unfolding.

What's actually happening here? In simple terms, these arrangements would allow these East Asian powerhouses to exchange currencies directly—yuan for yen, won for yuan—without the U.S. dollar playing middleman. It's essentially creating a financial shortcut that bypasses America's monetary highways.

The timing isn't coincidental.

With Western trade tensions ratcheting up and sanctions becoming the diplomatic weapon of choice, China appears to be installing financial backup systems. It's basic risk management, really. When you think someone might cut your access to critical infrastructure, you build alternatives before the crisis hits.

I've been tracking China's financial sovereignty movements since 2018, and this fits perfectly within what analysts call their "de-dollarization strategy"—a long, patient campaign to reduce dependency on American financial architecture.

What makes this particularly intriguing (and potentially concerning for Washington) is Japan and South Korea's willingness to entertain these discussions. These aren't just any countries; they're cornerstone U.S. allies with deep security ties to America.

Their openness suggests a pragmatic acknowledgment of economic reality. China remains the region's trade behemoth—political differences be damned.

"Countries in East Asia are increasingly hedging their bets," explained Dr. Min-Hee Park, an international finance expert I spoke with last week. "They're creating redundant systems that give them options if traditional financial channels become politically problematic."

This doesn't mean Japan and South Korea are abandoning their American alliance. Far from it. Instead, they're developing what I call a "both/and" approach to financial relationships—maintaining strong ties with Washington while simultaneously building alternative channels with Beijing.

The conventional wisdom suggests deeper economic integration leads to political cooperation. But that's not necessarily what we're witnessing. These countries can maintain conflicting security and economic postures simultaneously. It's complicated, messy, and entirely human.

(And isn't that exactly how international relations actually work in practice?)

This evolution toward a more multipolar financial system has been brewing for years. The 2008 financial crisis planted the seeds of doubt about dollar supremacy. Trump's weaponization of the dollar through sanctions accelerated concerns. Now, regional powers are quietly—very quietly—putting contingency plans in place.

For businesses with Asian exposure, these developments create both challenges and opportunities. Transaction costs might shift. Hedging strategies may need adjustments. Supply chain financing could see subtle but meaningful changes.

Having covered Asian financial markets for over a decade, I've noticed how often the most consequential changes happen without fanfare—quiet agreements signed in wood-paneled rooms rather than dramatic announcements. This appears to be one such case.

Will these discussions materialize into formal agreements? That remains uncertain. And how would Washington respond if they did? The Biden administration has thus far taken a measured approach to managing China relationships, but financial architecture touches core American interests.

Currency swap arrangements aren't sexy. They won't make the evening news or trend on social media. But in many ways, they represent the slow, tectonic shifts in global power that eventually reshape the world.

Sometimes in international relations, as in chess, the most significant moves are the subtle ones you barely notice... until suddenly, the board has completely changed.